Financials will start reporting 3Q results pre-open tomorrow. From May’s low, KBE has rallied into potentially crucial resistance. A breakout can trigger short squeeze. KBE short interest just shot up.

The September-quarter earnings season is upon us. Customarily, financials will get the ball rolling, with Friday seeing results from JP Morgan Chase (JPM), Citigroup (C) and Wells Fargo (WFC). Next week, Bank of America (BAC) and Goldman Sachs (GS) report on Tuesday and Morgan Stanley (MS) on Wednesday.

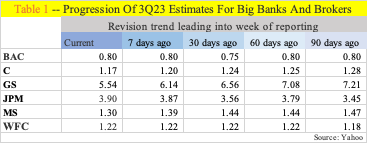

Of the major four banks, C’s 3Q consensus estimates have trended lower over the past three months, while the other three – JPM, BAC and WFC – are sideways to higher (Table 1). In contrast, the brokers – GS and MS – are lower than three months ago. The revision trend for GS and MS is not very encouraging, but at the same time this gives them a lower hurdle to jump over. In the June quarter, MS missed estimates, while GS beat them. For banks, JPM, BAC and WFC exceeded June-quarter estimates, while C came up short.

Leading up to this, KBE (SPDR S&P Bank ETF) has rallied into a crucial juncture. Unlike XLF (Financial Select Sector SPDR Fund), which for instance has both JPM and GS, KBE is a pure play on banks. Ahead of the 3Q results, the latter finds itself at a crucial spot.

KBE peaked at $60.60 in January last year. From that high through this May’s bottom at $30.85, it was just about cut in half – down 49.1 percent. The rally from that low stopped in July, tagging $42.58 on the 27th. Horizontal resistance at $42.50s goes back to June last year.

From the July high, KBE has trended downward in a descending channel, with the lower bound successfully tested several sessions ago. Currently, it is at the upper channel, which also lines up with lateral resistance just north of $37. In Wednesday’s long-legged doji session, it closed at $36.98, with a high of $37.44 and a low of $36.61.

If the dual resistance holds, KBE obviously turns back lower, leaving the channel intact. Or it could break out. Hence the significance of banks’ results this week and next – or how they are perceived in the markets. Should a breakout occur, it is likely the stops got taken out, and it can feed on itself.

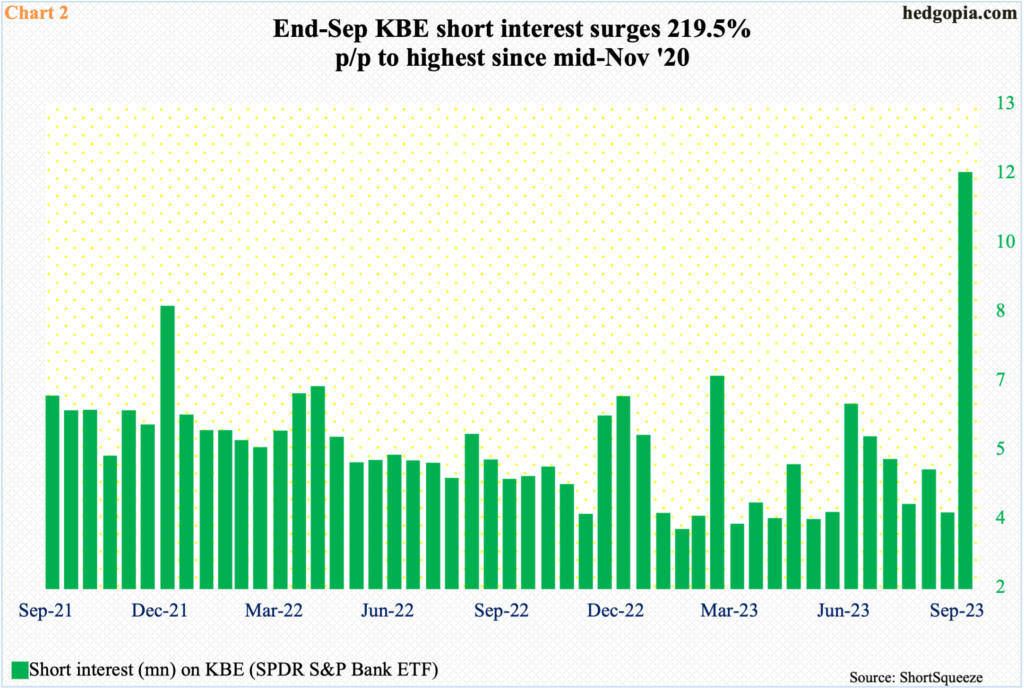

This is particularly so as KBE shorts just got very aggressive.

At the end of September, short interest surged 219.5 percent period-over-period to 11.5 million (Chart 2). This is the highest since mid-November 2020.

A breakout at $37-plus can act as a self-fulfilling prophecy as shorts scramble to cover.

Thanks for reading!