After having left the fed funds rate near zero for seven long years, the Fed seemingly has shifted to a tightening bias. In agreement, non-commercials in eurodollar futures are aggressively betting that rates are headed higher. Are they right?

Since December 2015, there have been three 25-basis-point hikes, including one two weeks ago. The Fed works hard to convince the markets there is more coming. The dot plot suggests at least two more this year. Tuesday, Stanley Fischer, Fed vice-chair, said he forecasts two more hikes this year. A day later, Eric Rosengren, Boston Fed president, and John Williams, San Francisco Fed president, both said not to rule out three more.

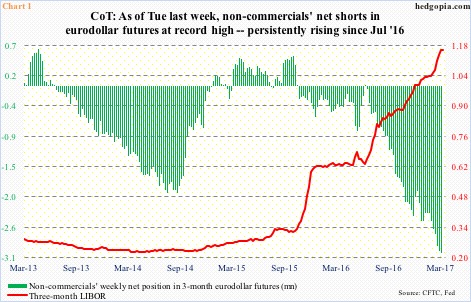

Non-commercials have bought into this (Chart 1). In the week ended Tuesday last week, they held north of three million net shorts in eurodollar futures. These positions make money if eurodollar rates head higher. (Eurodollars are time deposits denominated in U.S. dollars held outside of the U.S. banking system.)

There is one problem.

The long end of the Treasury yield curve refuses to go along. Bond vigilantes are either not on board the Fed’s hawkish rhetoric or are warning of bad consequences to the economy if the Fed continues on its path.

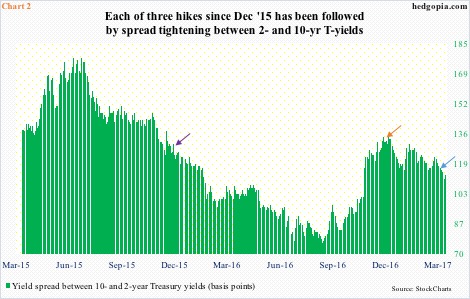

Since December 2015, each time the Fed hiked, the spread between 10- and two-year Treasury yields has tightened. This is denoted by arrows in Chart 2 – March 14-15, 2017 (blue), December 13-14, 2016 (orange), and December 15-16, 2015 (violet).

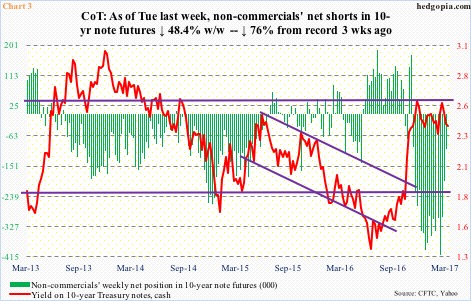

This is where it gets interesting. There was a time non-commercials were heavily net short 10-year-note futures – meaning they expected 10-year yields to shoot higher, in line with the short end.

In the week ended February 28, these traders were net short 409,659 contracts – a record (Chart 3). Three more weeks, and this dwindled to 100,354. They are still net short, but not remotely as aggressive.

This sets up an interesting dynamic.

Through eurodollar futures, non-commercials aggressively expect short rates to continue rising, but through 10-year-note futures they now lean toward long rates not rising as much.

Translation: The yield curve is not steepening anytime soon.

The longer the long end of the curve refuses to go along, the harder it is for the Fed to continue to tighten.

In this respect, for now, 2.62 percent on 10-year notes is where bond bulls and bears are locking horns, hence worth watching (Chart 4).

Ten-year yields remain in a three-decade-old declining channel, which gets broken around three percent. This is Jeff Gundlach’s (DoubleLine Capital) line in the sand. Bill Gross’s (Janus Capital) lies at 2.6 percent, where resistance goes as far back as early 2009.

Most recently, 10-year yields rose to 2.62 percent on December 15 last year before retreating. This level was tested again on March 13, and failed. Both coincided with the Fed’s decision to hike. Support at 2.31 percent is intact – which was just about tested this Monday.

In the very near term, yields (2.39 percent) look to be itching to move higher. (In four sessions through Tuesday, TLT, the iShares 20+year Treasury bond ETF, lost $169 million.) Real test lies ahead. A failure at 2.6 percent – yet again – likely forces non-commercials to reconsider their massive eurodollar shorts.

Thanks for reading!