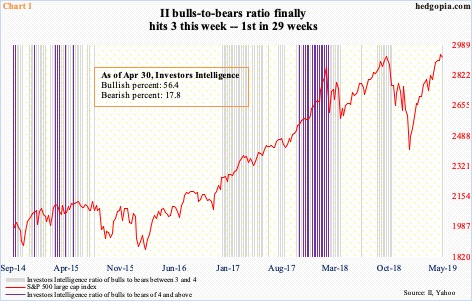

For the first time in 29 weeks, the Investors Intelligence bulls-to-bears ratio crossed three. Having come after a nearly 26 percent rally in the S&P 500, this likely is not the beginning of a trend.

Investors Intelligence bulls jumped three percentage points this week to 56.4 percent, even as bears slid six-tenths of a percentage point to 17.8 percent. This was the highest bullish reading since early October last year when it peaked at 61.8 percent; bears were the lowest since last June.

As a result, the bulls-to-bears ratio printed 3.17 this week – the first three-plus reading in 29 weeks (Chart 1). Leading up to the selloff in stocks last October, the ratio stayed north of three for nine weeks. Similarly, leading up to the selloff early last year, there were several four-plus readings. This time around, the ratio acts cautious. This can be interpreted by both bulls and bears to suit their own personal bias. Bulls obviously argue there is more room for their ranks to continue higher, while bears suggest this is more a sign of underlying weakness.

Indeed, from late-December lows to Wednesday’s high, the S&P 500 large cap index rallied nearly 26 percent. If this does not tempt those on the sidelines into jumping on the bullish bandwagon, what will?

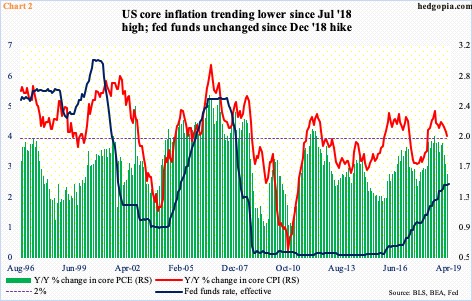

It is also possible bulls’ ranks jumped this week in expectation of a dovish message from the Fed. The FOMC met this week. As expected, the fed funds rate was left unchanged at a target range of 225 to 250 basis points. Ahead of this, trader hopes were building that the Fed would react to falling inflation by leaning dovish. Markets expect a cut later this year. Looking at Chart 2, there is logic in this.

Both core CPI and core PCE have trended lower since last July. The latter is the Fed’s favorite measure of consumer inflation. The bank has a two-percent target. Last July, for the first time since April 2012, core PCE crossed 2.04 percent but only to fall right back below. In past cycles, the fed funds rate would follow this lower.

On Wednesday, Jerome Powell, Fed chair, said this is a transitory phenomenon and that he expects inflation to move back up. At the same time, he said some asset prices are elevated, but not excessively so; non-financial corporate debt is a concern. In other words, no rate cuts are coming – not anytime soon. This is not what equity bulls wanted to hear. Stocks sold off slightly Wednesday.

In this scenario, it is awfully hard for bulls to continue to grow their ranks. Not when macro data continues to be a hit and miss. And not when the sell-side expects growth momentum in 2019 operating earnings estimates for S&P 500 companies to pick up speed as the year progresses.

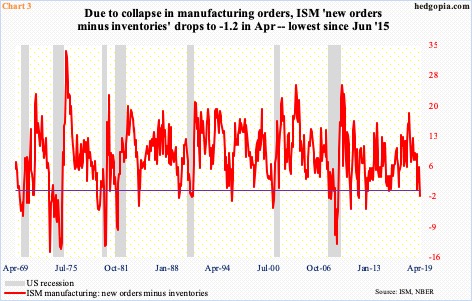

April’s ISM manufacturing index was published Wednesday. It dropped 2.5 points month-over-month to 52.8 – the lowest in 30 months. New orders collapsed 5.7 points m/m to 51.7, while inventories rose 1.1 points to 52.9. The difference between orders and inventories went negative – the first such occurrence in 46 months (Chart 3).

This raises the risk that at some point bulls, who have been quietly snorting the past four months, will be tempted into pulling back their horns.

Thanks for reading!