For the second consecutive month in July, foreigners were net purchasers of US equities, not sellers. They bought $24.3 billion worth, followed by $26.4 billion in June. This preceded 13 straight months of selling.

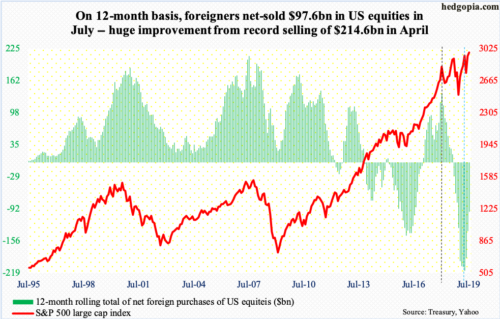

On a 12-month basis, foreigners are still net sellers, but the trend is improving. In the 12 months to July, they sold $97.6 billion worth. As recently as April, they were selling $214.6 billion worth, which was a record (blue vertical dashed line in chart below).

Historically, foreign buying – or a lack thereof – moves in tandem with the S&P 500 large cap index. In January last year, their buying peaked at $135.6 billion (black vertical dashed line). The S&P 500 suffered a quick two-week retreat back then. Since then, the index has slightly trended higher, with a couple of decent selloffs along the way. Foreigners, however, kept selling – until recently that is.

If past is prologue and the April 2019 bottom sticks, this can potentially turn into a tailwind. At least equity bulls hope so. The S&P 500 pulled back in August. If it turns out foreigners used that as an opportunity to buy, then it can be taken as a signal a shift in sentiment is taking place. That said, July’s numbers were reported Tuesday. Thus, it will be another month before we find this out.

Thanks for reading!