Small-caps have a big problem.

Investors do not fancy them, and it has been a while.

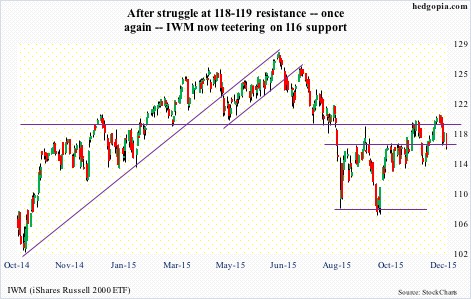

Having peaked last June, IWM, the iShares Russell 2000 ETF, with at least one false breakout, has lagged its large-cap brethren.

There probably are several reasons for this.

Increasingly, investors seem to be gravitating toward big-cap names. Small-caps, by default, measure investor willingness to take on risk, and from this standpoint risk-on attitude is lacking.

The global economy is soft. Yesterday, China reported its November exports, and they slumped again, down 6.8 percent in from a year ago – down for a fifth month. It is when things are booming investors throw caution to the wind and get on the risk curve.

As well, the Fed is all ready to hike come December 16th. While this shows its conviction in the economy’s ability to handle a tighter monetary policy, mixed signals abound. Small-caps, by nature, are domestically oriented.

Whatever the reason, IWM continues to struggle.

The sell-off was vicious in August. Later on, it, along with the S&P 400 index, were the only ones of major U.S. indices to have undercut the August lows.

Subsequently, IWM has tried to take out resistance at 118-119 three times and failed each time. This support goes back to March last year. The latest of these attempts came last week, with the ETF getting rejected at its 200-day moving average.

Yesterday, it dropped 1.5 percent, and found support intra-day at its 50-day moving average, which is still rising.

Weekly momentum indicators are in overbought territory and are about to turn lower. If they prevail, it is only a matter of time before the 50-day moving average gives way.

On a daily chart, IWM ($116.01) just had a bearish MACD crossover. Odds favor the ETF continues to come under pressure – at least this week. This will particularly be the case if $116 support is broken.

In this scenario, options can help generate some income. Hypothetically, December 11th 117 calls fetch $0.53. With four sessions remaining, if assigned, it is an effective short at $117.53. Else, it is a nice premium to keep.

Thanks for reading!