Here is a brief review of period-over-period change in short interest in the November 16-30 period in the Nasdaq and NYSE Group as well as nine S&P 500 sectors.

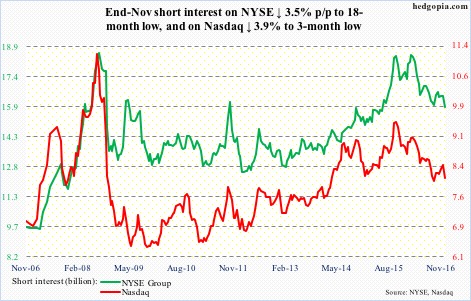

Nasdaq – short interest ↓ 3.9% p/p; Nasdaq composite ↑ 0.9%

In the November 1-15 period, the Nasdaq underperformed versus other major indices such as the Dow Industrials, the Russell 2000 small cap index and the S&P 500 large cap index. In the subsequent period (November 16-30), it still struggled to get its mojo back, but did break out to a new high – rather meekly. Probably why shorts decided to cut back.

Short interest dropped 3.9 percent p/p to a three-month low, but in a larger scheme of things remains elevated. In an optimistic scenario, this can potentially act as a source of squeeze.

NYSE Group – short interest ↓ 3.5% p/p; NYSE composite ↑ 0.9%

The index closed the November 16-30 period right underneath resistance at 10900. The rising 10-day moving average was providing support. Odds of a breakout were rising. Shorts covered. Short interest fell 3.5 percent p/p to an 18-month low. (It did break out last Monday, rallying 3.3 percent last week.)

As is the case with the Nasdaq, in a larger scheme of things NYSE Group short interest remains high.

…

Of the nine S&P 500 sectors below, short interest rose in five p/p (XLE, XLI, XLK, XLP, XLU). During the period, six were above their respective 50-day moving average (XLB, XLE, XLF, XLI, XLK, XLY) and three below (XLP, XLU, XLV).

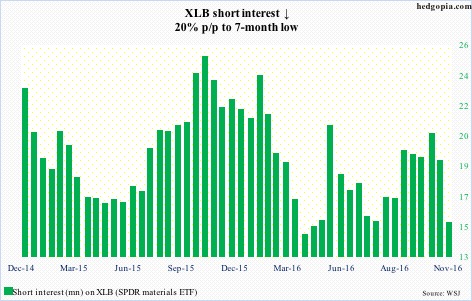

XLB (SPDR materials ETF) – short interest ↓ 20% p/p, ETF ↑ 3.1%

Resistance at $49, which stopped the advance in the prior period, was taken out. Then went down the February 2015 high. Shorts helped big time. Short interest dropped to a seven-month low.

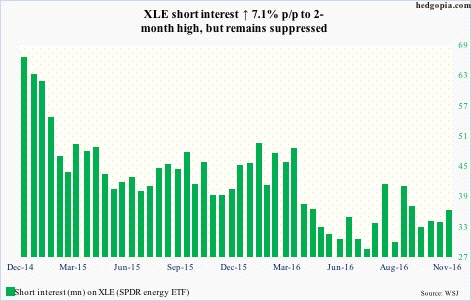

XLE (SPDR energy ETF) – short interest ↑ 7.1% p/p, ETF ↑ 3.6%

Since April this year, XLE had been trading within an ascending channel. Early last month, it found support at the lower end. On November 30, it kissed the upper end. Shorts apparently thought channel resistance would hold, and added (probably got squeezed as the ETF did break out in the current period.)

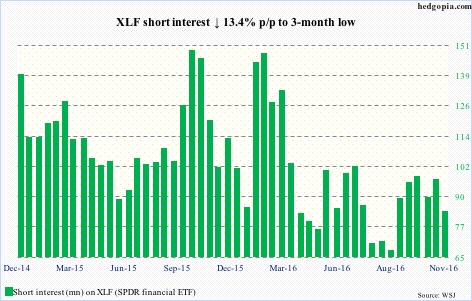

XLF (SPDR financial ETF) – short interest ↓ 13.4% p/p, ETF ↑ 1.5%

In the November 1-15 period, short interest went up 7.9 percent p/p even though the ETF surged 12.4 percent. Shorts obviously doubted if the rally was sustainable. In the November 16-30 period, the ETF digested those gains by going sideways, raising odds of a breakout. Shorts cut back (and probably got squeezed in the current period, as XLF did break out).

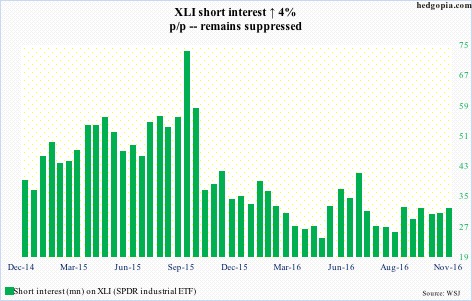

XLI (SPDR industrial ETF) – short interest ↑ 4% p/p, ETF ↑ 1.4%

Early in November, XLI meekly defended horizontal support at $56-plus extending back to February last year. This kind of laid the foundation for the post-Trump rally. The ETF ($63.98) in fact broke out of that resistance this July. A measured-move target comes to $66. Shorts are taking it easy.

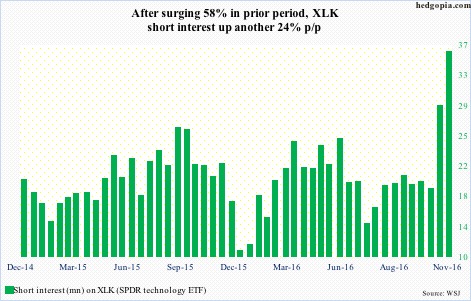

XLK (SPDR technology ETF) – short interest ↑ 23.7% p/p, ETF ↑ 1.8%

In the November 1-15 period, short interest surged 58 percent; XLK was unable to break out of resistance at $48. This continued in the November 16-30 period, and shorts added more.

Tech has been one of the unloved sectors post-Trump win. Should this change in the weeks ahead, the sharp rise in short interest will end up aiding the bulls.

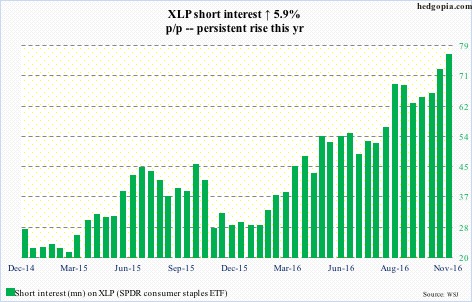

XLP (SPDR consumer stables ETF) – short interest ↑ 5.9% p/p, ETF ↓ 0.4%

Shorts had been gradually building short interest for a while now, and they added more. The ETF ($52.04) has been in a downtrend since July this year – further aggravated by the Trump win. A trend line drawn from that peak will be broken around $52.50. Once that happens, a massive squeeze is waiting to happen.

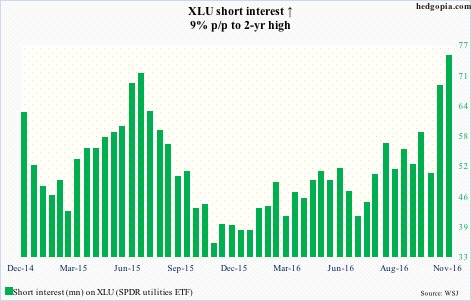

XLU (SPDR utilities ETF) – short interest ↑ 9% p/p, ETF ↑ 0.02%

As did XLP, XLU too peaked in July this year, and has struggled since. Long yields bottomed back then, putting bond proxies under pressure.

Support at $45-46 has held. Odds are growing that in due course shorts will get squeezed.

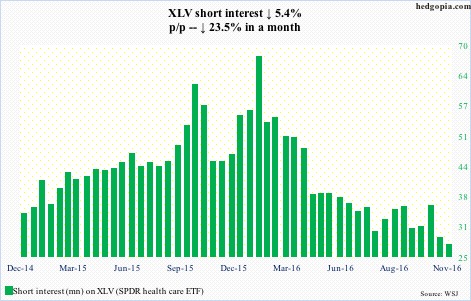

XLV (SPDR healthcare ETF) – short interest ↓ 5.4% p/p, ETF ↓ 2.4%

The ETF peaked early August this year, as it feared a Clinton win. A sharp rally post-Trump victory was quickly given back. Shorts nonetheless continue to hesitate to get aggressive on this one.

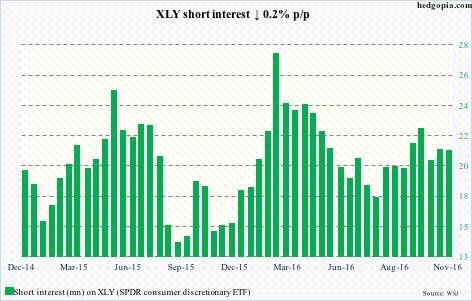

XLY (SPDR consumer discretionary ETF) – short interest ↓ 0.2% p/p, ETF ↑ 2.3%

The ETF broke out of three-month resistance at $82-plus. This did not dissuade shorts from staying put. Short interest is not as high as it was in the early months this year (the tallest bar as of mid-February this year when the ETF bottomed), but remains high.

Thanks for reading!