The SPDR Consumer Discretionary ETF (XLY) went through a lot last week – down 2.4 percent, as media and consumer discretionary stocks like Walt Disney (DIS) took it on the chin. On a weekly basis, the ETF is overbought and this condition may take time to be unwound. However, for traders near-term may be another matter.

XLY’s top five holdings are Amazon.com (AMZN) (8.6 percent weighting), DIS (7.2 percent), Home Depot (HD) (6.4 percent), Comcast Corp. (CMCSA) (6.3 percent), and McDonalds Corp. (MCD) (4.1 percent).

The daily charts for AMZN ($522.62), HD ($116.93) and MCD ($98.92) are “heavy” and each of these consumer stocks has a good chance of heading lower near-term. If AMZN decides to fill the post-earnings, July 24th gap-up, there is room for it to drop just north of five percent… but that may take time.

DIS ($109.35), on the other hand, dropped nearly 15 percent post-earnings in a matter of two sessions last week, and remains oversold on a daily chart. Ditto with CMCSA ($58.82), which got punished real hard on Wednesday and Thursday, is oversold near-term, and could be testing support-turned-resistance at $60.

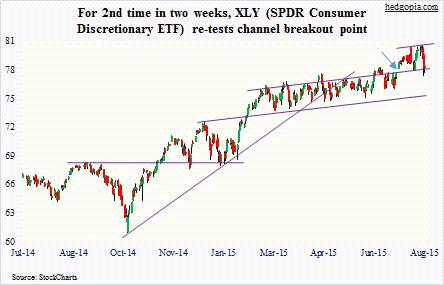

As far as XLY ($78.28) is concerned, buyers showed up near the 50-day moving average ($77.78) on both Thursday and Friday. The mid-July channel breakout remains intact (arrow in the adjacent chart). Since that breakout, it has already been tested twice – so far successfully.

Given the dynamics among the top five holdings of XLY, the ETF could go either way in the very near-term. As long as the above-mentioned support does not give way, the path of least resistance likely remains up. Although over the medium-term, the path of least resistance is probably down.

In this scenario, shorts have a decision to make – continue to remain short or cover now and wait for a better entry point?

The hypothetical options trade initiated on June 1 (and updated from time to time as part of this analysis) is now slightly in the money – by $1.01.

To refresh, a June 5th weekly 76.50 naked call was written for $0.47, resulting in effective short at $76.97. It was a trade gone wrong initially. But after three weekly short puts earning a cumulative $1.20, followed by a weekly short collar, the short price was pushed up to $79.29, from the original $76.97.

Use of options helped repair the early damage big time. Nonetheless, the trade has not panned out as expected. But no damage done. It is worth covering for now, and wait for better opportunities.

Thanks for reading!

Please keep in mind that this article was originally published yesterday (August 10th) by See It Market, where I am a contributor.