- U.S. bond market and Fed lock horns as relates to trajectory of short rates

- Fed continues to drop hints it is ready to lift rates off near-zero levels

- Should that come to pass, it has potential to help vigilantes’ case

Increasingly it seems the U.S. bond market and the Fed are caught in a duel. The latter continues to send out signals that it is ready to hike rates, and the former continues to hesitate to give its stamp of approval. On the 10-year Treasury, the last major peak came on the last session of 2013 (3.04 percent). Yields then dropped all the way to 1.65 percent early February. This at a time when the economy produced 3.7 million non-farm jobs in a space of 14 months (through February).

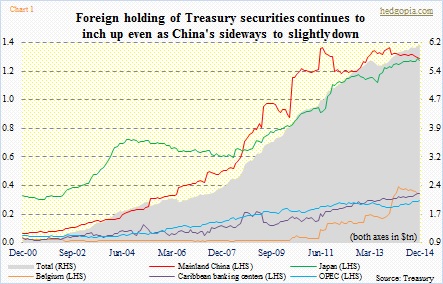

Several factors go into the supply-demand dynamics for Treasurys (previously discussed here), one of which is foreign demand. Over the last 12 months through December, foreigners raised their holdings of Treasury securities by $361bn, to $6.2 trillion (Chart 1). The two major holders are China and Japan. At $1.23 trillion, Japan is not that far off its November high of $1.24 trillion. China’s tally is $72 billion lower than its November 2014 high of $1.32 trillion. This shortfall has been more than offset by a rise in the shares of OPEC, Caribbean banking centers, and others.

As things stand now, yields on the 10-year Treasury are 10x higher than on German bunds. And then there is the dollar, which keeps gaining – and gaining and gaining. Dual benefit for European holders of Treasurys.

Foreign demand alone is not the sole arbiter of which way these yields go. It is a $12.5-trillion market. Ultimately it boils down to the economy – more importantly, prospects for the economy. In this respect, bond vigilantes could not have bet on the prevailing sluggish economic recovery any better. Every now and then, they have been caught off-guard, no doubt. One such moment came on Friday as February’s payroll number was stronger than expected. The 10-year saw a 13-basis-point move on that day! That long, green candle on the right side of Chart 2 says it all. A mini-breakout. However, the enthusiasm was short-lived. The 10-year yield yesterday was lower than on Thursday last week.

For a while now, each of these sell-offs (on price) has been an opportunity to go long bonds/notes. Simply put, the last six years the bond market has read the economic tea leaves much better than the Fed has.

In this context comes the Fed’s nods and winks that it is ready to hike – the implication thus being the economy can more than handle it. In the FOMC meeting next week, it is probable the Fed loses its “patience.”

But what if the bond market is wrong this time around? What if the Fed does indeed hike and the economy takes it in its stride? What are the odds of that happening?

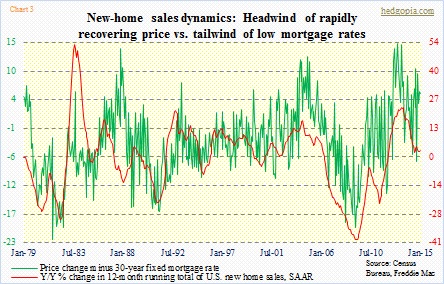

Not very high. The narrative on the Street is that a hike will show the economy is improving. But tell that to a potential home buyer who is already crimped by rapidly rising prices (Chart 3). The median price of a new home in January stood at $294.3k, not that far off the all-time high of $302.1k in December. (Lumber futures have been under persistent pressure for months now.) Or to multinationals that are getting hurt by the surging dollar, having rallied more than 24 percent since July last year. A hike here will only drive interest-rate differential even more in favor of the greenback.

In the end, assuming the Fed hikes, if nothing else just to test the waters – not a base case – that will only end up helping these vigilantes’ case, as the economic boat gets rocked. The 10-year has been trapped in a downtrend channel for 30 years now. The upper end of that does not get tested until 3.75 percent to four percent (Chart 4). A long way to go, if at all!