Last Thursday, Jamie Dimon, JPMorgan Chase (JPM) CEO, grabbed the headlines when he said someone was going to get hurt in the auto-loan lending market. “Auto is clearly a little stretched, in my opinion.”

JPM does not do much of auto loans. That partly explains why he may be trying to sound the alarm. But is he wrong?

Hardly.

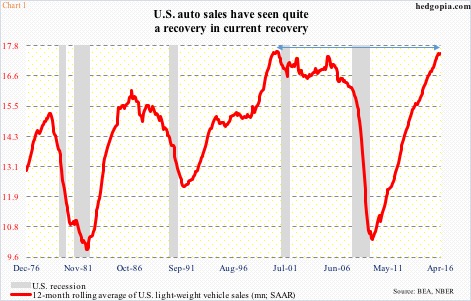

Sales of light-weight vehicles have had phenomenal growth in the past several years.

In April, sales came in at a seasonally adjusted annual rate of 17.3 million units. The current cycle peaked at 18.1 million last October.

Monthly sales obviously fluctuate. Using a 12-month moving average, April sales were 17.5 million, essentially on par with the all-time high of 17.6 million in September 2000. The parabolic rise in the red line in Chart 1 has an alarming look to it.

Growth in and of itself is hardly alarming. It can be, depending on how these sales are coming through.

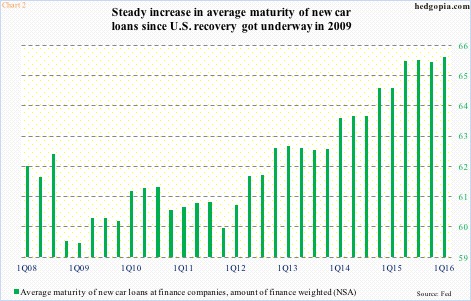

Chart 2 plots the average maturity of new car loans. The green bars have had a steady rise post-Great Recession. It is obvious. Maturity is being extended so buyers can afford the monthly payment.

Despite this, Experian, the credit-data company, points out that at north of $500 the average monthly payment is at a record.

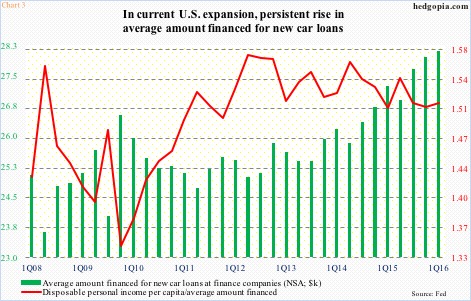

The average size of loans is rising as well. In 1Q16, this stood at $28,140. In 3Q09, when the recovery had just started, this was $24,010 (Chart 3).

The average auto loan has gone up, but not because there has been a commensurate increase in the disposable personal income per capita. The latter was $42,551 in April. The ratio between the two peaked in 2Q12 at 1.57, with 1Q16 at 1.51. In other words, there is a persistent increase in the average loan size as a percent of disposable personal income.

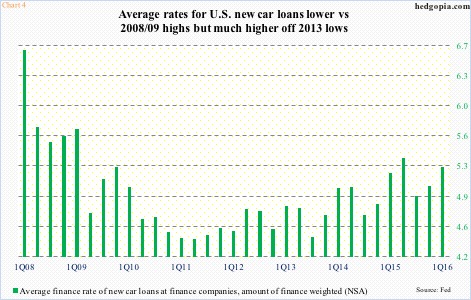

Incidentally, the average rate of these loans is on the rise. Thanks to the Fed’s ZIRP (zero interest-rate policy), rates are low and affordable, but have been rising, albeit slightly (Chart 4). If the Fed ends up hiking in the second half this year, that likely puts additional upward pressure on these rates.

It is hard to say what is going to rock the auto-lending market, or even when. In the right circumstances, “stretched” can stay stretched longer than one can imagine. Nowhere was this more apparent than in the last housing bubble.

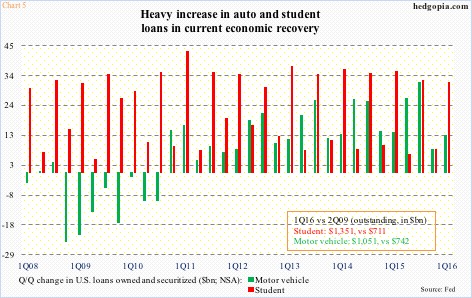

That said, auto loans just exceeded $1 trillion – $1.05 trillion in 1Q16. When the recovery started, they were $742 billion. Incidentally, along with auto loans, Chart 5 also plots student loans, which have nearly doubled from $711 billion in 2Q09 to $1.35 trillion.

To be fair, size-wise, both auto and student loans are nowhere as alarming as was the household mortgage market at its peak. The latter was $10.7-trillion strong in 1Q08 ($9.5 trillion in 4Q15). But the rate of growth is. Plus, at north of $1 trillion, this is nothing to sneeze at.

“Stretched’ may stay stretched a while longer, but once it snaps, repercussions are bound to be felt.

Thanks for reading!