During the August 31-September 15 period, the Nasdaq composite rallied 0.7 percent – quite an achievement considering that at the lows on September 12 it was down as much as 2.2 percent.

The tech-heavy index’s performance was also in contrast to the 1.5-percent drop in the NYSE composite … not to mention the 1.1-percent drop the S&P 500 large cap index was handed out.

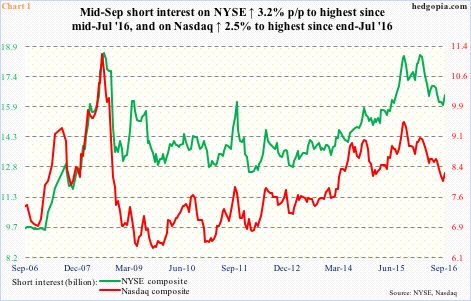

From the viewpoint of performance, the Nasdaq diverged from the NYSE, but not from the standpoint of short interest, which rose in both – up 2.5 percent and 3.2 percent period-over-period, respectively (Chart 1).

On the NYSE, this was the first p/p increase in three months, and on the Nasdaq since the end of June this year. Shorts probably got tempted to get aggressive owing to the September 9th thrashing, when the Nasdaq lost 2.5 percent and the NYSE 2.47 percent (the S&P 500 fell 2.45 percent in that session). But equity bulls quickly defended crucial support 2120 on the S&P 500, once again denying shorts of an opportunity.

We have seen this play out over and over again during this bull market. Shorts smell an opportunity and build/add to position, which in due course ends up hurting them instead. The persistent rise in short interest has been a persistent source of squeeze.

Will the latest buildup meet the same fate? Time will tell. But this much is clear. Shorts show conviction. Of the nine S&P 500 sectors below, except for nominal drop in XLP and XLY, short interest rose in all seven, on some massively.

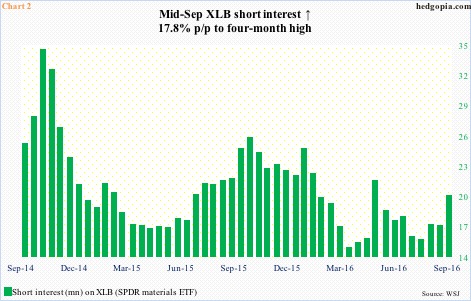

XLB (SPDR materials ETF) – short interest up 17.8 percent p/p

Cyclically oriented sectors such as XLB, XLE (Chart 3) and XLI (Chart 5) tend to benefit more when the economy improves. Unfortunately, the U.S. economy – or global, for that matter – is still tentative, sort of hit-and-miss. XLB is hanging in there, although it has been recently pushed back underneath the 50-day moving average – one possible reason why shorts got aggressive in the latest period.

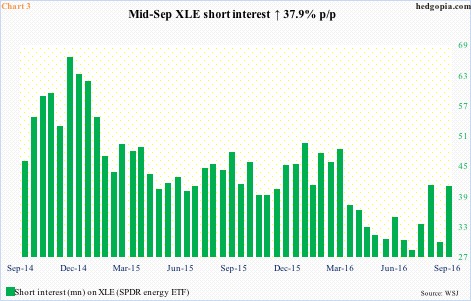

XLE (SPDR energy ETF) – short interest up 37.9 percent p/p

XLE short interest dropped just north of 40 percent between the middle of January this year and end-August. From peak to trough between January and September, the ETF rallied 46 percent. One of the factors leading to the squeeze was talk/rumor that OPEC in its meeting this week would agree to production freeze/cutback, which, we learned yesterday, was not happening. From this perspective, the latest rise in short interest has been vindicated.

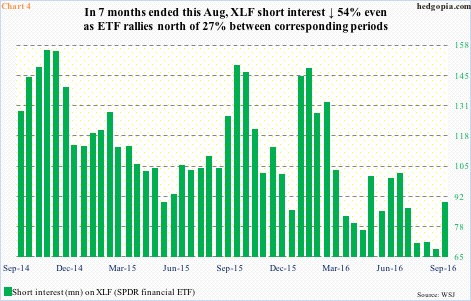

XLF (SPDR financial ETF) – short interest up 31.2 percent p/p

XLF is essentially flat this year – an underperformer vs other sectors. Shorts have had their share of squeeze nonetheless. Between the end of January this year and the end of August, XLF short interest fell north of 54 percent. Off the lows of February this year through the highs early this month, the ETF jumped more than 27 percent.

A steeper yield curve would help this sector, but the Fed continues to stand pat on interest rates. The latest increase in short interest preceded the September 20-21 FOMC meeting, when rates were left unchanged.

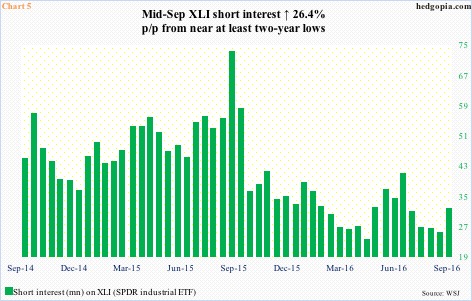

XLI (SPDR industrial ETF) – short interest up 26.4 percent p/p

Despite the increase in the latest period, XLI short interest hovers near at least two-year lows. Despite the state of the U.S. economy – as well as global – the ETF had an important breakout this July. It is still above it, but has lost the 50-day moving average.

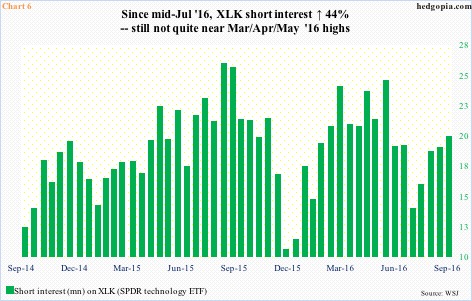

XLK (SPDR technology ETF) – short interest up 4.9 percent p/p

Since mid-July this year, XLK short interest has risen 44 percent. Since the post-Brexit June 27th low to the September 22nd high, the ETF rallied just short of 17 percent. Hard to say if the recent rise in short interest is reflective of shorts’ rising conviction or they are setting themselves up for another squeeze.

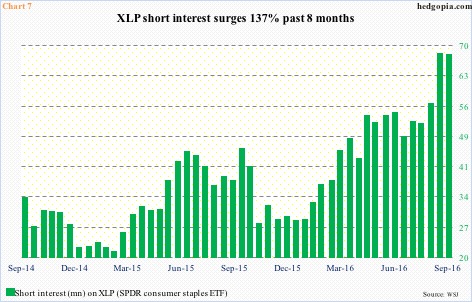

XLP (SPDR consumer stables ETF) – short interest down 0.4 percent p/p

Many staples boast high dividend yields, attracting yield-hungry investors, or those that wanted to hide into the safety these stocks provided. These bond proxies are not cheap. Hence shorts’ temptation into pressing their case. So far, they have had success. XLP peaked mid-July this year.

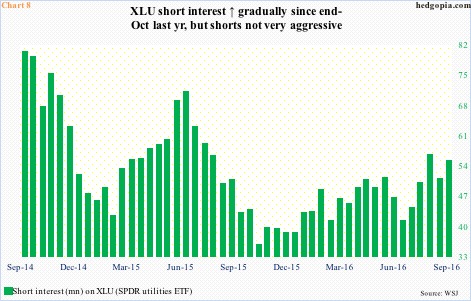

XLU (SPDR utilities ETF) – short interest up 8.2 percent p/p

XLU, too, peaked in July – early July. This is another one of those bond proxies, and could get hammered if the Fed were to deliver on its tightening rhetoric. Shorts do not anticipate this, the way they are positioned.

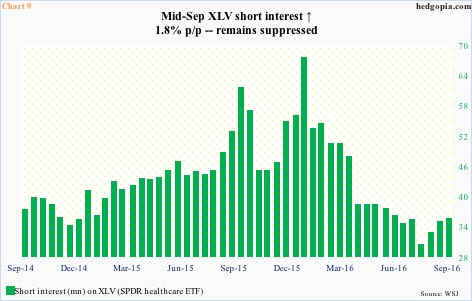

XLV (SPDR healthcare ETF) – short interest up 1.8 percent p/p

XLV peaked in July last year, bottoming first in August last year and then again in February this year. By the middle of January this year, short interest had built up to 67.3 million, which by the end of July dropped to 30.1 million. The ETF rallied 22 percent during the corresponding period. Early August, XLV tested the afore-mentioned peak, and failed. Shorts are yet to treat it as such, as short interest remains suppressed.

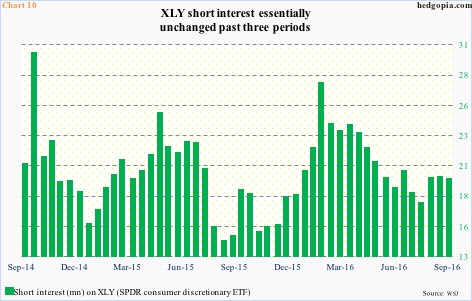

XLY (SPDR consumer discretionary ETF) – short interest down 0.8 percent p/p

XLY short interest has essentially remained unchanged since the middle of August, even as the ETF gave back 3.9 percent through the middle of September. Shorts are staying put, not adding either – perhaps in anticipation of at least a retest of broken support-turned-resistance at $80.

Thanks for reading!