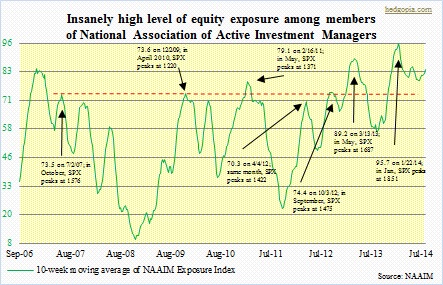

Yesterday was the first time since April the S&P 500 Index violated its 50-day moving average – both simple and exponential. This was the first test since May, yet there was hardly any resistance from the bulls. Sellers simply overwhelmed buyers. The 1950 level is being closely watched by a lot of technicians and technically-minded investors/traders. The break has been convincing, so it is probable (1) potential buyers decide to watch from the sidelines and see what transpires next, and/or (2) shorts get active. Short interest can play an interesting role in this respect. Year-to-date, it has had a consistent month-over-month increase. The sooner equities stabilize, the higher the odds that some sort of short-covering takes place. On the other hand, a failure to do so would only embolden potential shorts. The second scenario is not out of the question, given how extended things are – from ultra-bullish newsletter writers to signals coming from the options market (SKEW and put-to-call ratio) to lofty levels of margin debt to divergences (small-caps, high-yield corporate bonds, financials, etc.). Increasingly, institutions in particular have been seeking shelter in big-caps. And things can only get stretched so far. The adjacent chart offers one more example of how extended things are. And this is an important group. Unlike newsletter writers, NAAIM member firms are active money managers, who hold the purse strings. While the Investors Intelligence survey provides a glimpse into investor sentiment, the NAAIM survey essentially tells us if there is any dry powder left. One look at the chart, and it does not take a genius to realize that they are all in. Needless to say, in a bull market that is in its sixth year, there is a lot of profit on paper. The Fed is only a few months away from ending its bond purchases. So it is not outside the realm of possibility that these managers try to preempt that and decide to lock in some of that profit. It is just a scenario, but if it indeed unfolds that way, it has the potential to feed on itself. Interesting few weeks lie ahead, at least!

Yesterday was the first time since April the S&P 500 Index violated its 50-day moving average – both simple and exponential. This was the first test since May, yet there was hardly any resistance from the bulls. Sellers simply overwhelmed buyers. The 1950 level is being closely watched by a lot of technicians and technically-minded investors/traders. The break has been convincing, so it is probable (1) potential buyers decide to watch from the sidelines and see what transpires next, and/or (2) shorts get active. Short interest can play an interesting role in this respect. Year-to-date, it has had a consistent month-over-month increase. The sooner equities stabilize, the higher the odds that some sort of short-covering takes place. On the other hand, a failure to do so would only embolden potential shorts. The second scenario is not out of the question, given how extended things are – from ultra-bullish newsletter writers to signals coming from the options market (SKEW and put-to-call ratio) to lofty levels of margin debt to divergences (small-caps, high-yield corporate bonds, financials, etc.). Increasingly, institutions in particular have been seeking shelter in big-caps. And things can only get stretched so far. The adjacent chart offers one more example of how extended things are. And this is an important group. Unlike newsletter writers, NAAIM member firms are active money managers, who hold the purse strings. While the Investors Intelligence survey provides a glimpse into investor sentiment, the NAAIM survey essentially tells us if there is any dry powder left. One look at the chart, and it does not take a genius to realize that they are all in. Needless to say, in a bull market that is in its sixth year, there is a lot of profit on paper. The Fed is only a few months away from ending its bond purchases. So it is not outside the realm of possibility that these managers try to preempt that and decide to lock in some of that profit. It is just a scenario, but if it indeed unfolds that way, it has the potential to feed on itself. Interesting few weeks lie ahead, at least!