Bears must be scratching their heads over the move by equities the past couple of sessions. Intra-day, the S&P 500 (2041) has managed to rally 3.7 percent. If we must find a catalyst, there are many to choose from – from the Swiss National Bank’s negative interest rate move to the Putin press conference today to the FOMC statement/Yellen press conference yesterday to the extremely oversold oil complex.

But deep down, the bears probably brought it on themselves. First of all, the VIX once again was spot-on. Beginning last Friday, it was sending strong signal that it would begin to go lower soon. And lower it did. But why blame the bears for the move in equities?

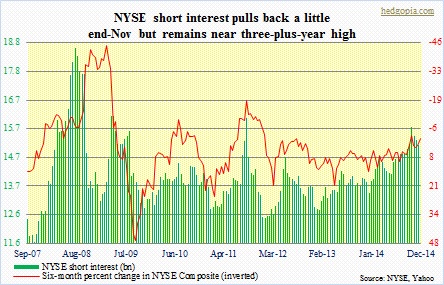

Well, look at short interest. On the NYSE, it has come down a little from the mid-October three-year-plus high, but remains elevated. So many times particularly the past two years, persistently rising short interest has helped create a floor in stocks, as shorts rush to cover. This is probably what is going on. The day is young. So it is too early to say if there is genuine buying interest or this is just one of those short-covering-induced buying.