This week’s dot plot indicated one more hike is possible this year. Equity bulls did not want to hear this. In the futures market, a wide gap remains between what fed funds traders see things and what the Fed tells us.

The conclusion of this week’s FOMC meeting, followed by the statement of economic projections and Chair Jerome Powell’s presser, pretty much amounted to a Damocles sword hanging over the head of US stock indices.

Ahead of the meeting, equity bulls were hopeful that not only will the Federal Reserve not raise in this meeting but that it would signal an end to the tightening cycle. As expected, there was no hike, as the fed funds rate was left unchanged at a range of 525 basis points to 550 basis points. But the outlook was quite unanticipated.

The dot plot indicated that one more rate hike is possible this year. Two more FOMC meetings remain this year – in October/November and in December. For 2024, FOMC members now expect two cuts, which is two fewer than June’s dot plot indicated.

The central bank’s bias clearly shifted more toward being restrictive and keeping rates elevated for longer. Equities puked on both Wednesday and Thursday. The S&P 500 top-ticked in the first half an hour Wednesday and selling accelerated in the last hour and a half, closing down 0.9 percent to 4402; this was followed by Thursday’s 1.5-percent drubbing, closing at 4330.

The large cap index failed to remain above the 50-day last week, slicing through the average on Friday. Thursday’s session essentially ended at 4320s, which is a retest of a breakout from June (Chart 1). This is a must-save. Inability to defend this can result in a hurried test of the 200-day at 4189, where a decent reflex rally could ensue.

Mid- to long-term, the monthly chart is itching to go lower.

From the bulls’ perspective, between now and the next meeting (October 31-November 1), anytime economic data comes in stronger than expected, the odds of a November hike goes up. Inflation particularly is the wild card.

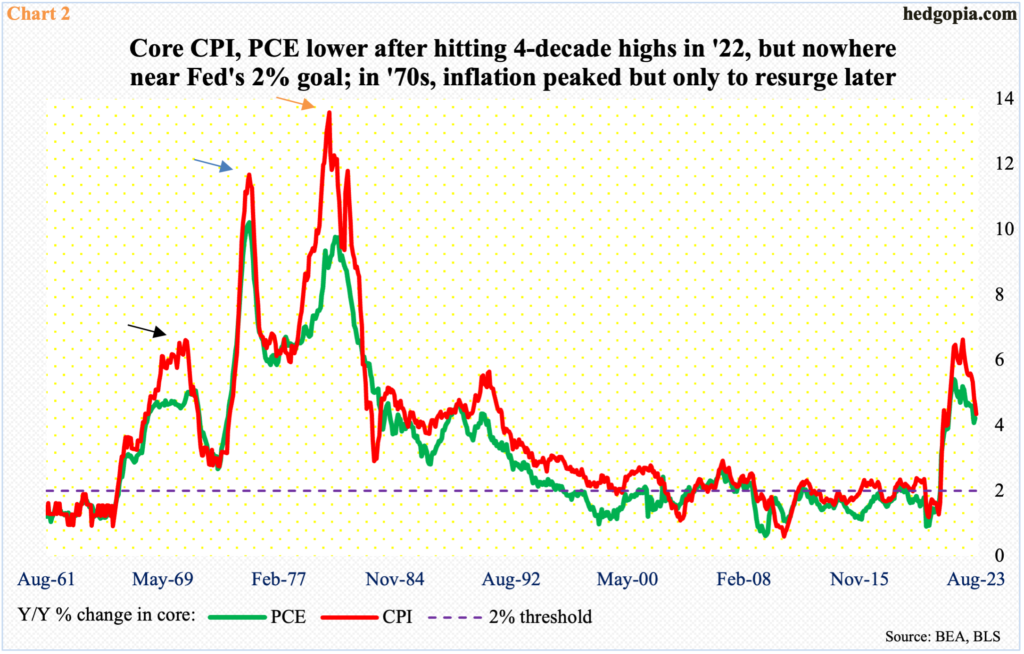

From last year’s four-decade highs, both headline and core consumer inflation has come down quite a bit but remain lofty – particularly the core.

The Fed has a two percent target on core PCE (personal consumption expenditures). In the 12 months to July, this metric rose 4.2 percent, up from June’s 4.1 percent pace; it peaked in February last year at 5.4 percent. August’s numbers are due out next Friday. In August, core CPI (consumer price index) increased 4.4 percent from a year ago, peaking last September at 6.6 percent.

The Fed expects core PCE to end this year at 3.7 percent and next year at 2.6 percent. Given how inflation behaved in the ’70s, with a pattern of higher highs (arrows in Chart 2), they need to remain mindful of that risk. Even if they wind down the tightening cycle, they will remain wary. They can afford to.

The economy’s resilience has surprised many, including the Fed. They now expect GDP to expand 2.1 percent this year, versus one percent growth they expected in June; next year’s was revised up from 1.1 percent in June to 1.5 percent. The economy is “expanding at a solid pace,” versus the word “moderate” used previously.

In March last year, the fed funds rate was zero to 25 basis points. Over the next 16 months, the benchmark rates went up 525 basis points. The full effect of this tightening is probably yet to be felt in the economy, but the fact that it has held up as well as it has gives the Fed a cover for remaining restrictive.

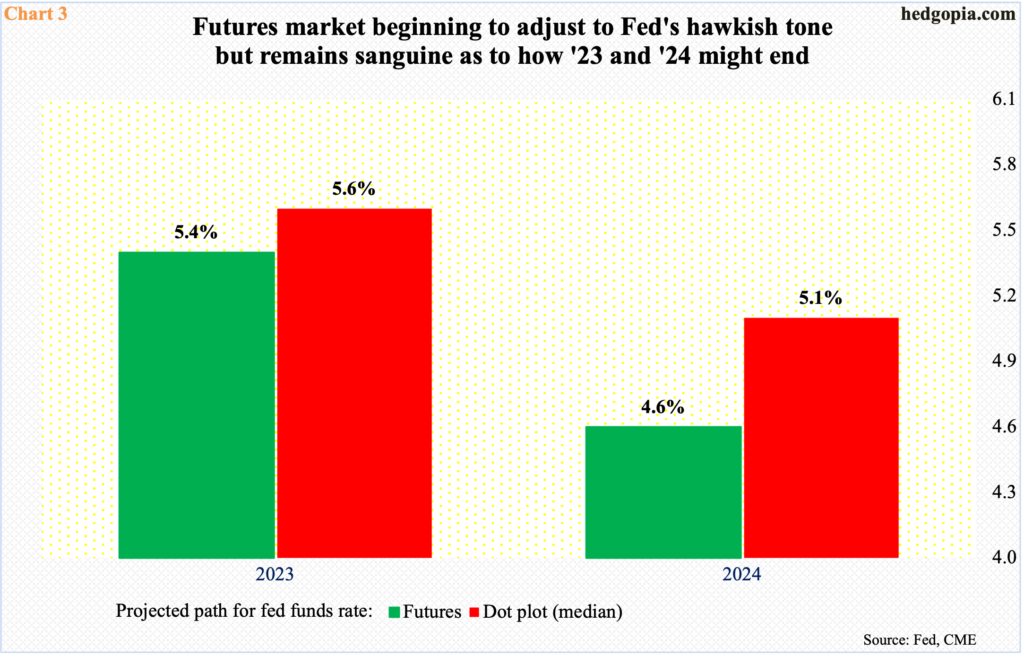

With all this as a background, there is still a yawning gap between how futures traders expect the fed funds rate would end this year and next and where the Fed is at.

The CME’s FedWatch Tool shows these traders are betting that the fed funds rate peaked with the July hike. On the other hand, this week’s dot plot showed there might be one more hike, to a range of 550 basis points to 575 basis points.

For next year, the dot plot expects two 25-basis-point cuts to 500 basis points to 525 basis points, while futures traders expect 2024 to end at 450 basis points to 475 basis points. Over the last several weeks, these traders have been forced to readjust their optimism – lower, of course – as the Fed doggedly stuck to its message; until not too long ago, they were expecting the fed funds rate to end 2024 south of four percent. There is more adjustment ahead, and that will have implications for asset valuations – as was evident this week in the stock market.

Thanks for reading!