The S&P 500 rallied strongly in the past month. Investors Intelligence bulls expanded eight percentage points in the last three weeks. In the options market, investors are taking off protection they bought earlier. Greed has replaced fear. Unwinding is the path of least resistance.

There is nothing like price to change sentiment.

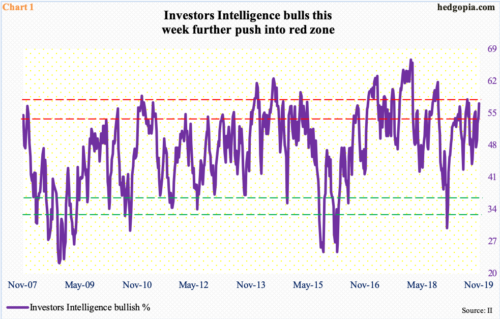

In the first half last month, Investors Intelligence bulls languished under 50 percent for two consecutive weeks. In the next three, their count expanded by eight percentage points, to this week’s 57.1 percent, which is a 14-week high.

With this, sentiment has now pushed into the red zone. Nothing says this cannot continue higher. It has in the past. But, as is seen in Chart 1, it will be awfully difficult to sustain in the current range.

Sentiment followed stocks. Early October, the S&P 500 large cap index dropped intraday to 2855.94, and bids were waiting. A rising trend line from June was defended, as was support north of 2800. The latter was aggressively defended early August (Chart 2).

Momentum decisively shifted upward after the index recaptured both the 50-day moving average and horizontal resistance at 2940s-50s on the 11th. Subsequently, Investors Intelligence bulls’ count began to expand. Last week, the index rallied past the prior high of 3027.98 from late July. This week, bulls grew by another 2.9 percentage points.

Amidst this, VIX (13.10) dropped from an intraday high of 21.46 on the 2nd last month to last Thursday’s low of 12.19. The volatility index has not closed under 12 since October last year. This support is holding, with a little bit of divergence to boot.

Monday, the S&P 500 ended in the green, so did VIX. In normal circumstances, they go the opposite way. For two weeks now, VIX has been held down by a falling 10-day, including the past two sessions, but the average is also trying very hard to at least go flat. On the daily, the MACD is on the verge of a bullish crossover. Immediately ahead, there is resistance at 13.50s, followed by both the 50- and 200-day (Chart 3).

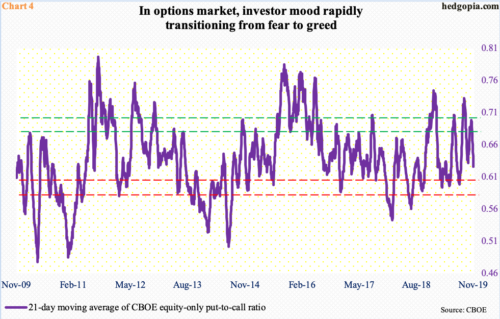

Elsewhere in the options market too, unwinding is just a matter of time.

In six of the past eight sessions, the CBOE equity-only put-to-call ratio printed 0.50s. As a result, the 21-day moving average ended Tuesday at 0.626, down from 0.699 on October 18. Investor fear was building back then. Historically, the ratio tends to unwind from highs 0.60s to low 0.70s. The S&P 500 rallied strongly as investors took off the protection they had purchased. Now they are inching ever closer to exuberance. Once again, if past is prologue, the ratio tends to bottom at high 0.50s to low 0.60s. As recently as September 24, it bottomed at 0.632 (Chart 4). Because there have been multiple 0.50s readings in recent sessions, in the next few sessions, the 21-day average likely continues lower to eventually enter the red zone.

This will have taken place even as the S&P 500 (3074.62) remains grossly overbought, particularly on the daily. To bulls’ advantage, shorter-term moving averages continue to rise, and they continue to hold the momentum ball. At the same time, risk-reward odds increasingly are less favorable. Immediately ahead, short-term support lies at 3050. After that lies breakout retest at 3020s. A breach runs the risk of bulls turn tail and seek protection. In this scenario, VIX rallies and the put-to-call ratio will begin to reflect fear. The cycle continues.

Thanks for reading!