Bulls have managed to wrest control of momentum near term. Bears had an opportunity late July-early August when in seven sessions intraday the S&P 500 lost 6.8 percent. Bulls put their foot down near crucial support just north of 2800. The range-bound action since was broken to the upside last Thursday, with a breakout retest Tuesday. The index is merely 0.9 percent from its late-July record high. Bears continue not to trust the rally.

End-August, NYSE Group and Nasdaq short interest rose 1.8 percent and 0.4 percent period-over-period to 17.1 billion and 9.2 billion, respectively. Since end-April’s low, short interest has gone up 15.2 percent and 8.1 percent, in that order. As a result, NYSE’s is at the highest since end-March 2016 and Nasdaq’s since mid-October 2015 (Chart 1).

The prospect of a short squeeze at some point in the future is looking real.

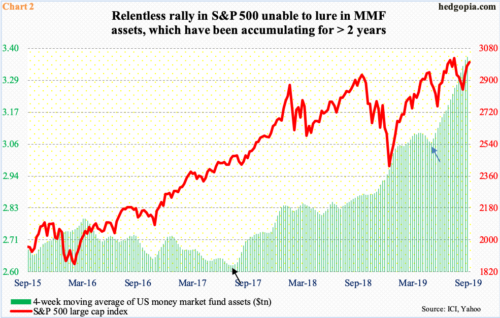

In the right circumstances for bulls, money-market funds can play the role of a catalyst. Last week, these assets grew $16.7 billion week-over-week to $3.38 trillion – the highest since October 2009.

The buildup in these assets is evident in Chart 2, which uses a four-week moving average. The green bars began rising in July 2017 (black arrow) and have gone parabolic since May this year (blue arrow). The S&P 500 pulled back in May, bottoming early June. The rally since, however, has not been able to lure in these funds. When this occurs, this can act as a massive tailwind for equities.

Until then, the bull-bear tug of war continues, with the former in possession of the ball right now. That said, daily momentum indicators on several indices including the S&P 500 are getting extended. So, bulls in all likelihood will be forced to defend support in the not too distant future. Dynamics change should short interest/money-market-fund winds begin to blow longs’ way right away.

Thanks for reading!