Semis have come a long way. Through last Thursday, SMH, the Market Vectors Semiconductor ETF, rallied 21 percent since the August 24th low and nearly 11 percent since the September 29th low. The latest rally in particular came in a mere seven sessions (arrow in Chart 4).

The move probably has more to do with technicals than fundamentals.

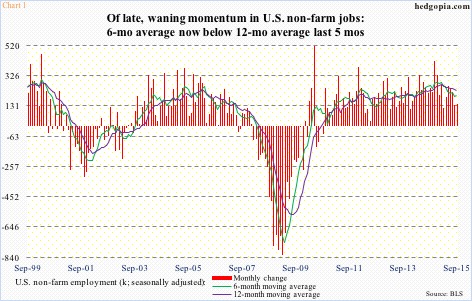

U.S. economic data continue to come in tentative, with even the erstwhile reliable jobs numbers beginning to show waning momentum. September only produced 142,000 non-farm jobs, with downward revisions for both August and July. Year-to-September, an average of 198,000 jobs has been created, versus a 2014 average of 260,000. For the last five months, the six-month average has dipped below that of the 12-month (Chart 1).

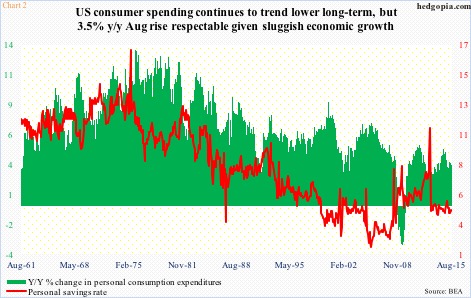

Even so, consumer spending is hanging in there. Business is disappointing, though.

Personal consumption expenditures were up 3.5 percent year-over-year in August, to $12.4 trillion, and have grown at a north of three-percent clip since January 2014 (Chart 2). With that said, even on this front, there is deceleration. Spending grew at five percent in August last year.

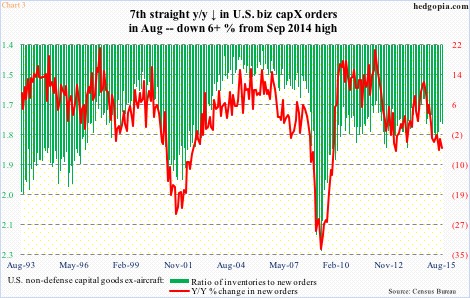

Deceleration is starker on the capital expenditures front. Orders for non-defense capital goods ex-aircraft – a capex proxy – were $74 billion in September last year, and August came in at $69.3 billion. Orders have grown since they bottomed at $67.4 billion in February, but it will be a while before they start notching year-over-year growth. Since they peaked last September, they stayed in the $70 billion range for the next four months before beginning to weaken. Similarly, the inventories-to-orders ratio has come in a tad in recent months but remains elevated (Chart 3).

It is not just the U.S. As a matter of fact, U.S. growth is holding up just fine versus what is going on in the rest of the world. Just last week, the IMF cut its global growth forecast for 2015 from 3.3 percent in July to 3.1 percent. In April, it had predicted 3.5 percent growth.

Viewed from this perspective, the rally in semis in the past several weeks can best be described as technical in nature.

The August sell-off was vicious, with SMH dropping nearly 18 percent in 10 sessions before bottoming at $43.53 on the 24th. It dropped nearly 28 percent between that low and the June 1st high of $60.13.

During the August downdraft, the ETF lost support at $52-$53 going back to September last year. This was tested twice this September – unsuccessfully – and once again SMH is literally sitting on it (Chart 4). On a daily basis, conditions are grossly overbought. Hence, the probable path of least resistance is down – at least near-term. The 50-day moving average lies at $50.09.

Here is the risk. The 200-day moving average lies at $54.19, which likely gets tested if SMH rallies here.

This week, three of SMH’s top five holdings report third-quarter financials – INTC (19.8 percent weight) later today, ASML (5.9 percent) tomorrow and TSM (15.1 percent) the day after. The other two top five holdings are TXN (5.2 percent) and BRCM (five percent).

For two weeks now, give and take, all these stocks have rallied strongly, and barring BRCM, are all in gross overbought territory (on a daily chart). They will really have to knock the cover off the ball if they are to continue rallying.

INTC is expected to earn $0.59. Estimates over the past three months have gone up by $0.02. Last year, the company earned $0.66. The phenomenon of deceleration, once again! ASML is expected to earn $0.82, versus $0.78 expected three months ago; last year was $0.74. The consensus forecast for TSM is $0.45, with estimates having gone up a penny in the past three months; last year, it earned $0.49.

Having rallied strongly into earnings, even if results come in better than expected, odds favor rallies get sold, especially if SMH rallies toward $54.

The ETF does not trade weekly options, otherwise hypothetically an ideal trade would be to sell upside calls to either go short near $54 or earn decent premium. Or, even an iron condor to play a range-bound action.

Since options cannot be deployed, as things stand now, risk/reward dynamics probably favor going short the underlying near-term.

Thanks for reading!