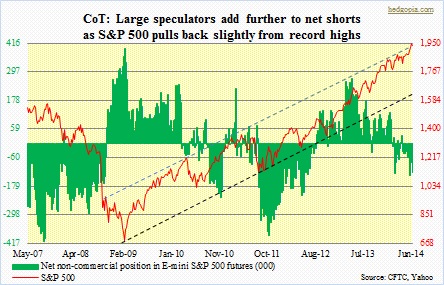

There are some interesting things happening in e-mini S&P 500 futures. First, non-commercials are now net short 121k contracts, nearly double from two weeks ago. In the intervening period, the S&P 500 index has managed to inch up, having backed off after notching an all-time high of 1955.55. Secondly, these large speculators switched from a brief net long position to net short beginning early April. Since then, they have increased shorts by 105 contracts and cut longs by 47k – a combo indicative of conviction by the shorts and a lack thereof by the longs. Odds are rising that these large speculators are going to be on the right side of trade, at least in the near-term. The index, as mentioned last week, has backed off after kissing the upper end of a five-year channel, the caveat being there have so far been no signs of widespread distribution. That is not going to occur unless important support levels are taken out – moving averages, and others. But, given how overbought technicals are, the path of least resistance is down. This is probably the mindset non-commercials are in currently. The only question is, down by how much?

There are some interesting things happening in e-mini S&P 500 futures. First, non-commercials are now net short 121k contracts, nearly double from two weeks ago. In the intervening period, the S&P 500 index has managed to inch up, having backed off after notching an all-time high of 1955.55. Secondly, these large speculators switched from a brief net long position to net short beginning early April. Since then, they have increased shorts by 105 contracts and cut longs by 47k – a combo indicative of conviction by the shorts and a lack thereof by the longs. Odds are rising that these large speculators are going to be on the right side of trade, at least in the near-term. The index, as mentioned last week, has backed off after kissing the upper end of a five-year channel, the caveat being there have so far been no signs of widespread distribution. That is not going to occur unless important support levels are taken out – moving averages, and others. But, given how overbought technicals are, the path of least resistance is down. This is probably the mindset non-commercials are in currently. The only question is, down by how much?

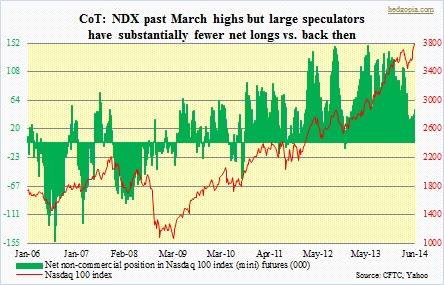

The divergence between the S&P 500 and the Nasdaq continues. The latter has been leading the former since early May – which, from bulls’ perspective, can be considered good in that it suggests risk-on is back in favor. But that is not quite the case given large-caps (both within and outside tech) increasingly are leading others. Looking at this through the eyes of large speculators, this divergence likely continues. At least that is how they are positioning themselves, and of late, they have been on the right side of this trade. If one has to nitpick though, it is worth pointing out that the Nasdaq 100 is past early-March highs, but non-commercials are not as aggressive as they were back then with their longs and conversely they have more shorts. So subtly, the message that is coming out is the same as is coming out of the S&P 500 – that of more conviction by the shorts.

The divergence between the S&P 500 and the Nasdaq continues. The latter has been leading the former since early May – which, from bulls’ perspective, can be considered good in that it suggests risk-on is back in favor. But that is not quite the case given large-caps (both within and outside tech) increasingly are leading others. Looking at this through the eyes of large speculators, this divergence likely continues. At least that is how they are positioning themselves, and of late, they have been on the right side of this trade. If one has to nitpick though, it is worth pointing out that the Nasdaq 100 is past early-March highs, but non-commercials are not as aggressive as they were back then with their longs and conversely they have more shorts. So subtly, the message that is coming out is the same as is coming out of the S&P 500 – that of more conviction by the shorts.

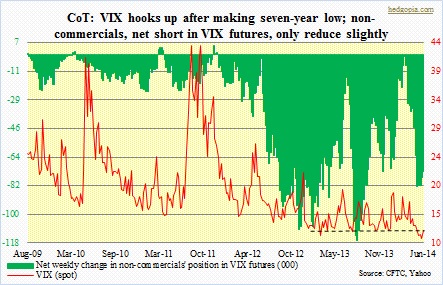

For the Naz to continue to lead the S&P 500 – not necessarily absolute but relative – semis will need to continue to attract bids. In the past four weeks, SMH has gone up nearly 10 percent. Talk about exuberance! Barring the raising of guidance by INTC last week, there has not been much fundamentally to explain for it. We can find some explanation technically. When semis started to move mid-May, most indicators turned up from the middle of the range. Concurrently, SMH broke out of a triangle formation. With the four-week move, technicals are now way stretched – long- and near-term already were, now joined by medium-term. With that said, as is the case with the S&P 500 and the Naz, we are yet to see major distribution. Sentiment overall continues to skew overly bullish. The Investors Intelligence survey recorded a second consecutive weekly reading of bulls in the 60s. At the CBOE, month-to-date in 10 trading sessions, nine registered a put-to-call ratio in the 50s, with three in the 40s. The VIX has managed to find a multi-year trough, and needs to find support at short-term moving averages to muscle its way higher. And last but not the least, there is a genuine dearth of analysts/observers/strategists who are raising the yellow flag. A shout-out to Michael Sincere who last week penned exactly such a ‘caution’ piece on Marketwatch.

For the Naz to continue to lead the S&P 500 – not necessarily absolute but relative – semis will need to continue to attract bids. In the past four weeks, SMH has gone up nearly 10 percent. Talk about exuberance! Barring the raising of guidance by INTC last week, there has not been much fundamentally to explain for it. We can find some explanation technically. When semis started to move mid-May, most indicators turned up from the middle of the range. Concurrently, SMH broke out of a triangle formation. With the four-week move, technicals are now way stretched – long- and near-term already were, now joined by medium-term. With that said, as is the case with the S&P 500 and the Naz, we are yet to see major distribution. Sentiment overall continues to skew overly bullish. The Investors Intelligence survey recorded a second consecutive weekly reading of bulls in the 60s. At the CBOE, month-to-date in 10 trading sessions, nine registered a put-to-call ratio in the 50s, with three in the 40s. The VIX has managed to find a multi-year trough, and needs to find support at short-term moving averages to muscle its way higher. And last but not the least, there is a genuine dearth of analysts/observers/strategists who are raising the yellow flag. A shout-out to Michael Sincere who last week penned exactly such a ‘caution’ piece on Marketwatch.