Next week brings three important housing-related data points: the NAHB/Wells Fargo housing market index (September), existing home sales (August), and housing starts (August).

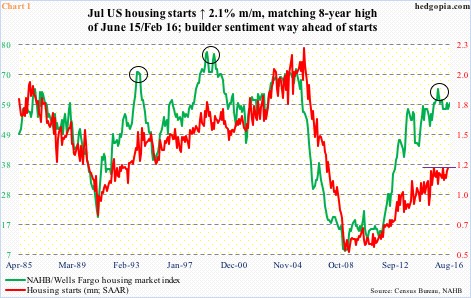

In July, starts rose 2.1 percent month-over-month to a seasonally adjusted annual rate of 1.21 million units, matching cycle highs of February 2016 and June 2015. These were the highest since 1.26 million in October 2007. Chart 1 shows the sideways pattern starts have been in for over a year now.

That said, starts have fallen behind builder sentiment. In other words, despite recent strength in starts, builders are not aggressively putting money where their mouth is. There is quite a gap between the red and green lines in Chart 1. At least going by how things evolved in the ‘90s, whenever sentiment gallops ahead of starts, the former in due course tends to drop to meet with the latter.

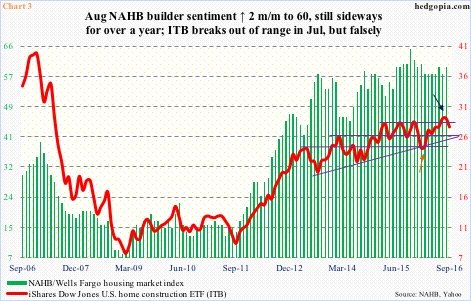

Medium- to long-term, this can have implications for stocks of builders and other housing-related outfits (Chart 3).

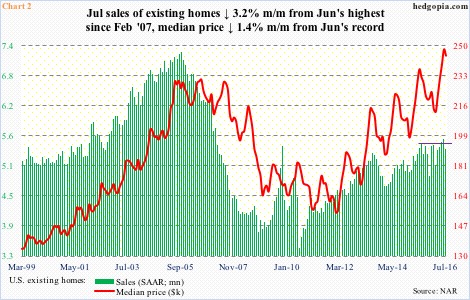

Also in July, existing home sales were down 3.2 percent m/m to a seasonally adjusted annual rate of 5.39 million units. June’s 5.57 million units were the highest since 5.79 million in February 2007 (Chart 2).

At the time, June gave an impression as if sales were breaking out of a one-year range, but a weak July pushed it back under the range. If price did not hurt, it probably did not help either. The median price of an existing home jumped 3.6 percent in June to an all-time high of $247, 600 – higher than the bubble highs, although sales were nowhere near (Chart 2). Despite the price surge, sales are holding up. This is what is keeping builder sentiment buoyant.

The NAHB housing market index in August was up two points month-over-month to 60. The index peaked at 65 last October – a 10-year high (Chart 3).

Longer-term, the green bars in Chart 3 have essentially gone sideways the past three years. ITB, the iShares Dow Jones U.S. home construction ETF, tends to follow builder sentiment.

In early July, ITB broke out of horizontal-line resistance going back to March last year, rallying to $30 (dark blue arrow in Chart 3). That proved fleeting … and false. The ETF has fallen back into a well-established range of $26-plus and $28-plus.

During the current weakness, ITB is yet to test the lower bound of that range, but it may or may not. Since that July 27th peak, it has given back eight-plus percent, and is oversold on a daily basis.

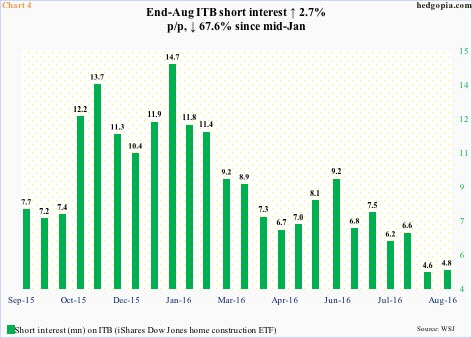

Medium-term, there is probably more weakness ahead. ITB shorts have been squeezed out. Short interest rose 2.7 percent period-over-period at the end of August, but that mid-August low was the lowest since mid-January this year (Chart 4). The ETF bottomed in early February, persistently rallying as shorts gave up (orange arrow in Chart 3).

Near-term, there are decent odds of a rally. Worse, it drops toward the 200-day moving average ($26.82). Hypothetically, the ETF ($27.65) was shorted on July 15 at $29.16. Worth covering – for now.

Thanks for reading!