After rallying 13-plus percent in a couple of months, gold has come under pressure the past couple of weeks. Non-commercials may end up deciding what happens next.

Once again, the yellow metal sits at a crucial juncture.

On July 10, gold bottomed at $1,204/ounce, and then rallied – rallied big, past resistance at $1,300 and on to an intraday high of $1,362.4 by September 8.

The September 8 high essentially tested resistance going back seven years. September-to-date has produced a reversal candle, with a long wick. The bears hope this proves to be an important rejection. Time will tell.

Last Thursday, gold successfully tested the 50-day moving average. This also approximates support at $1,300, which has proven to be an important level going back seven years, and makes up the neckline of a potentially bullish inverse head-and-shoulders formation. Thus the significance of developments around this price.

A successful breakout retest of $1,300 can potentially cause buying pressure, if nothing else just to squeeze shorts.

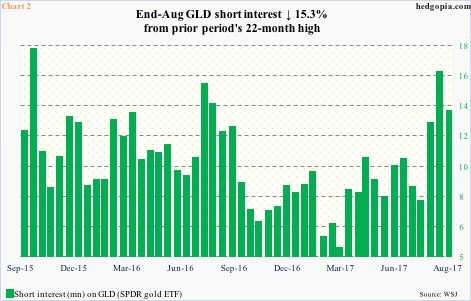

Short interest on GLD (SPDR gold ETF) remains high. Mid-September numbers will be reported Tuesday. End-August was 13.5 million, down 15.3 percent period-over-period, but mid-August was the highest since end-September 2015 (Chart 2).

As early as mid-July, short interest stood at 7.9 million, so has built up. Shorts would have won if the bulls were to convincingly lose $1,300.

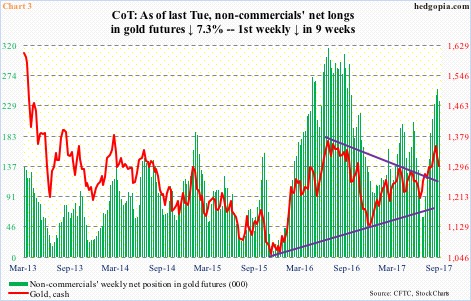

Non-commercials can play a role here – potentially.

They rode the afore-mentioned 13-percent rally perfectly. Mid-July, they were net long 60,138 contracts in gold futures. In the next eight weeks, this had soared to 254,760 – a one-year high (Chart 3). In the latest week (as of last Tuesday), holdings dropped 7.3 percent week-over-week. This was the first weekly decline in nine weeks. As noted above, the cash peaked on September 8.

These traders tend to be trend followers, and could not have ridden the most recent uptrend better. If they decide a new trend – this time down – has begun, they will act. Particularly so if gold loses $1,300. They are sitting on nice gains. For gold bugs, this is a worse-case scenario. Things could exacerbate if dollar bulls manage to put their foot down.

From early this year through the nearly three-year low on September 8, the US dollar index shed 12.4 percent, in the process losing support at 92-plus, but not by much. It lost that level a month ago, and several rally attempts since have been repelled (Chart 4) – unable to rally even as U.S. rates have come under upward pressure of late.

Futures markets have priced in 71-percent odds of a 25-basis-point hike in December (12-13), up substantially from just a couple of weeks ago.

Intraday between September 7 and 21, two-year Treasury yields – most sensitive to the Fed’s monetary policy – went from 1.27 percent to 1.46 percent, and 10-year yields from 2.05 percent to 2.28 percent between September 7 and 20. Between the periods, the US dollar index (cash) was essentially flat to ever so slightly up. Either it does not trust the recent backup in yields or is in the process of hammering out a decent bottom.

Since it lost multi-year support at 92-plus, the dollar index has more or less gone sideways, with a potentially bullish crossover between 10- and 20-day. Friday was a hammer, as was the low on September 8 (Chart 4). The bulls need to first conquer the resistance in question, followed by the 50-day (92.96).

In this scenario, gold can come under pressure.

Once again, the rally in July began from just north of $1,200 (Chart 1). Around $1,220 lies major support from a rising trend line from December 2015, when gold reached a major bottom at $1,045.4. This preceded a drop from September 2011 when the metal peaked at a record $1,923.7.

If in due course gold proceeds to test that December 2015 support and holds, it remains in uptrend. But this is also a scenario that right now looks far-fetched. It may never come to pass if gold bugs defend $1,300 and non-commercials do not get tempted to cash in their gains. But at the same time it does not hurt at least being aware of a possible curve ball – just in case.

Thanks for reading!