- Six years into recovery, U.S. corporate capX potential yet to turn into reality

- September saw several macro/company data points in deceleration

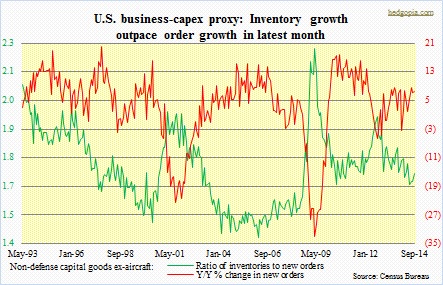

- Latest being m/m order shrinkage in business capX proxy

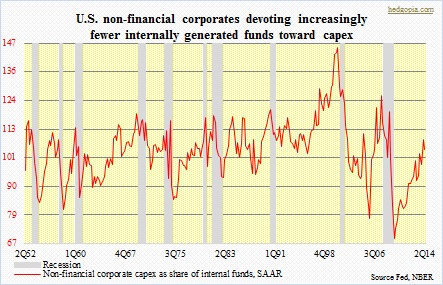

Five-plus years and counting. Still a no-show. The chart below does a good job of portraying what is wrong with the U.S. corporate capital spending scene. Fewer and fewer of non-financial corporates’ internal funds (after-tax profit minus net dividends paid plus capital consumption allowance) are going toward capX. If there is any consolation, it is that in three of the last four quarters, capital expenditures have exceeded internal funds. But spending historically remains suppressed. Despite signs of firmer capX here and there, there are no signs of this changing any time soon.

Back on October 13th when Microchip preannounced a shortfall in its September quarter, markets were not sure if that was supposed to be taken as a canary in the coal mine or was a one-off. Semi stocks initially took a hit. But a few days later, (1) stocks in general bottomed, and (2) subsequent results from the likes of Intel and Texas Instruments looked fine. Semis have gone on to recover a substantial portion of the recent decline. But the fact that Microchip is an entity with over 80k customers and that it reports sales on a sell-through basis cannot be brushed off. Management pointed out September being particularly weak. Since then, there have been other data points showing a weak September. Retail sales were weaker than expected in that month. Then came the September survey of the National Federation of Independent Business that showed member firms’ capX plans dropped to a 20-month low.

Yesterday, we had one more data point showing things indeed did decelerate in September. Orders for durable goods fell 1.3 percent month-over-month. From the July peak of $300bn, orders are actually down 19 percent. Orders for non-defense capital goods ex-aircraft, a proxy for business capX, fell 1.7 percent m/m from August peak of $73.1bn. With that said, as shown in the chart above, year-over-year growth is still healthy. Since June this year, orders for the capX proxy have hung in the low $70bn, with healthy y/y growth. October growth should be o.k. as orders were less than $66bn last year. But beginning November, y/y growth will begin to decelerate as comparisons look tougher. The good thing is, inventory is not that out of line – yet. Deceleration in order momentum eventually can impact both shipments and inventories.