Here is a brief review of period-over-period change in short interest in the February 1-15 period in the Nasdaq and NYSE Group as well as nine S&P 500 sectors.

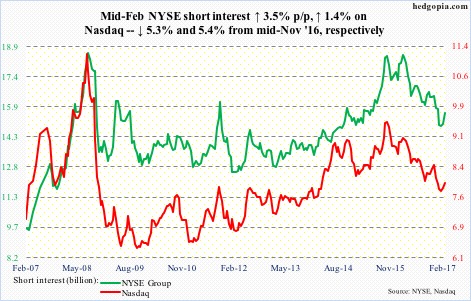

Nasdaq – short interest ↑ 1.4% p/p; Nasdaq composite ↑ 3.6%

From mid-November last year (post-Nov 8 U.S. presidential election) – not to mention from February last year – short interest has been a big tailwind for the Nasdaq composite (5861.90).

That said, shorts have added in the past couple of periods, although the index continued to rally. Well-placed conviction or more fuel for squeeze later on? Remains to be seen. Depending on if shorts use the next pullback/correction as an opportunity to add or continue to cut back, they will be sending a telling message.

NYSE Group – short interest ↑ 3.5% p/p; NYSE composite ↑ 2.6%

The same logic also applies on the NYSE composite (11558.35). Mid-February last year, short interest had jumped to 18.5 billion, nearly matching the end-July 2008 all-time high of 18.6 billion. Since then, short interest dropped 16.1 percent, and the composite rallied 29 percent.

Shorts likely get aggressive if bulls are unable to save support at 11100-11200.

…

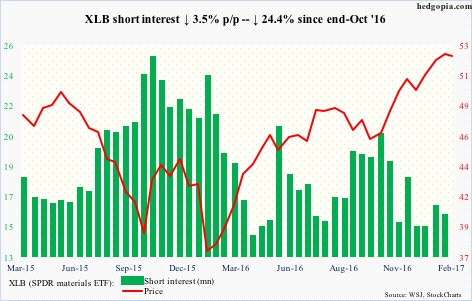

XLB (SPDR materials ETF) – short interest ↓ 3.5% p/p, ETF ↑ 0.9%

XLB ($52.30) has not been able to build on the January 24 breakout, with the ETF pretty much going sideways for the last four weeks. Shorts had already been squeezed. They will likely add more once the ETF loses support at $51.30, and $50 after that.

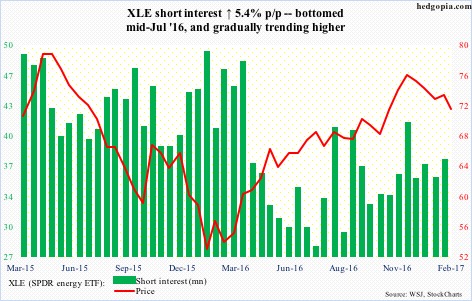

XLE (SPDR energy ETF) – short interest ↑ 5.4% p/p, ETF ↑ 0.6%

December produced a long-legged doji on XLE ($71.60), followed by down January and February. At least the 3.2-percent drop in January was not the result of short selling; short interest went nowhere during the month.

The ETF has been trading within a declining channel for the past two and a half months, and is approaching the 200-day moving average. This likely holds near term. In the event the ETF rallies, squeeze odds are decent.

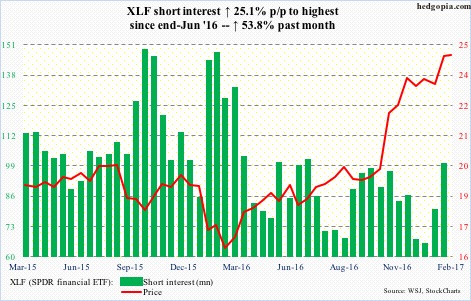

XLF (SPDR financial ETF) – short interest ↑ 25.1% p/p, ETF ↑ 5.2%

On February 13, XLF ($24.55) broke out of a two-month, one-point range, and then stalled at the measured-move target of $24.70-ish, with two daily doji last week. Shorts have gotten active in the past month, and would probably add more should $22.85 give away. Down below, there is massive support at just under $20.

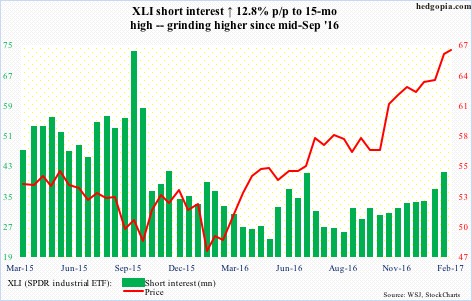

XLI (SPDR industrial ETF) – short interest ↑ 12.8% p/p, ETF ↑ 3.8%

XLI ($66.13) shorts have been gradually adding since mid-September last year, with not much success. Their odds go up if bulls are unable to defend $63.75, which is where the 50-day moving average lies.

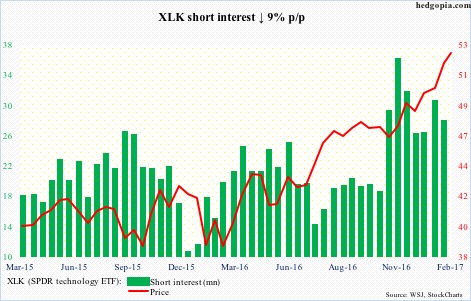

XLK (SPDR technology ETF) – short interest ↓ 9% p/p, ETF ↑ 3.6%

Post-election, XLK ($52.60) short interest surged 95 percent in November alone. Shorts are paying the price for this aggressive bearishness. The ETF is up nearly nine percent this year alone. Short interest is still elevated versus where it was pre-election.

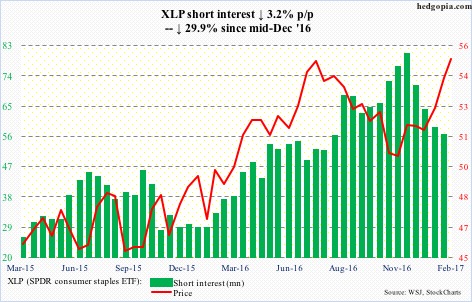

XLP (SPDR consumer stables ETF) – short interest ↓ 3.2% p/p, ETF ↑ 2.9%

After a massive rally post-bottom in early December last year, XLP ($55.03) is testing the high from July last year. Shorts lent a helping hand in this as short interest has been under pressure since mid-December.

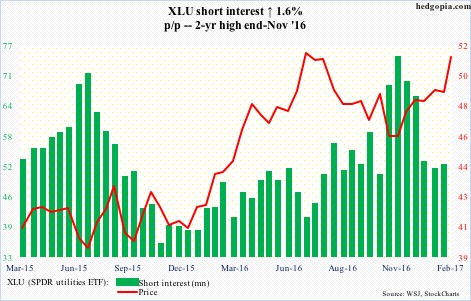

XLU (SPDR utilities ETF) – short interest ↑ 1.6% p/p, ETF ↓ 0.3%

XLU ($51.30), too, is testing the high from last July, and has rallied big after bottoming mid-November last year. Shorts have gotten squeezed. Short interest has been under pressure since mid-December last year.

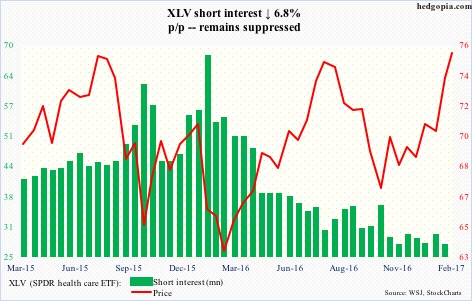

XLV (SPDR healthcare ETF) – short interest ↓ 6.8% p/p, ETF ↑ 4.5%

XLV ($75.14) has rallied hard since late January – currently testing the highs from July/August 2015 and July/August 2016. A breakout here would be massive. Short interest remains suppressed, and thus cannot help the bulls much. If anything, a failure at this resistance can embolden the shorts.

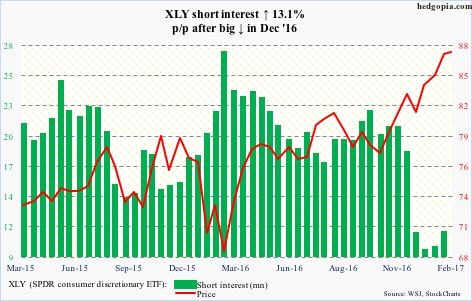

XLY (SPDR consumer discretionary ETF) – short interest ↑ 13.1% p/p, ETF ↑ 2.3%

In the last half of last December, XLY ($87.02) lost two percent, but shorts went on to cut short interest by 40 percent. That proved to be a wise decision as the ETF has gone on to rally nearly seven percent this year. Shorts are taking it easy.

Thanks for reading!