The FOMC dot plot yesterday surprised many with expectations of two more 25-basis-point hikes by December. Futures traders are only betting on one hike in July. Several times over the last several months, they have been forced to readjust; odds favor they will do so again.

Fed funds futures traders blinked – again – and more blinking probably is in store. The staring contest between them and the Federal Reserve continues to side with the latter. This is a change – historically. For decades beginning Alan Greenspan’s era in the late 1980s through the leadership of Ben Bernanke, Janet Yellen and even current Chair Jerome Powell’s initial years, markets routinely guided – or influenced – the central bank’s action. This is how the infamous term “Fed put” was born.

This time around, Chair Powell and his team refuse to get pushed around by markets’ unjust demands. Until just a few weeks ago, futures traders had their money on the fed funds rate peaking around – or just north of – five percent, followed by three 25-basis-point cuts by the end of December. They persistently demanded this even in the face of strong jobs numbers and what is proving to be sticky inflation. The Fed, with a dual mandate of maximum employment and price stability, was – and is – laser-focused on the latter.

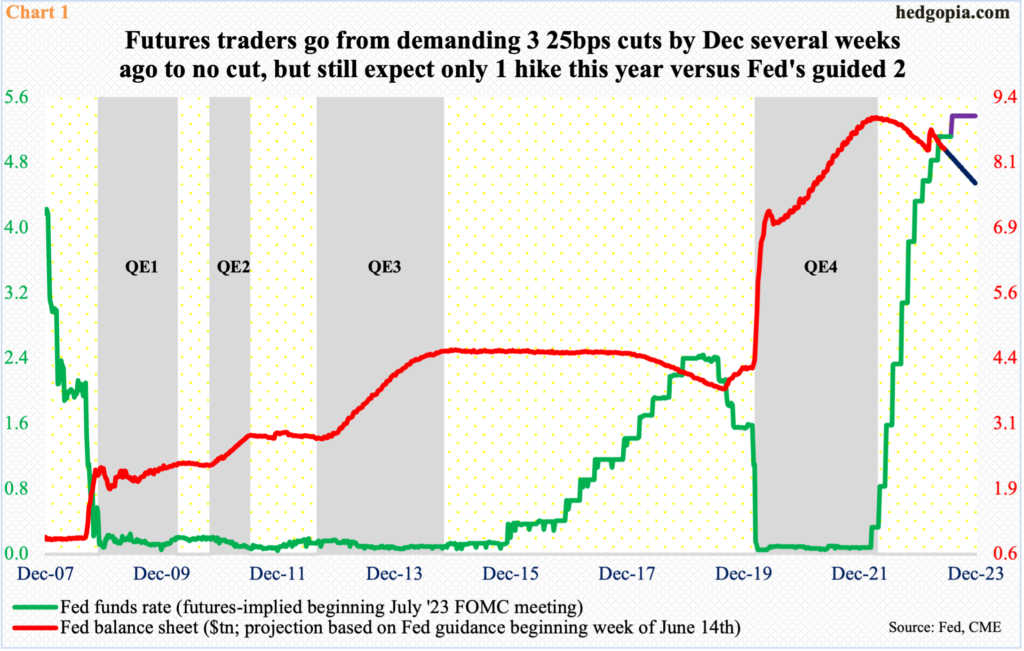

These traders are having to repeatedly adjust their bets. Post-Wednesday’s FOMC statement, they again adjusted but only partially. They have now given up on expectations of a cut this year; going into this week’s meeting, they expected one cut by December. Nevertheless, they still expect the year to end at a range of 525 basis points to 550 basis points, with a hike in July (Chart 1). This is still lower than the two hikes anticipated by the FOMC dot plot. The fed funds rate yesterday was left unchanged between 500 basis points and 525 basis points – up from zero to 25 basis points in March last year – with 12 of 18 FOMC members expecting two more hikes by December.

Futures traders may still not be done adjusting. They are having trouble understanding the dogged message coming out of the Eccles Building. In the post-meeting press conference yesterday, Powell repeatedly tried to drive home the fact that core inflation remains high and that they are not seeing a lot of progress on core PCE (personal consumption expenditures), which is their favorite.

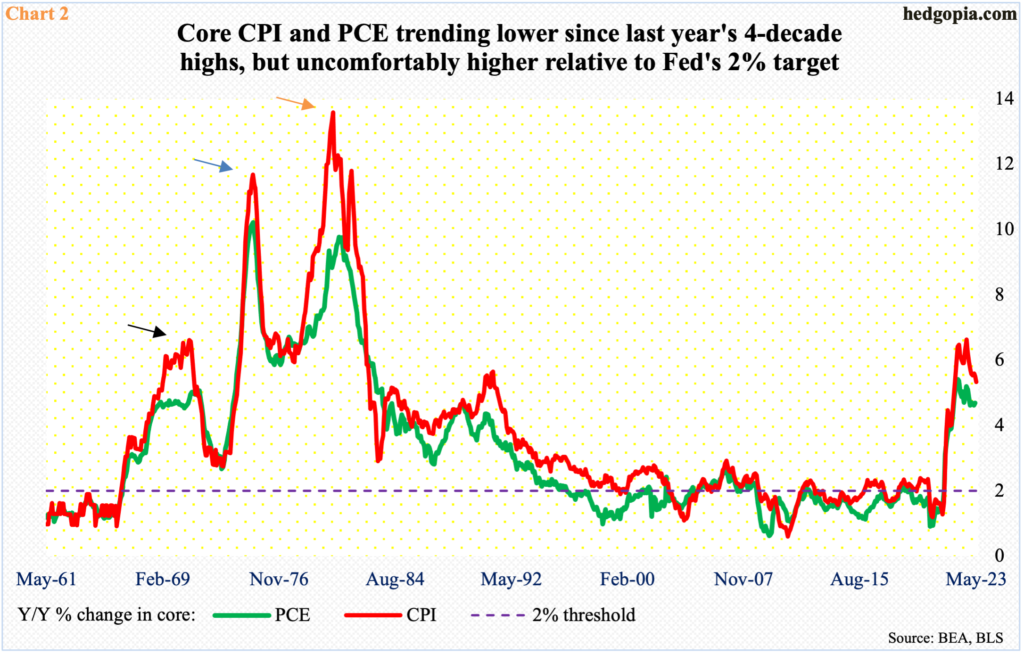

In the 12 months to April, core PCE grew 4.7 percent – a three-month high. This Tuesday, May’s consumer price index was reported; core CPI increased 5.3 percent from a year ago. Both these metrics are lower than last year’s four-decade highs of 5.4 percent and 6.6 percent respectively but remain much higher than the Fed’s two-percent goal (Chart 2).

The chart also highlights how inflation was able to regain strength several times in the 1970s. Central bankers are aware of this, hence would rather err on the side of tightening. Powell said yesterday risks to the inflation are to the upside. Futures traders have not adjusted to this new reality enough.

Thanks for reading!