Here is a brief review of period-over-period change in short interest in the September 16-29 period in nine S&P 500 sectors.

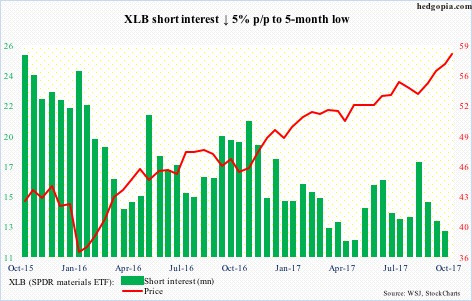

The last time XLB (57.93) had a down month was October last year. Month-to-date, it is up another two percent, with a new intra-day high of 58.11 Tuesday.

Shorts have helped, with short interest down 28 percent since mid-August. Going back further, it peaked mid-October two years ago.

Near-term support lies at 55-plus.

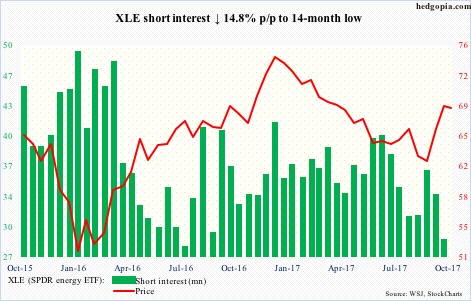

After rallying 13 percent in five weeks, XLE (68.27) reached a six-month high of 68.93 on Tuesday. Shorts got squeezed during this advance.

Now, signs of fatigue are showing up.

XLE is still above the 200-day moving average (67.15), but a test looks imminent.

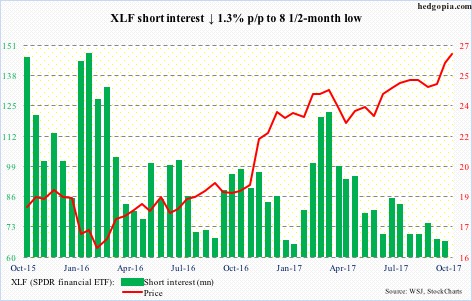

XLF (26.37) three weeks ago broke out of 10-plus-year resistance at 25-plus. It achieved all this without much help from shorts, who are lying low.

Last Friday, the ETF rose to a fresh all-time high of 26.46, and has gone sideways since.

Breakout retest at 25-plus – should it happen – has major significance. Failure could entice shorts.

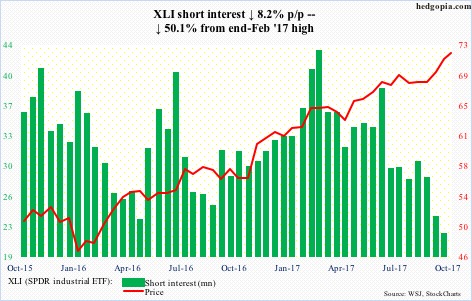

As overbought as XLI (71.85) is, the bears have been unable to break the upward momentum. The daily RSI has remained north of 70 for the last 15 sessions. That said, the 10-day could very well be in a process of rolling over.

Near-term support lies just south of 69. The 50-day (69.01) lies around there.

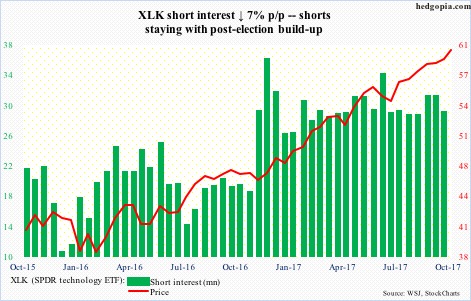

Post-presidential election last November, XLK (60.16) short interest spiked. Shorts are hurting. Through Tuesday’s all-time high of 60.34, the ETF already rallied 29 percent. Nonetheless, in a show of conviction – time will tell if it is misplaced or genuine – they are staying put.

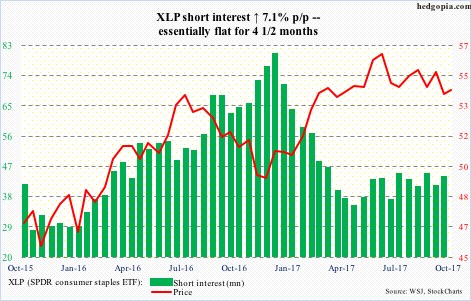

XLP (SPDR consumer stables ETF)

XLP (54.13) peaked at 56.57 on June 5, and has been making lower highs since. The bulls lost both the 50- and 200-day, before reclaiming the latter Tuesday.

More important, they were able to defend support at 53.60 on Monday. Their best-case scenario near term: a test of descending trend line from the June high around 55. There is some potential for squeeze should a breakout occur.

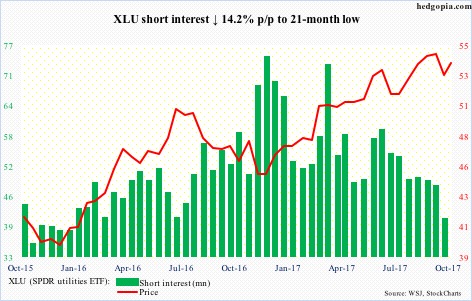

The recent backup in yields was bad news to XLU (54.02). The bulls were unable to build on the mid-August break out of 53.80.

At least near term, 10-year T-yields seem to be wanting to go lower. Maybe that will help XLU bulls. Tuesday, they retook the 50-day, but barely. Potential squeeze fuel remains muted, though.

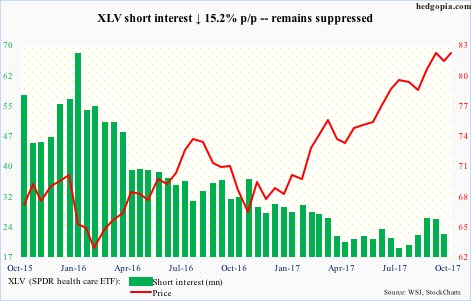

Last Friday, XLV (82.56) rose to a new all-time high of 83.21, but the session also witnessed an unsuccessful test of the prior high of September 13. Thus the significance of support just south of 81, which was defended on September 27, but in all likelihood another test is imminent.

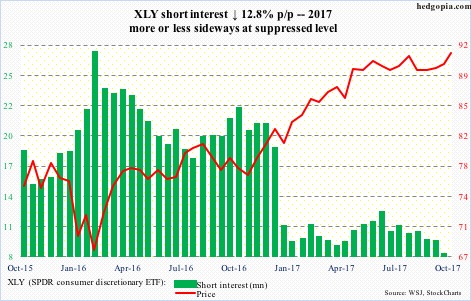

XLY (SPDR consumer discretionary ETF)

Monday produced a bearish engulfing candle on XLY (91.34). This was also an unsuccessful test of four-month resistance just under 92. There is essentially no one left to get squeezed.

In a worse-case scenario, XLY drops to six-month support at 87.50-88, which approximates the 200-day (87.84).

A loss of this support would complete a triple-top, with technicians eyeing 84 as the new target.

Thanks for reading!