Margin debt has diverged from US stocks – or not. It depends if margin debt is pitted against large- or small-caps. The former shows divergence, the latter not.

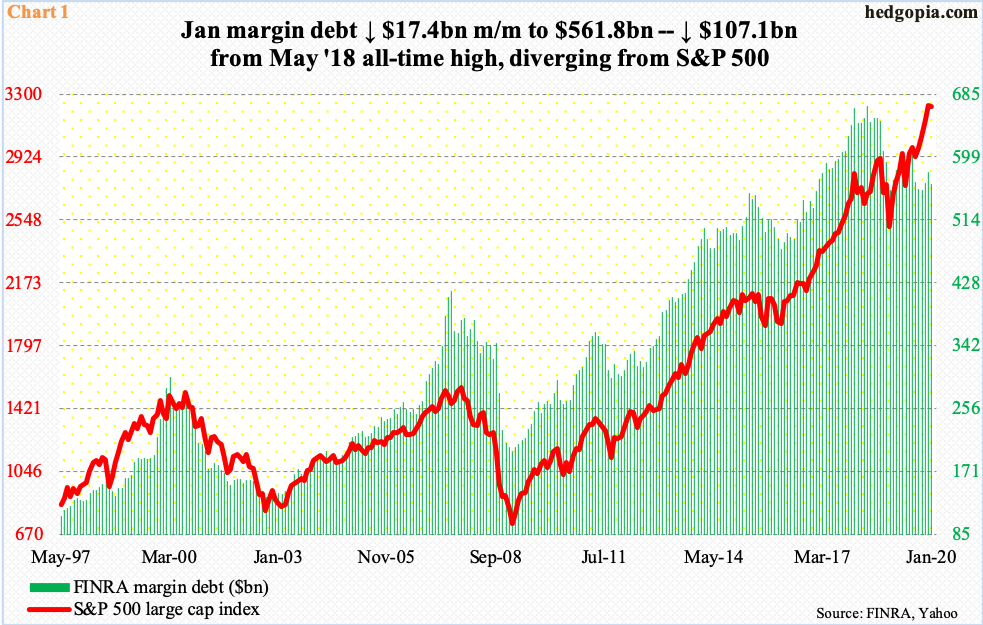

Historically, FINRA margin debt tends to move hand in hand with US stocks. Chart 1 plots margin debt with the S&P 500 large cap index. The relationship between the two worked to perfection when bear markets began in 2000 and 2007. But it has come undone for months now.

Margin debt peaked at $668.9 billion in May 2018. The S&P 500 began a three-month correction in October that year, but also formed a major bottom in December. From that low, it rallied to newer highs, with the latest high having been recorded five sessions ago. Margin debt, on the other hand, went the other way. In January, it fell $17.4 billion month-over-month to $561.8 billion, down $107.1 billion from its record high set nearly two years ago.

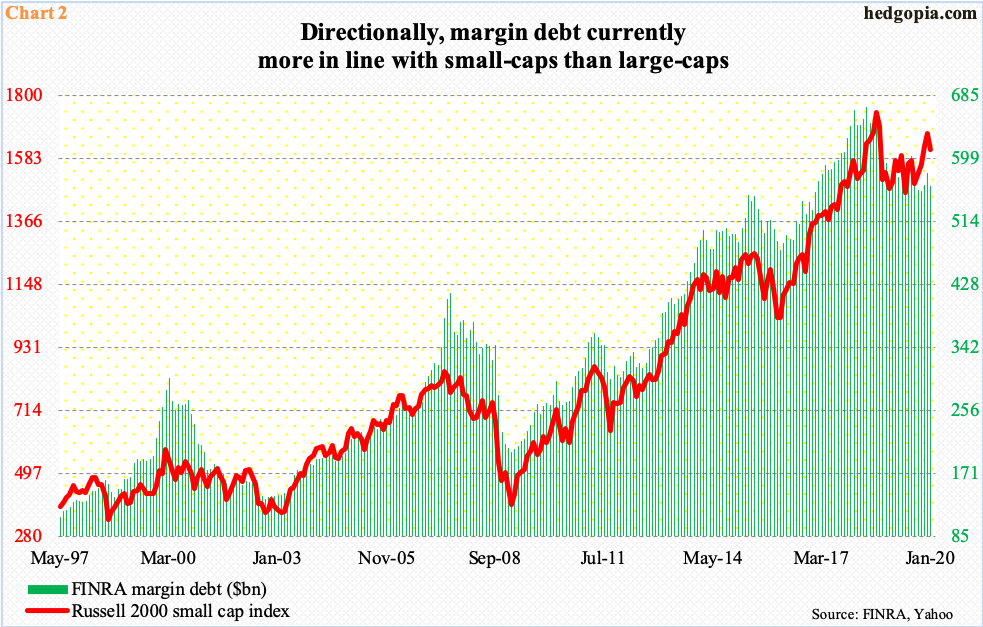

The breakdown in this relationship is evident if we plot margin debt with large-caps. Versus small-caps, the picture looks entirely different, which is what Chart 2 shows.

The Russell 2000 small cap index (1571.90) peaked in August 2018 at 1742.09, three months after margin debt peaked. It has not been able to surpass that high, even as the S&P 500 rallied to new – and newer – highs. From their respective highs, the Russell 2000 is down nearly 10 percent, margin debt 16 percent.

In general, investors tend to both add leverage and gravitate toward small-caps if they are in a mood to take on risk. Chart 2 shows that is not the case currently. Investors are hiding in large-caps.

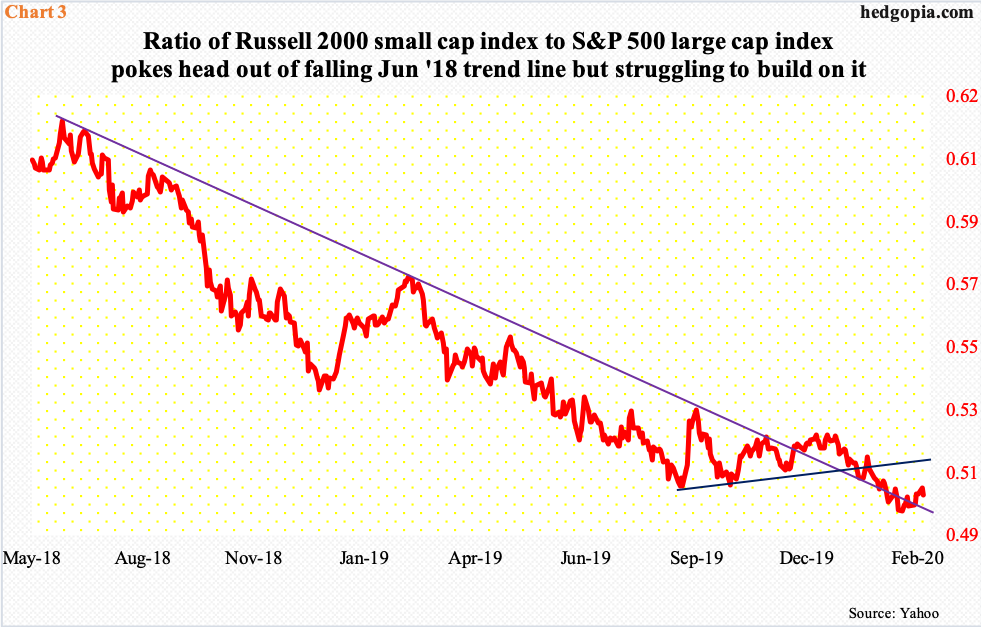

The ratio of the Russell 2000 to the S&P 500 has trended down since June 2018 (Chart 3). As mentioned earlier, the former peaked in August that year. On the 10th this month, the ratio printed 0.498 – the lowest since August 2004 – with Tuesday at 0.503. It has managed to poke its head out of the falling trend line, but right above lies trend-line resistance from last September. A breakout potentially bodes well for small-caps, and, by default, margin debt, but investors likely are not holding their breath. The Russell 2000 Tuesday was pushed back under 1600-plus, which has proven to be a crucial price point going back two years.

Thanks for reading!