Large-cap bulls are on the rampage. Sell-side analysts are egging them on, as they continue to lower June-quarter earnings estimates for S&P 500 companies. Some sentiment readings look dangerously elevated.

Equity bulls are not taking a break. They have been running wild since last October when the major US equity indices bottomed. There was a brief respite in March and April. Other than that, the rally has been parabolic.

The Nasdaq 100, for instance, has been rallying all along an ascending channel from the April low. Last Friday, the tech-heavy index closed at 20392 – right at the upper end of the channel. This is yet another opportunity for the bears to get active. That said, they have repeatedly failed to cash in on potential opportunities.

Last week’s 3.6-percent rally was preceded by back-to-back weekly candles showing indecision/distribution. Three weeks ago, a gravestone doji showed up, followed by a spinning top the week before (Chart 1). These potentially bearish candles needed confirmation, and that was not forthcoming last week.

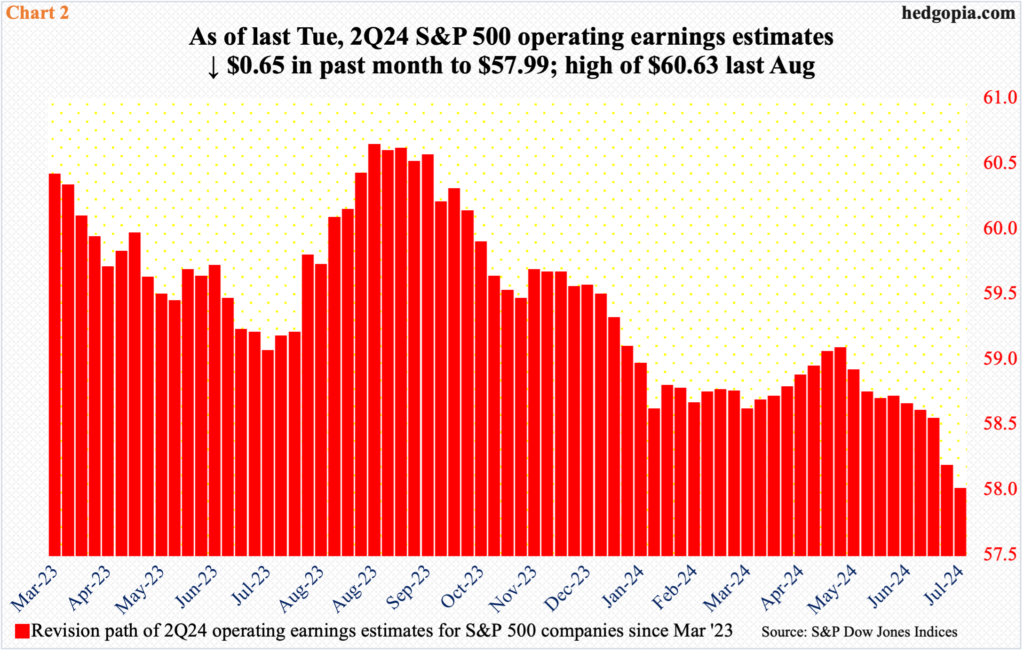

Help is coming from the sell-side analysts who publish their operating earnings estimates for S&P 500 companies. They continue to lower their numbers for the June quarter.

As of last Tuesday, these analysts were penciling in $57.99. In just the past month, these estimates have gone down by $0.65. Never mind the fact that the consensus was $60.63 last August (Chart 2).

The downward revision trend also applies to the annual estimates. These companies are expected to bring home $239.38 and $276.21 this year and next respectively. In March last year, 2024 earnings were expected to come in at $246.31, while 2025 estimates have been revised lower after cresting at $276.84 as of mid-June (this year).

Importantly, earnings estimates are getting revised lower but not falling apart. This lowers the bar for the companies when they report. The reporting season for the June quarter begins in earnest this Friday when financials, including JP Morgan (JPM) will get the ball rolling.

Going into this, sentiment remains profuse.

Last week, Investors Intelligence bulls were 63.1 percent, which is the highest reading since April 2021; bulls’ count has remained north of 60 percent the last four weeks.

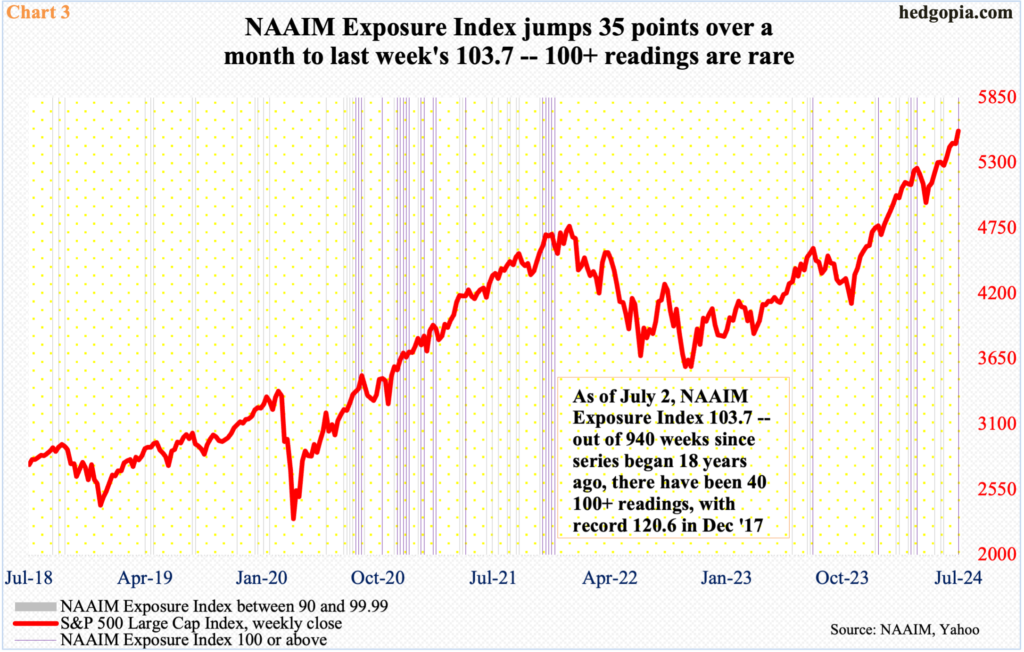

Concurrently, the NAAIM Exposure Index, which represents National Association of Active Investment Managers members’ average exposure to US equity markets, jumped 18.2 points week-over-week to 103.7. Readings above 100 are rare. The series began in July 2006. In the 940 weeks since, there have only been 40 100-plus readings.

With that said, there have been times in the past when the NAAIM readings have remained north of 100 for several weeks, with the last such one occurring in October-November of 2021 (Chart 3); back then, the S&P 500 peaked the following January and did not bottom until October that year. When sentiment is lopsidedly bullish, there is no one left to hop on the bandwagon. This is the risk right now.

Thanks for reading!