In a session the S&P 500 rallied 2.3 percent, VIX held up better on Wednesday. It is probably due to the uncertainty surrounding US-China trade talks over the weekend in Argentina. Should, come Monday, stocks initially get roiled it is possible the weakness gets bought.

As far as US equities were concerned, November pretty much began where October left off. The S&P 500 large cap index collapsed 6.9 percent in October. By last Friday’s intraday low, it had fallen another three percent in November.

With a rally in the first three sessions this week, the picture looks slightly different. The November loss has been wiped out and then some. The index is now up 1.2 percent for the month. Jerome Powell, Fed chair, was credited for Wednesday’s 2.3-percent jump (Chart 1).

Early October, Powell suggested that interest rates were still “a long way” from neutral. After three 25-basis-point hikes this year, December is pretty much a lock for another hike. The FOMC dot plot expects three more next year. Markets are nowhere near that. So when Powell made that comment, an overbought market took it as an excuse to sell off. Wednesday, speaking before the Economic Club of New York, he seems to have blinked, saying the rates are “just below” the neutral range. Markets took it as a shift downward in his prior hawkish stance.

Time will tell if markets are interpreting yesterday’s speech right. Right now, longs are yearning for anything positive – perceived or real – to hang their bullish hat on. After the October rout, stocks in general are oversold.

One more catalyst could come this weekend, when at the G-20 meeting in Buenos Aires President Donald Trump and his Chinese counterpart Xi Jinping will sit down face-to-face for trade talks. Anything close to a breakthrough in diffusing months-long tensions can lit a fire under stocks in a seasonally favorable period.

VIX, however, remains guarded. On Wednesday, when bulls were on a rampage, it only fell 0.53 to 18.49, staying above support. That said, since rallying to an intraday high of 28.84 on October 11 (arrow in Chart 2), it has persistently made lower highs, even as the S&P 500 continued lower. Despite Wednesday’s action, in the right circumstances, there is room for volatility to head lower.

In this scenario, if come Monday markets are initially disappointed with what comes out of Argentina it is possible the weakness gets bought.

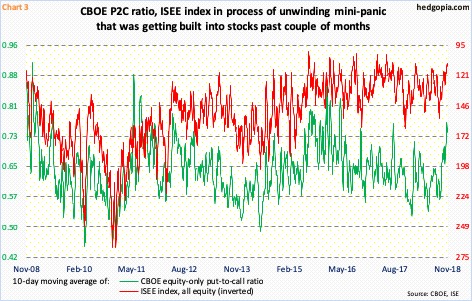

Should things unfold this way, Chart 3 comes in handy for the bulls. It plots the 10-day moving average of the CBOE equity-only put-to-call ratio and the ISEE index, all equity. The latter is a call-to-put ratio, hence inverted. Over the past couple of months, both have built in mini-panic, unwinding of which will help stocks.

This is particularly so if 2800, or just north of it, gets taken out on the S&P 500 (2743.79). Since the index sold off in January-February this year, this level has proven significant, including mid-October and early this month (Chart 1).

Immediately ahead, resistance lies at the 200- and 50-day – respectively 2761.54 and 2781.86. The daily upper Bollinger band lies at 2816.61. The latter approximates the afore-mentioned resistance, and may just act as a magnet near term.

Thanks for reading!