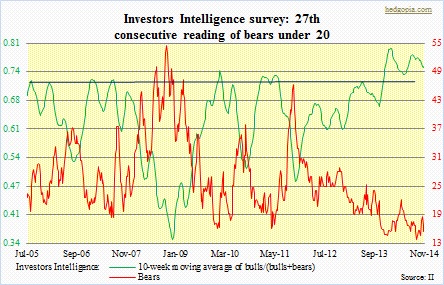

- Even during recent sell-off, Investors Intelligence bears never went over 20

- Overall sentiment too smug, but buy-the-dip complacency has paid off – so far

- Risk is, stretched sentiment readings mean there are too many on one side of trade

After six consecutive weeks of sub-50 reading, bulls in Investors Intelligence’s weekly survey went back over 50 this week, coming in at 54.6. More revealing perhaps is how bears are holding up. Even in the midst of September 19th-October 15th nearly 10-percent correction, they held their ground; in the week that saw stocks bottom out and reverse, bearishness rose as high as 17.3. That is it. That is how smug bulls/neutrals have been. The last time bears had a reading over 20 was late April this year. That is 27 consecutive weeks of sub-20 reading. Complacent? Yes. But the complacency has so far not hurt the bulls. In the last three weeks, the S&P 500 Large Cap Index has regained everything it lost, and then some. Time and again, buying the dip, large and small, has been the right strategy, and the recent one was no exception.

This probably explains why sentiment has stayed so stubbornly high. As shown, the 10-week moving average of bulls/(bulls+bears) has weakened a bit, but it comfortably sits in the mid-70s. Historically, .72-.76 has been a level to get cautious on equities. However, for a year now it has been persistently in that range. On the one hand, this shows conviction on the part of bulls. On the other, this is also increasingly creating a situation in which things are getting stretched. When the levee breaks, there will be no place to stay. That is the risk when sentiment is as elevated as it is. Some market participants use this metric as a timing model, and their sell signals are not generated until it drops below .67. This obviously is yet to take place. Be that as it may, the trend is down – having dropped from .8 early this year to .75 now.