Small-cap bulls had to wait three long years to see a new high on the Russell 2000, but they failed to hang on to the gains last week. They have achieved this feat at a time when 2024 earnings are set to drop from last year’s and when bullish sentiment is building but not extreme yet.

The Russell 2000 peaked at 2459 in November 2021, before dropping all the way to 1641 by June 2022, which was then successfully tested in October of both 2022 and 2023 (1642 and 1634 respectively). The rally that followed peaked at 2300 this July, with 2260s offering tough resistance until it gave way on November 6 when equities rallied huge after Donald Trump became president-elect. By the 11th, the index ticked 2442 – just 17 points short of the November 2021 high – and came under pressure to just about retest the breakout at 2260s (Chart 1). It then rallied all the way to 2466 last Monday to post a new intraday high, although bulls were unable to hang on to it with the session ending in a shooting star. By the end of the week, the index finished up 1.2 percent for the week to 2435, but still lower than the November 2021 high. When it was all said and done, the week finished with a spinning top.

Small-cap bulls are probably not happy to see last week’s weekly candle as well as the way Monday acted and the candle it produced. This is coming at a time when fatigue could be setting in. But as long as 2260s remains intact, bulls should be given the benefit of the doubt.

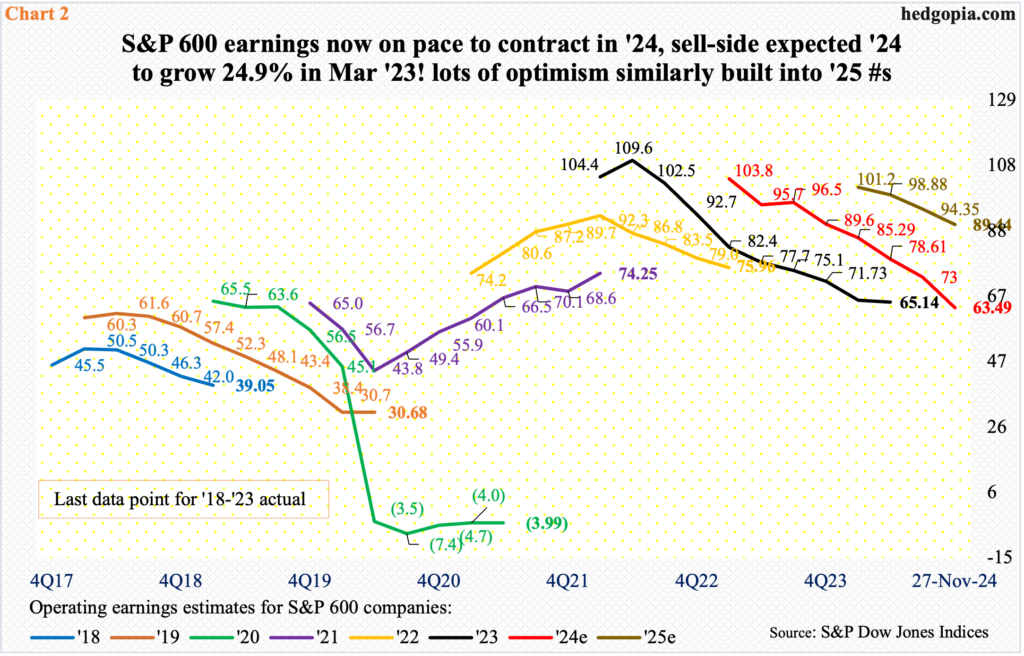

Small-cap stocks have come alive at a time when earnings momentum is in deceleration. In fact, S&P 600 companies are now on pace to earn less this year than they did last year. By last Wednesday, 2024 estimates stood at $63.49, versus the $65.14 they rang up in 2023 (Chart 2). The irony is that the sell-side in March last year had penciled in $105.68 for this year.

Estimates for next year similarly are elevated – currently $89.44. Although even here, the revision trend is down, with $102.88 being the highest estimate this May. The optimists – particularly the ones that bought or added post-election – are obviously counting on optimism that small-cap fortunes will turn up under the next administration.

This factor – last month’s elections resulting in a Republican sweep – is beginning to also positively impact the overall investor sentiment.

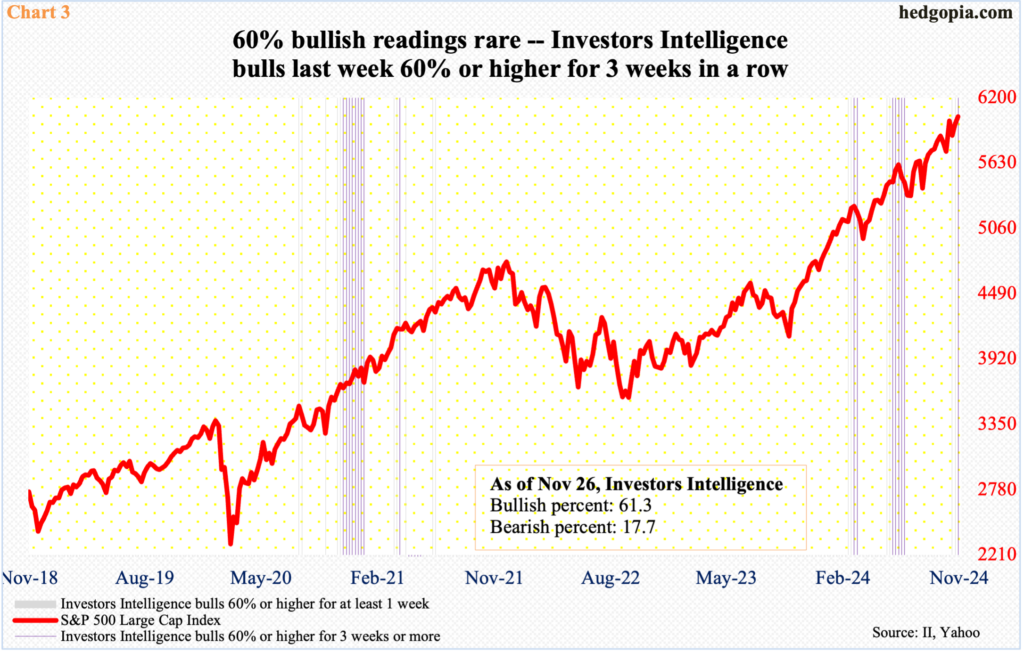

In the week to last Tuesday, Investors Intelligence bulls increased 1.3 percentage points week-over-week to 61.3 percent – an 18-week high – even as the bearish percent dropped six-tenths of a percentage point to 17.7 percent, which was a 17-month low.

Last week’s bullish reading was the third week in a row sentiment was 60 percent or higher. Bullish sentiment in this range is rare, let alone persisting for several weeks (Chart 3). Most recently, sentiment remained 60 percent or higher for seven consecutive weeks in June and July this year. Before that, the streak lasted 10 weeks between November 2020 and January 2021 and 17 weeks between October 2017 and January 2018.

So, the current momentum in bullish sentiment can continue for weeks in the right circumstances. This is what equity bulls are banking on – particularly the ones that have gravitated toward the small-caps, which are considered risk-on. Small-cap bulls do have an opportunity to build on the recent momentum, although things look a little extended here. But running out of fume at a prior high can prove costly. It is a decision time.

Thanks for reading!