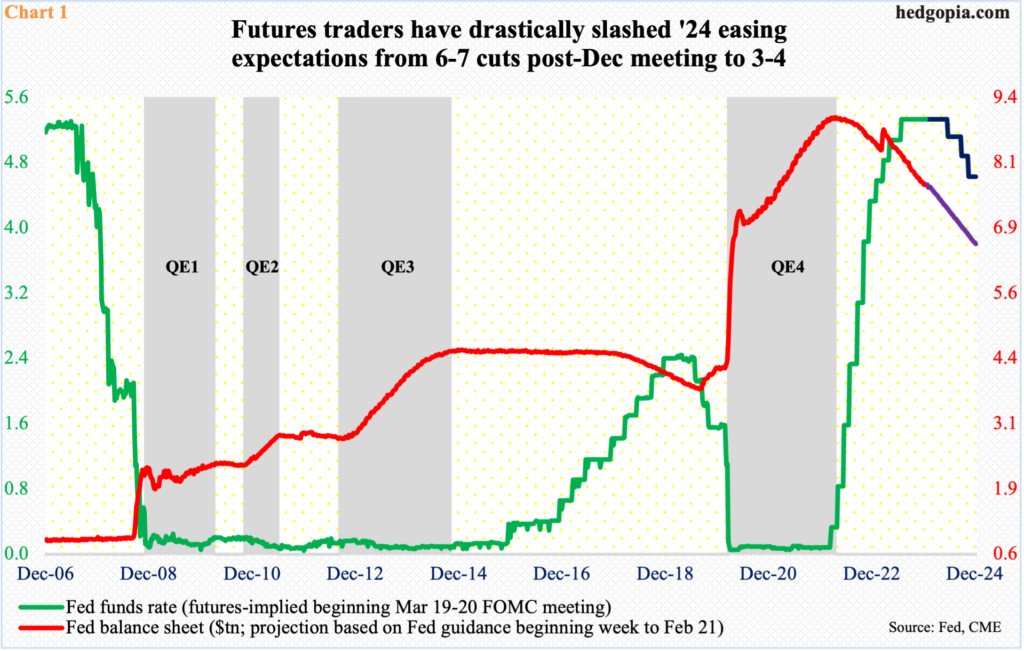

Economic data for the most part continue to come in stronger than expected. In the futures market, traders’ rate expectations are now down to three to four cuts this year, down from six to seven post-December ‘Fed pivot’ meeting. It is very possible the FOMC dot plot will go back to forecasting two cuts this year, down from three at the December meeting.

Until recently, fed funds futures traders priced in the easing cycle to begin in March. They now expect the first cut to occur in June, with December-meeting odds just about 50-50. By that meeting, they are betting on three 25-basis-point cuts (Chart 1). This would be in line with the December FOMC dot plot, in which members telegraphed three cuts in 2024, up from two during the September meeting.

Post-December FOMC meeting, these traders at one time were pricing in six to seven cuts this year. They were irrationally optimistic. FOMC officials constantly pushed back on this optimism/demand.

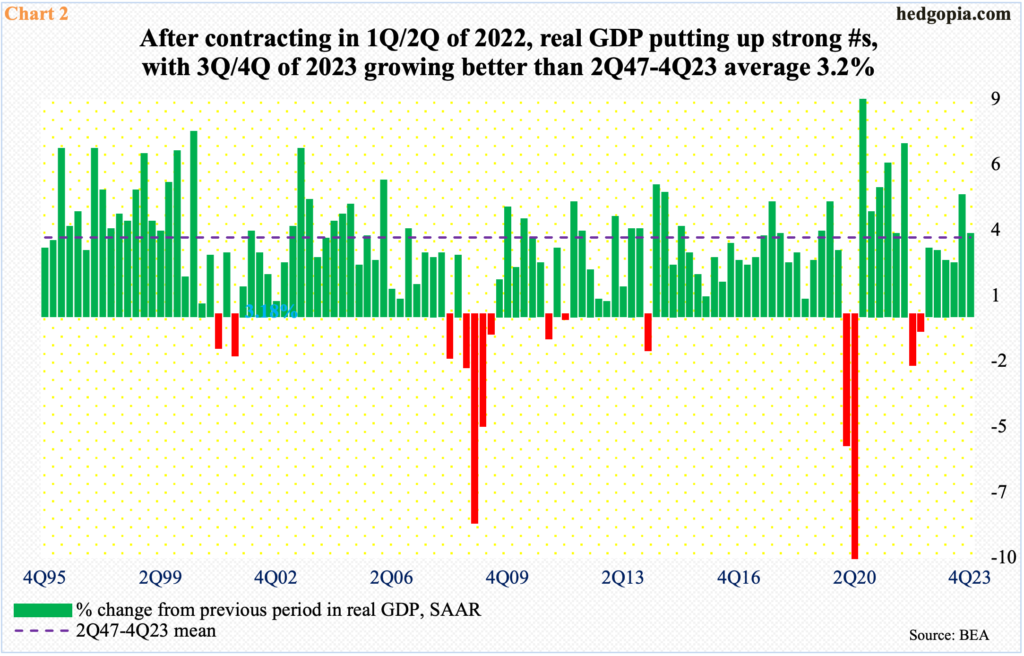

Concurrently, the economy for the most part has continued to churn out better-than-expected numbers, including the creation of 353,000 non-farm jobs in January and 333,000 in December, and real GDP growth of 3.3 percent in the December quarter, which is better than the average growth of 3.2 percent going back to 2Q47 (Chart 2).

The Federal Reserve says it is restrictive. From the looks of it, it certainly seems that way. The fed funds rate has been raised from a range of zero to 25 basis points in March 2022 to between 525 basis points and 550 basis points. That is an increase of 525 basis points over 16 months. That said, the rates were tightened from a zero-bound. Because of this, it is possible it is either taking longer to have the desired effect on the economy or the conditions are not as restrictive as previously thought.

The Fed itself is confused. Minutes of the January 30-31 meeting were released Wednesday, and the officials indicated that they were in no hurry to cut rates. This is a slight change in tone from what was conveyed by Jerome Powell, chair, at the December-meeting press conference.

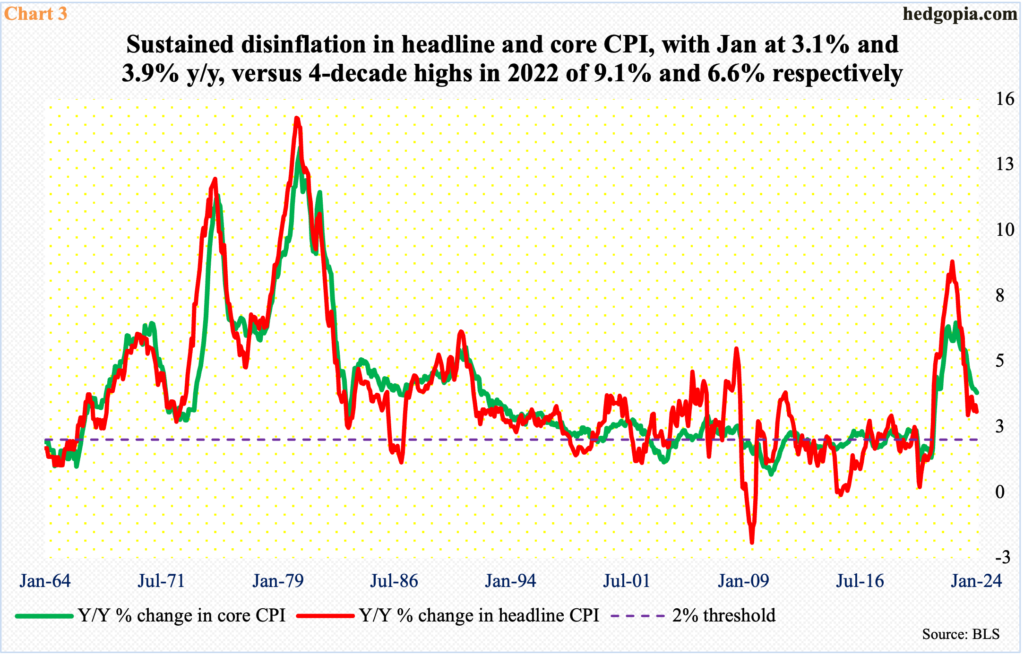

Since that meeting, the members have had an opportunity to consider several fresh data. Not only are economic data coming in stronger than expected but January’s CPI (consumer price index) and PPI (producer price index) both were hotter than expected, although the year-over-year disinflation trend in headline and core CPI since reaching four-decade highs in 2022 is intact (Chart 3).

The January-meeting minutes summed up FOMC members’ concern this way: “Most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 percent.”

In other words, of the dual mandate of maximum employment and price stability, they are clearly focused on the latter. This raises the risk that the dot plot will revert to two cuts this year as well as maintain the current pace of the balance-sheet runoff come the March meeting, which is scheduled for 19-20. By then, January’s PCE (personal consumption expenditures) will have been out, as it is published a week from today. Core PCE tends to be the central bank’s favorite, and it will be watched very closely as to if it will confirm January’s CPI that spooked the markets.

Thanks for reading!