Much ado about nothing!

Pretty much.

There was much talk of short squeeze primarily contributing to the rally in stocks in the June 30-July 15 period, but, as it turns out, at least on an index level, that was not the case.

The S&P 500 large cap index (2169.18) rallied three percent in that period, breaking out of 16-month consolidation as well as May 2015 high, to a new high. The Nasdaq composite jumped 3.9 percent, and the NYSE composite 2.7 percent. The latter two are yet to score new highs.

The period in question is of interest not only because the S&P 500 broke out but also due to the fact that short interest in the prior period (June 15-30) went essentially sideways – up 0.7 percent on the Nasdaq and down 0.4 percent on the NYSE. The S&P 500 rose 1.3 percent during that period, but short interest hung on. This was a two-week period in which stocks truly had a roller-coaster ride. Post-Brexit, the S&P 500 collapsed 5.3 percent in two sessions through June 27th and then rallied 4.9 percent in the next three through June 30th.

So when the S&P 500 broke out of months-long congestion on July 8th – up 1.5 percent in that session – squeeze was thrown around as a possible cause. By July 15th, the index rallied another 1.5 percent. Shorts had to be suffering.

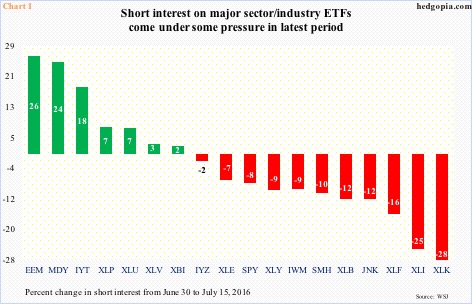

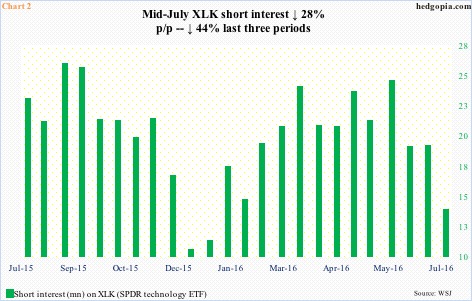

Yes, looking at various industry/sector ETFs, quite a few of the major ones have experienced large/decent drops in short interest (Chart 1). XLK, the SPDR technology ETF, for example. Short interest dropped 28 percent to a six-month low (Chart 2). The ETF rallied 3.8 percent during the period.

Or XLI, the SPDR industrial ETF – short interest down 25 percent p/p – or XLF, the SPDR financial ETF – short interest down 16 percent.

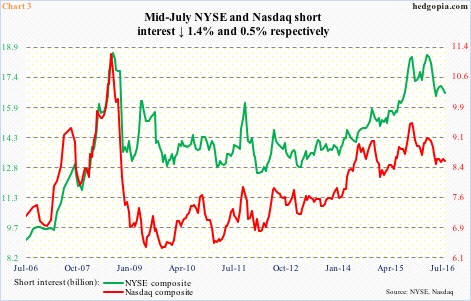

But on an index level, there is no major change, given range breakouts and new highs on several indices. NYSE composite short interest dropped 1.4 percent p/p to a two-month low, and on the Nasdaq composite it fell 0.5 percent to a two-period low (Chart 3).

Given the low volume on breakout, short squeeze probably played a role in the rally. At the same time, it seems as though shorts got right back into it.

First off, the breakout on the S&P 500, as well as the Dow industrials, is not confirmed by the likes of small-caps, techs, and transports. Secondly, institutions are not piling into stocks post-breakout (not evident in volume). Thirdly, stocks have rallied big since the post-Brexit low a month ago. Technicals are overbought, with momentum decelerating.

If all this has convinced equity bears to hang on to their shorts, they are probably not wrong in their thesis near- to medium-term. But the question is that of long-term.

Unless stocks enter a bear market/severe correction, elevated short interest can be a source of pain for the bears. Since mid-February, NYSE short interest dropped north of 10 percent. The S&P 500 has rallied 20 percent since the February 11th low.

Thanks for reading!