Macro news is bad. Earnings revision trend continues lower. Yet, stocks continue higher. Besides the liquidity push from the Fed, help is also coming from overzealous shorts.

On the macro front, news is bad – from employment to capacity utilization to activity in both services and manufacturing, not to mention 2020 earnings expectations that continue lower. Yet, stocks are ignoring this fundamental deterioration and rallying hard. Off the March 23rd lows, major US equity indices have all rallied in the high-30-percent to low-40-percent range.

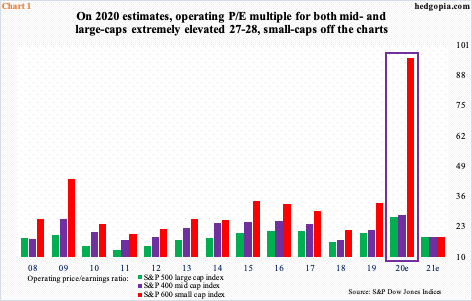

Valuation multiples have persistently moved higher. With 1Q just about done, using 2020 estimates, the operating P/E for large-, mid- and small-caps are currently 27.5x, 28.3x and 95.6x (no typo). Earnings estimates are as of Wednesday last week, and it is possible multiples edged higher, as indices have continued to rally even as estimates, if they followed the recent trend, likely headed lower.

When the year began, the consensus expected $175.52 for S&P 500 companies, $114.21 for S&P 400 and $56.49 for S&P 600. Now, they have been cut down to $110.62, $63.56 and $8.77, in that order. Reality quickly caught up with the sell-side. But characteristically they remain optimistic about next year, expecting $162.52, $96.94 and $45.09. But even using this pie-in-the-sky optimism, multiples only drop to 18-19x – still not reasonable (Chart 1).

Against this backdrop, the persistent demand for equities is a head-scratcher. Longs have of course been emboldened by the firehose of liquidity from the Fed, which wants higher stock prices and the wealth effect to kick in. Also, if bulls are willing to buy at these lofty multiples, they have essentially written off 2020. Then, there is the shorts themselves.

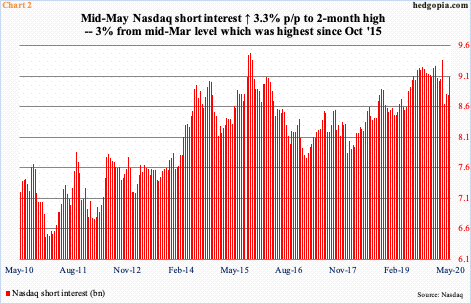

Bears look around, see all the deterioration in fundamentals and are encouraged to go short, and end up aiding the bulls. This has been going on for a while.

Take Nasdaq short interest. By the middle of March, as stocks were collapsing, short interest rose to 9.4 billion shares, which was the highest since October 2015. The index bottomed on the 23rd that month, and shorts rightly pulled back, with short interest dropping 7.6 percent in the end-March period. This provided a nice tailwind to the Nasdaq, which has continued to rally. Shorts, however, continue to fight this. From end-March through mid-May, short interest went up five percent, to 9.1 billion, which historically remains elevated (Chart 2).

After rallying 1.4 percent in the first half this month, the Nasdaq is up another 4.4 percent in the second half. Shorts likely lent a helping hand in this. The index is merely 4.5 percent from its February record high. Bulls hope short squeeze will help them at least test that high.

Thanks for reading!