August’s CPI report dealt a fatal blow to market hopes for a 50-basis-point cut next week. Nevertheless, futures traders are betting that the Fed would lower rates by 250 basis points in the next one year, beginning with 25 basis points next week. If this comes to pass, consensus earnings estimates for next year are destined to massively fall short.

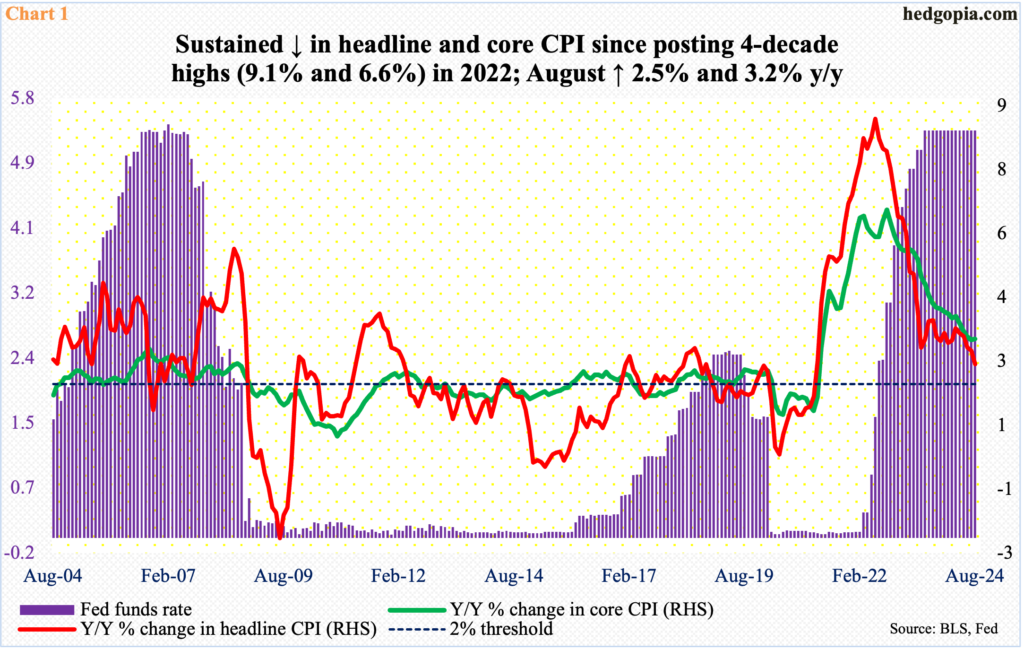

August’s year-over-year increase in headline CPI (consumer price index) was the slowest since March 2021. The 2.5-percent annual pace compares with the four-decade high of 9.1 percent which was hit in June 2022.

The core, however, is proving a little sticky. In September 2022, it was growing at a 6.6-percent pace. Last month, this metric increased 3.2 percent from a year ago, with July’s 3.17 percent at a 39-month low. This metric came in a tad higher than expected.

After leaving the fed funds rate zero-bound for a couple of years, the Federal Reserve began to tighten in March 2022. By July last year, the benchmark rates were sitting at a range of 525 basis points to 550 basis points (Chart 1). The central bank is on pace to begin easing next week, when a two-day FOMC meeting begins on the 17th.

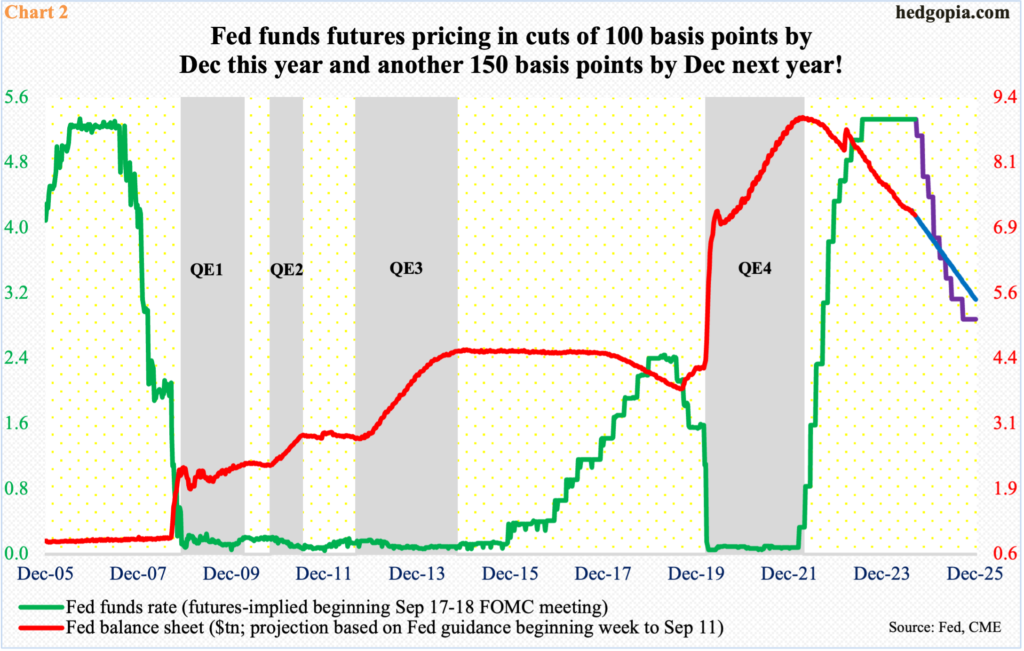

Going into the CPI report, the odds of a 50-basis-point cut next week were about 55/45. Post-CPI, this changed to 85/15 for a 25-basis-point reduction. However, they continue to expect 100 basis points of cuts this year. With three meetings remaining, this suggests a 50 in either November or December.

Next year is even more interesting. These traders are now pricing in 150 basis points of cuts by September, for a total 250 basis points in the next year, ending 2025 between 275 basis points and 300 basis points (Chart 2). This is quite aggressive.

If these traders turn out to be right, the only way a rate cut of this magnitude would be required is if the economy comes apart at the seams. Yes, things are slowing down, but for the Fed to show the kind of urgency that the futures market reflects, they would need their dual mandate cooperate fully – higher unemployment and lower inflation. One also wonders what that would do to the balance sheet.

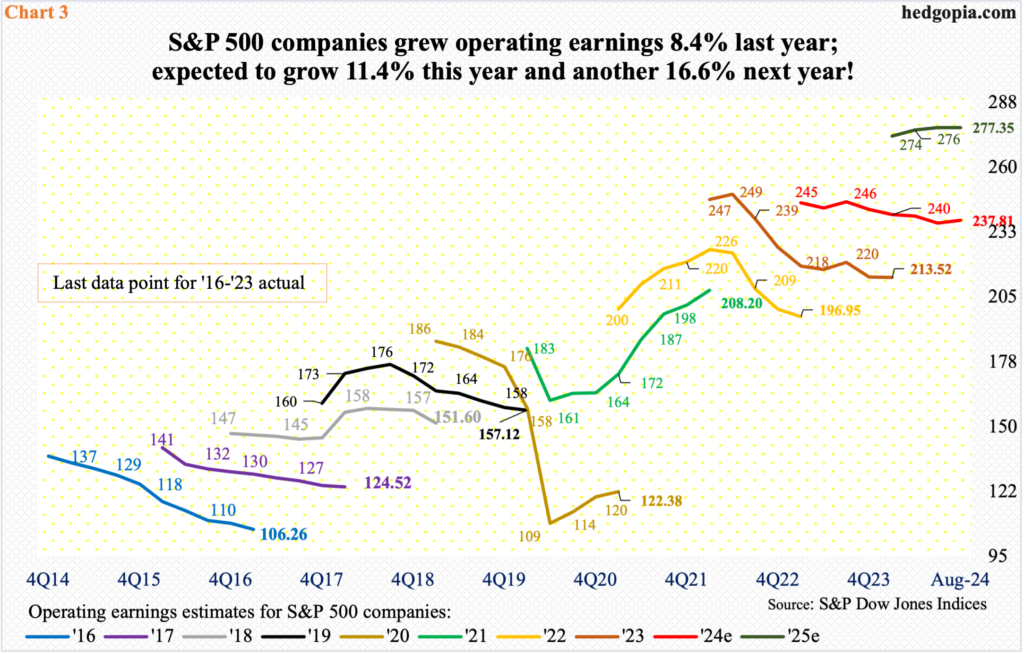

As things stand, the sell-side is not on the same page as futures traders. Earnings optimism remains very high for next year.

Operating earnings estimates for S&P 500 companies are $277.35 for 2025 (Chart 3). With two quarters gone, blended estimates for this year are $237.81. If realized, this would amount to a growth rate of 16.6 percent, which would be much better than the expected 11.4 percent for this year. In 2023, earnings grew 8.4 percent.

The sell-side has a habit of starting out optimistic and then bring out a pair of scissors as the year progresses. In 2023, for instance, $213.52 was rung up; however, expectations were as high as $250.12 in April 2022. Even this year, the sell-side expected $246.31 in March last year.

The point here is that it is prudent not to take the consensus estimates at their face value, especially when 2025 has not even begun.

Equities, too, are in divergence with what the fed funds futures traders are seeing. If the Fed is compelled to lower the benchmark rates as aggressively as foreseen by these traders, then 2025 in Chart 3 would look quite different. The current sell-side optimism for next year would remain just that – optimism.

But markets are not concerned. The S&P 500 is merely 2.1 percent from its record high from July. And odds favor this even narrows in the sessions ahead.

The large cap index acts as if it wants to once again go after 5640s, which it unsuccessfully tried to break out of for seven sessions before reversing lower on the 3rd (Chart 4). The mini-selloff ended on the 6th. This week, buying pressure was witnessed both Tuesday and Wednesday, with the index reversing yesterday from an intraday low of 5407 to closing at 5554, for a massive bullish hammer.

The daily wants higher prints – at least for now.

Thanks for reading!