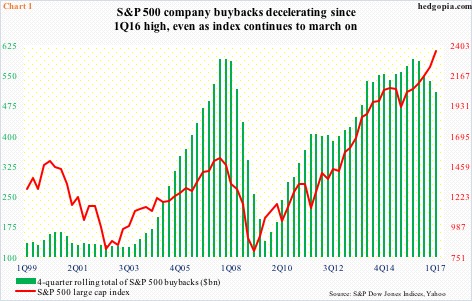

The final numbers are in for buybacks, and it continues to show a decelerating trend.

In 1Q17, S&P 500 companies spent $133.2 billion in share purchases– down 1.6 percent quarter-over-quarter and down a whopping 17.5 percent year-over-year. One year ago, buybacks reached $161.4 billion, which was the highest since the all-time high $172 billion in 3Q07.

On a 12-month rolling total basis, too, buybacks peaked in 1Q16 at $589.4 billion – a record, with 1Q17 at $508.1 billion (Chart 1).

The decelerating trend in buybacks is yet to catch up with the S&P 500 large cap index. In 1Q17, the index rose 5.5 percent.

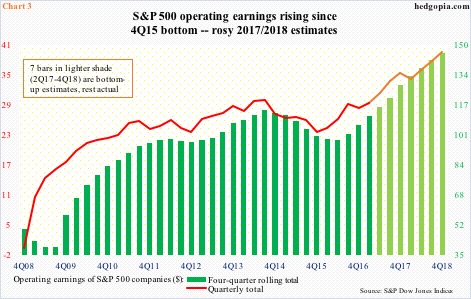

In fact, a combination of less money spent and a rising price resulted in fewer share reductions, which by default meant lesser tailwind for earnings per share. During the quarter, operating earnings rose 3.3 percent q/q (Chart 3).

The relation between the two variables in Chart 1 does not necessarily have to be linear quarter by quarter. But over time the red line tends to follow the green bars.

Thus far, the two have diverged.

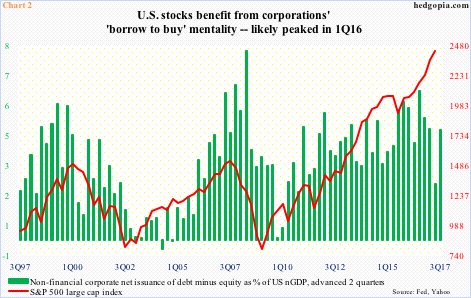

There is a similar dynamic in play in Chart 2, which combines non-financial corporate equity issuance with debt issuance. Equity issuance is subtracted from debt issuance, and the net is used to calculate a share of nominal GDP.

In 1Q17, for instance, corporations raised $426.6 billion (seasonally adjusted annual rate) in debt, even as they spent $475.9 billion in equity purchases. The total equaled 4.7 percent of nominal GDP of $19 trillion, which is what the green bars show, and they are advanced by two quarters.

In 1Q17, there was a nice jump in the green bar, but it also peaked a year ago. The trend is down. Once again, the two variables in Chart 2 are on a divergent path.

Hence the importance of Chart 3.

Buybacks are already in deceleration. There is a limit to using debt issuance as a perennial funding source of buybacks. Earnings are a different matter.

As things stand, 2017/2018 estimates have built in a very optimistic scenario. If they are realized, the buyback ship can steady itself.

Here is the thing, though.

As of the 15th this month, operating earnings estimates of S&P 500 companies for this year were $128.16. This would have risen from $106.26 last year. Similarly, 2018 estimates stand at $145.67. How realistic are these estimates?

We know this much. The revision trend is decidedly down.

In January last year, 2017 estimates were $141.11. In February 2015, 2016 estimates were $137.50. Even 2018 estimates in January this year were $147.21, but are holding up – relatively.

For these estimates to come through, the U.S. economy probably needs to do a 360 and start growing in the three-percent range. Given where things are in the cycle and how subdued the cycle has been thus far, it is one scenario to fade. Translation: Elevated earnings expectations in all probability fail to come through, and buyback deceleration continues.

Thanks for reading! Please share.