- GE stages massive breakout Friday on back of massive buyback announcement

- S&P 500 companies splurged $565 billion on share repurchases in 2014

- As/when buybacks dry up, support zones become more vulnerable

Before last week, GE shares had been on a sideways journey since December 2013, with firm resistance between 26 and 27. That abruptly ended Friday, with a massive breakout (Chart 1). The stock surged nearly 11 percent, to 28.51. This was the biggest one-day move since March of 2009. Volume was eight times its three-month average.

This is as powerful a signal as can be that a trend shift has occurred.

Shorts probably got squeezed, too. As of end-March, short interest totaled 76.6 million, which was down from 84.6 million two weeks ago, but it had been gradually rising. At the end of September, it stood at 55.9 million.

GE is a bellwether. Which by definition means one that leads or indicates trends. It is a $287-billion market cap behemoth, a conglomerate whose tentacles are spread globally. Revenues were $149 billion in 2014. So a breakout in the stock has to mean that a seismic fundamental shift has just occurred. And that has to portend good things for the economy – not only U.S. but global.

But is it that simple?

Is it a genuine signal or just a noise?

On Friday, investors/traders were responding to the company’s announcement that it plans to dispose of most of its finance and real-estate assets in the next two years. GE Capital’s assets will be reduced from $363 billion to about $90 billion. This comes in the wake of the SYF spin-off last year. The company is essentially going back to its industrial roots.

Why the sudden change in strategy?

Probably because GE Capital is one of the four non-banks designated as SIFIs (systemically important financial institutions) in the U.S. So regulatory supervision is higher than normal. Viewed from this light, exiting this business is not such a bad idea. But these are also assets that have been generating a lot of earnings, which raises the risks that earnings will be at a standstill for a while.

But that is not what the stock is telling us. It undoubtedly liked something it saw.

That same day, GE also authorized a stock buyback program totaling up to $50 billion through 2018. Annual dividends will stay put at $0.92 until 2016.

Bingo!

Hence the question, should GE shares’ Friday reaction be treated as a signal or a noise? Should a technician in particular even honor the breakout? (By the way, the breakout gives us a target of $30 near-term.)

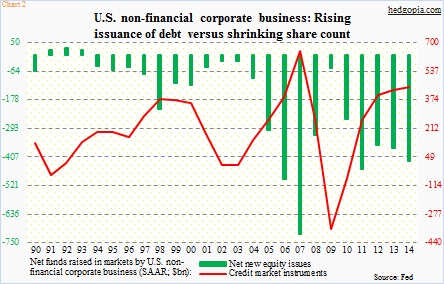

The reason for the skepticism arises as buybacks are easy come, easy go. As Chart 2 shows, the green bars are a fluctuating bunch, as is the red line.

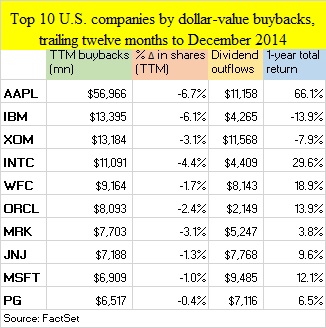

Secondly, when it is all said and done, it is the fundamentals that matter. As shown in the adjacent table, in the 12 months to December, AAPL reduced its share count by 6.7 percent; its total return was 66 percent. IBM, too, reduced its share count by nearly as much (6.1 percent), and its total return was minus 14 percent (courtesy of FactSet).

FactSet also points out that in 2014 S&P 500 companies spent $565 billion on share repurchases, up 18 percent year-over-year.

This leaves room wide open for distortion.

One of the things in technical analysis is a simple concept of support and resistance, and how broken resistance turns into support, and vice versa. When buybacks are in full force, resistance gets taken out left and right, distorting the supply-demand dynamics. But when things reverse (in other words, buybacks dry up), there would not be enough funds around to support these support zones.

That is the risk these massive buybacks now are creating – risk of nasty breakdowns down the line, when stocks cannot help but slice through support, like a hot knife through butter.