Hindsight is always 20/20.

The post last Monday hypothetically discussed three ways to play beaten-down GLD, the SPDR Gold ETF: (1) go long at $103.09; (2) short November 27th 102.50 puts for $0.49, which could result in effectively going long the ETF at $102.01, and (3) November 27th buy-write, in which 103.50 calls were sold for $0.54, effectively going long at $102.55.

At the time, the buy-write idea looked good… the thinking being the ETF last week would either go sideways or rally slightly past the strike.

Instead, GLD ($101.25) got beat even more, losing another 1.8 percent, most of it on Friday when it dropped 1.2 percent.

All three scenarios above would end up in the red. The buy-write reduced the effective cost to $102.55, while the short put would have reduced it to $102.01. In hindsight, the latter would have been a better choice.

Instead of the woulda-coulda-shoulda, from longs’ perspective, a better and productive exercise would be to try to figure out how best to deal with the situation at hand.

The Friday action in particular potentially changes GLD’s near-term picture. Until Thursday, it looked like gold/GLD was trying to stabilize. This followed the ETF losing four-month support at $104-ish two weeks ago. Even earlier – early this month – it lost one-year support at $110-ish.

Friday’s selloff only made things worse, and the selling came out of nowhere. Yes, the US dollar index was up 0.2 percent in that session – but probably not enough to exert that big of a downward push on the ETF.

Now, $102 is all set to provide resistance, followed by $104 and then $110… and $114 (Chart 1).

On spot gold ($1,056.10), GLD’s $102 resistance corresponds to $1,070-$1,080.

Importantly, gold bugs were unable to defend $1,095 (on the spot), which amounts to 50-percent retracement of the July 1999-September 2011 surge. This follows persistent sell-off for four years, with occasional countertrend rallies. For gold not to be able to hold on to the afore-mentioned support says a lot about the prevailing sentiment toward the metal.

With this, gold/GLD has once again fallen into the ‘needs-to-go-sideways’ phase. Shorter-term moving averages continue to point lower.

Given this, barring an outright sale, it is probably not a bad idea to try to exit with the minimum damage possible… for now.

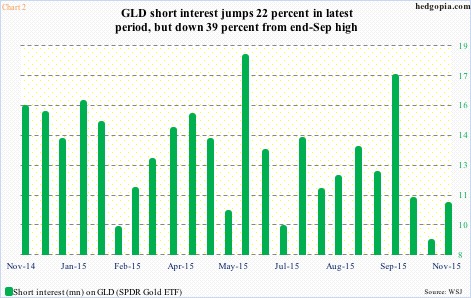

Incidentally, short interest rose from 8.7 million shares to 10.6 million in the latest period (November 13th), but remains much lower versus a month and a half ago (Chart 2). From longs’ perspective, on one hand shorts not getting aggressive could be viewed as positive, on the other hand this could also mean a lack of potentially squeeze opportunity.

In any case, using a hypothetical covered call, longs can at least do some damage repair. December 4th weekly 102 calls bring $0.56. If assigned, the long position gets sold for a profit of $0.01. Else, the effective cost drops to $101.99. In the worst-case scenario, longs continue to hold GLD, but with a lowered effective cost.

Thanks for reading!