Equity bulls are struggling at resistance. Last Friday’s news of consumers’ heightened inflation expectations for the next year was used as an opportunity to lighten up at/near resistance. This is taking place at a time when bullish optimism remains high in the options market.

Consumers’ inflation expectations are rising – spiking, in fact. Last Friday, February’s preliminary reading of the University of Michigan’s consumer sentiment index was released, and it dropped 3.3 points month-over-month to 67.8 – a seven-month low. Sentiment was 74 in December, and 79.4 in March (last year).

Concurrently, consumers are expecting a big jump in inflation for the next year (Chart 1). February’s 4.3 reading is a whole point higher than January’s. As recently as last November, this stood at 2.6. November was when the presidential election took place. Donald Trump’s win, and his fiscal and tariff agenda, is evidently making consumers nervous about the near-term inflation outlook. Go out five years, they are not much worried, however, as it rose one-tenth of a point this month from January’s to 3.3.

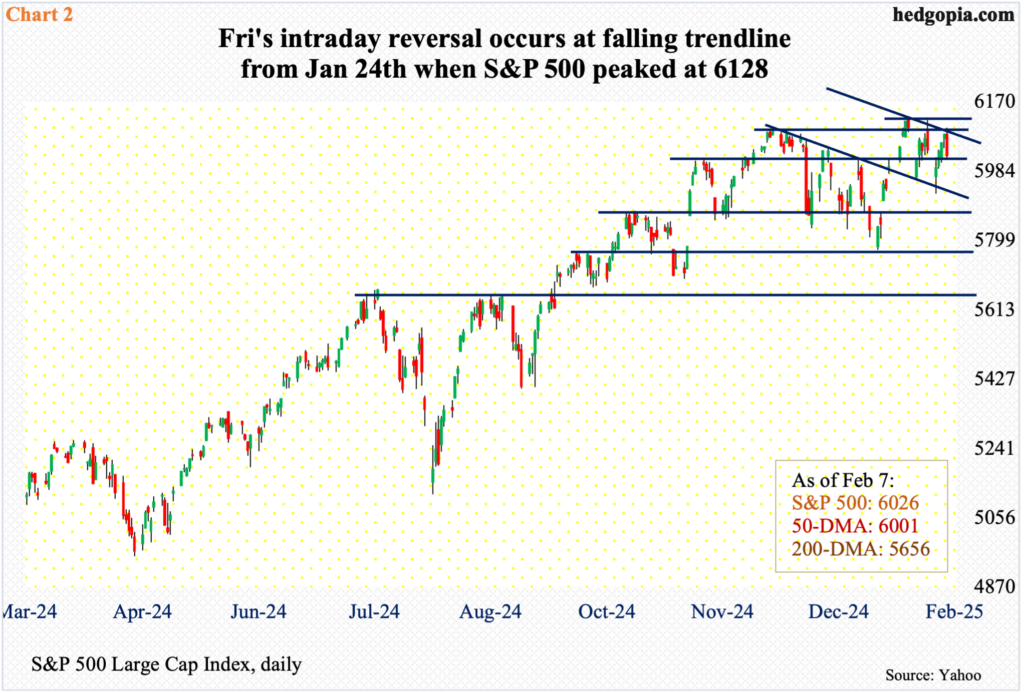

As soon as the sentiment news hit the tape last Friday, equities reversed lower. Until 10AM in that session, the S&P 500 was up one percent for the week, touching 6101 intraday; then it reversed lower. Arguably, bulls used the news as a pretext to lighten up at an important technical level, as 6100 has attracted selling for a couple of months now. Of course, the large cap index tagged 6128 intraday on January 24, but it did not last for too long. Since that peak, it has made lower highs, with Friday’s high kissing that trendline (Chart 2). This resistance also approximates the underside of a broken trendline from October 2023 (not shown in the chart). When it was all said and done, the week ended lower 0.2 percent to 6026.

Ahead, there is horizontal support at 6010s, which is not that far away. The 50-day moving average lies at 6001.

Earlier, the S&P 500 lost 5.4 percent from December 6 to January 13 when it bottomed at 5773. This is a price point the bulls cannot afford to be in breach of.

The Nasdaq 100 behaved similarly last Friday, when at one time it was up 1.8 percent for the week; in the end, it was only up 0.1 percent to 21491. Bears showed up at a falling trendline from December 16 when the tech-heavy index printed an intraday all-time high of 22133 (Chart 3).

At 21380, the 50-day is a little over 100 points from here. Just under at 21100s lies horizontal support, which lines up with a rising trendline from January 13 when the tech-heavy index bottomed at 20538, down 7.2 percent from the high. In a worse-case scenario for now, horizontal support at 20500s is a must-hold, should it get tested.

Over on the Russell 2000, small-cap bulls had an opportunity Thursday to bust out of 2320s but could not quite pull it off, reversing lower after tagging 2327. This level has resisted rally attempts for three weeks now. Interestingly, bears showed up at that hurdle a day before other indices did, with Friday rallying as high as 2312 and turning lower, ending the week down 0.4 percent to 2280.

The good thing from the bulls’ perspective is that although they were repelled at 2320s, they did show up Monday at the bottom of a month-and-a-half ascending channel (Chart 4). So, for now, the Russell 2000 remains between two important price points – 2320s and 2260s, with the latter going back to mid-July (last year). Near term, either way it breaks, momentum likely follows; as things stand, the risk is to the downside.

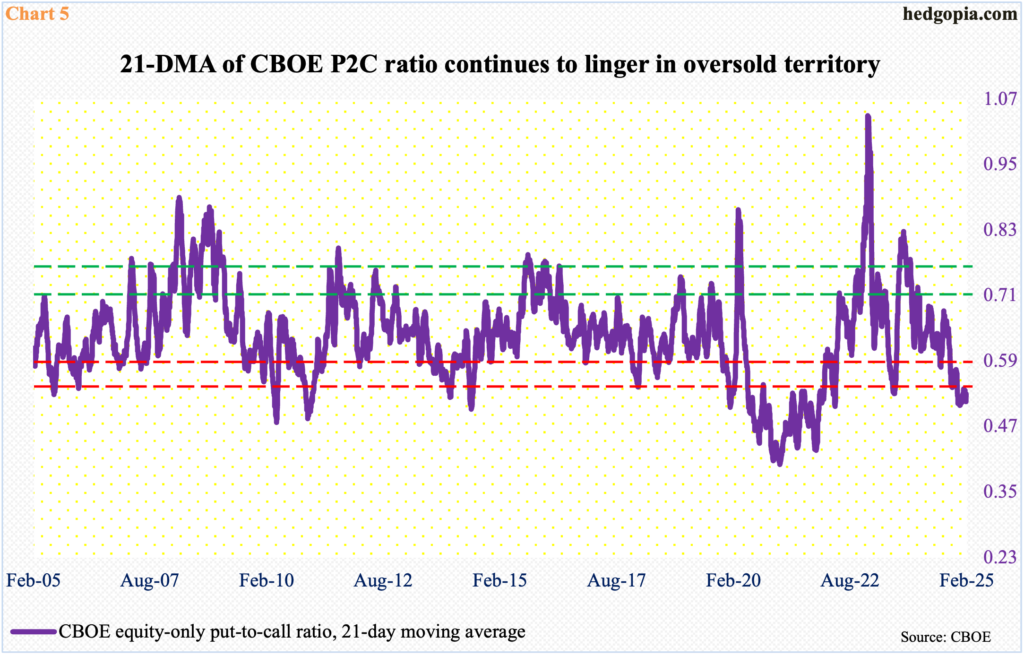

Equity bulls’ inability to clear out hurdles on all these indices comes at a time when the options market continues to reflect a decent amount of optimism.

For 15 consecutive sessions now, the CBOE equity-only put-to-call ratio has produced readings in the 0.40s and 0.50s. As a result, the 21-day moving average of the ratio last Friday came in at 0.526, with readings stuck in the 0.50s for four months now (Chart 5). This is deep oversold territory. Of course, the 21-day average has gone lower several times in the past, but only to snap back up quickly. The longer it remains oversold, the more the potential for energy released when it goes the other way. When that happens, stocks tend to take a hit. How soon that happens is anyone’s guess. But bulls’ inability last week to hang on to the gains has given the bears some hope.

Thanks for reading!