How times have changed? It did not take long for markets’ attention to do a 360 from fears of deflation to that of inflation.

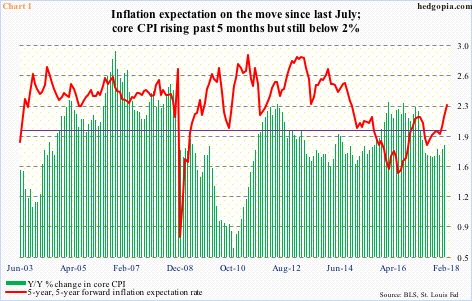

January’s consumer price index was reported Wednesday. It was stronger than expected. In the 12 months to January, core CPI rose 1.82 percent (Chart 1).

So what is the big fuss about, one might wonder? This measure of inflation is still below the Fed’s goal of two percent. Ditto with core PCE (personal consumption expenditures), which increased 1.52 percent in the 12 months through December. The latter is the Fed’s favorite measure of inflation, and has been sub-two percent since May ’12. (Core PCE for January will be released March 1st.)

Simplistically, markets are trying to look ahead, not just focus on the present.

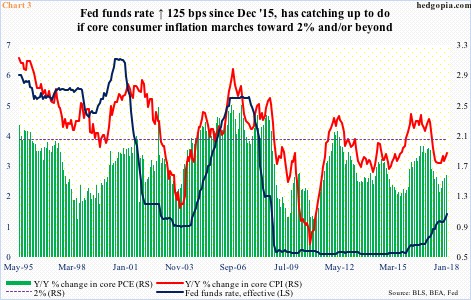

First, both core CPI and PCE have been rising since last September (Chart 3). Nothing crazy, but still the trend has been up.

Second – and perhaps more important in markets’ eyes – inflation expectation is on the move. Once again, nothing out of the ordinary here, but it has firmed up quite a bit in the past couple of months.

In November, the five-year, five-year forward inflation expectation rate stood at 1.95 percent. It then rose to 2.04 percent in December, 2.15 percent in January and 2.3 percent this Monday (Chart 1). It is not headed the right direction. What could have possibly triggered this?

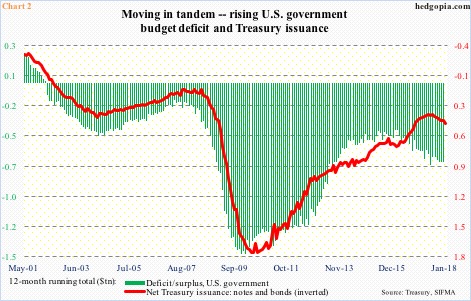

The Tax Cuts and Jobs Act of 2017 was signed into law by President Trump on December 22 last year. These cuts pretty much ensure higher deficits, which then entails higher Treasury issuance. On a 12-month rolling total basis, government deficit was already $681 billion last December (Chart 2).

In due course, fiscal stimulus in an economy already nine years into recovery can put upward pressure on inflation. At least in theory, and at least the bond market is beginning to fear this scenario. Wednesday, 10-year Treasury yields jumped seven basis points to 2.91 percent – the highest since January 2014.

How about the Fed? When it is all said and done, they are the ones to decide how steep the tightening path should/would be going forward. Some hints might be forthcoming next week, not to mention the upcoming March 20-21 meeting.

FOMC minutes for the January 30-31 meeting are published next Wednesday. Markets would be most interested in learning what members thought of rising inflation expectations as well as core inflation which has been creeping higher in recent months, and if they thought they needed to nip it in the bud.

If – a big IF – the Fed concludes the red line and green bars in Chart 3 are headed toward two percent and beyond, the blue line would have a lot of catching up to do.

Thanks for reading!