After being under pressure for a couple of months, the S&P 500 has approached an area of potentially crucial support. This takes place even as pessimism is heavy in the options market.

From its July 27th high of 4607 through Tuesday’s low of 4216, the S&P 500 gave back 8.5 percent. Particularly since September 14th when it made a lower high (4512), coming on the heels of September 1st’s 4541, selling has been persistent – first losing the 50-day moving average and then horizontal support at 4320s.

Since the July high, the large cap index has been trading within a descending channel, and it is currently at the lower bound. This lines up with support at an ascending channel from last October when the S&P 500, along with other equity indices, bottomed. Plus, Tuesday’s low was not too far away from the 200-day (4204), which has not been breached since March 17th this year.

Equity bulls are clearly looking at a confluence of support, and this is happening at a time when fear is seeping into the market.

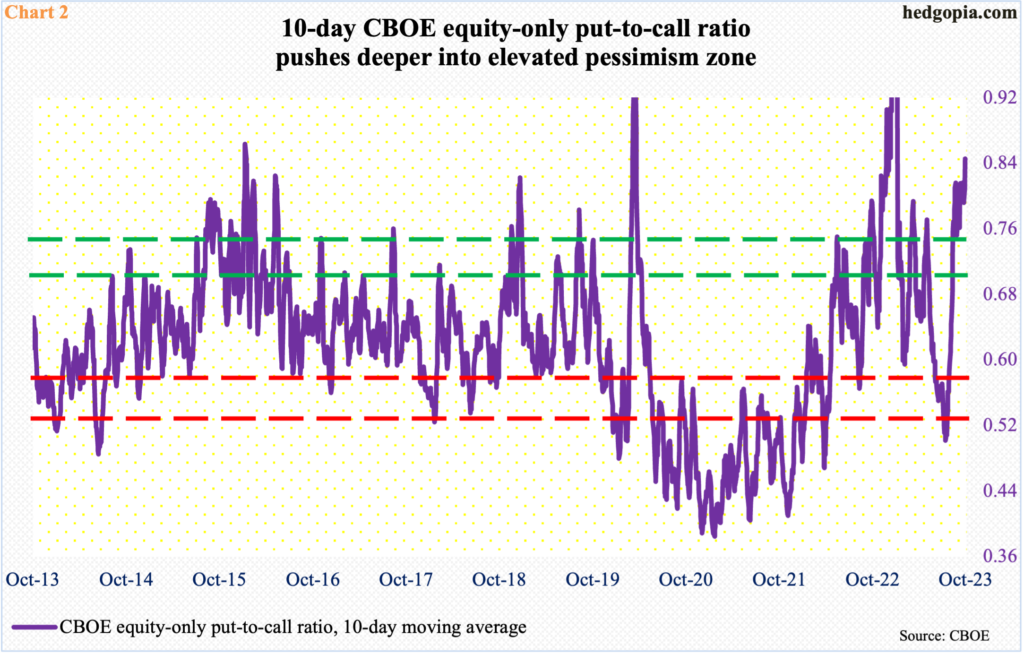

In the options market, the CBOE equity-only put-to-call ratio on Wednesday produced a reading of 1.11. A ratio of one tends to be rare. That said, the metric has remained elevated in recent weeks, as stocks came under pressure and as equity bears got more and more emboldened.

Since August 16th, there have been three plus-one readings in the put-to-call ratio – the other showing up on September 13th. In the 14 sessions between Wednesday and September 13th, there was one session of a low-0.60s reading; the rest were all in the 0.70s, 0.80s and 0.90s. And between August 16th and September 13th, there were 18 sessions, with only one session of a mid-0.50s reading; the rest were in the 0.60s, 0.70s, 0.80s and 0.90s, with three in the high-0.90s.

The point is, bears have amassed tons of puts. In the event the above-mentioned support does not give way on the S&P 500 – which is looking probable – these traders will be forced to unwind their trades, in turn acting as a tailwind for the S&P 500.

As things stand, the 10-day average of the ratio finished Wednesday at 0.846, which is the highest since January 11th this year. This is elevated territory. If past is prelude, unwinding is just a matter of time.

Thanks for reading!