Markets that were prepared for a blue wave scrambled to adjust when they found out the red wall would not break down. Assets see-sawed in overnight futures as the vote count started coming in. As things stand, results in some key states may not be known for at least a couple of days.

At the time of posting (4:30AM EST), Vice President Biden led President Trump by 25 electoral votes – 238 to 213. With 270 needed to win, markets did not expect as close an election as it is turning out to be.

Polls expected a blue wave. Based on last week’s spike in volatility measures such as VIX (S&P 500) and RVX (Russell 2000), markets were girding up their loins in preparation for a Democratic sweep – in both presidency and the Senate.

In the end, polls seem to have overestimated Biden’s prospects, or underestimated Trump’s. In overnight futures, markets scrambled to readjust. Major equity indices vacillated between red and green. At one time, Nasdaq futures were up 4.5 percent. The reflation trade was out the window. The 10-year Treasury yield dropped as much as 13 basis points. The dollar caught the bid, and the Chinese yuan slid. These are all trades pointing to better-than-expected performance by Trump.

But as the night progressed and it became clear that the outcome will not be clear before the market opens on Wednesday, gains dissipated. In fact, we could be waiting hours or days before results from Pennsylvania (20), Michigan (16), Georgia (16) and Wisconsin (10) were certified. Amidst all this, the Russell 2000 massively underperformed, as the value trade that was put on got unwound.

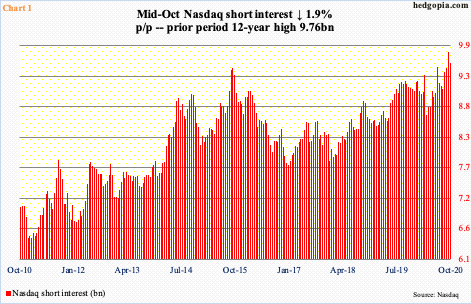

Ahead of the election, Nasdaq shorts had built up a massive position. Mid-October, short interest fell 1.9 percent period-over-period, but the prior period’s 9.76 billion was the highest since mid-September 2008 (Chart 1). Short squeeze likely played a role in the overnight futures action. Should Trump pull off a win – or even if the Republicans continue to hold the Senate – squeeze can continue in a seasonally favorable time of the year.

Leading up to this, the Russell 2000 (1614.30) rallied 4.9 percent in the first two sessions this week to essentially close right on make-or-break 1600-plus (Chart 2). Small-caps inherently have larger exposure to the domestic economy versus their large-cap peers, who are also exposed internationally. How they behave post-election will be telling as to how the collective wisdom of markets views where things are headed. The economy is in need of fiscal stimulus, which was easier if the Democrats took both the White House and the Senate.

On Tuesday, apart from 1600-plus, the Russell 2000 also closed right underneath a falling trend line from October 12th when the index peaked at 1652.05. A takeout of this dual resistance opens the door to a test of that high, and maybe rally further to test another trend-line resistance. This was a near certainty in a blue wave scenario but is a toss-up if Trump wins, although if the Republicans keep the Senate the road to fiscal stimulus opens up – size notwithstanding.

Thanks for reading!