After giving out signs of fatigue several times in the past couple of weeks, the Nasdaq dropped 1.5 percent Tuesday, losing the 50-day. More downward pressure is likely near term. At the same time, it is possible bears will end up coming to bulls’ rescue.

US stocks took it on the chin Tuesday. The Nasdaq Composite fell 1.5 percent, slicing through the now-slightly-falling 50-day moving average.

The index (7993.63) peaked on July 26 at 8339.64, before coming under slight pressure early August. After remaining rangebound throughout August, it staged a mini breakout early this month. But building on that momentum proved tough.

On the 12th this month, the Nasdaq intraday was within 1.2 percent of its July high, in the end closing with a candle with a long upper shadow. Then on the 19th, it traded in a similar fashion, with a hanging man forming a day prior. Signs of fatigue and distribution also showed up on the weekly in the last couple of weeks.

Tuesday, the index closed right on a rising trend line from last December. Throughout August, bulls used that support to go long/add to positions. Currently, the daily is in the process of unwinding its overbought condition. It is only a matter of time before the trend line is breached, which should then open the door to a test of horizontal support at 7600-7700 (blue horizontal line in Chart 1). The 200-day at 7680.12 lies right around there.

If in the sessions ahead the Nasdaq indeed proceeds toward the afore-mentioned support, odds favor it holds – for now. Or, at least bulls hope so. Ironically, it is possible bears end up coming to bulls’ rescue.

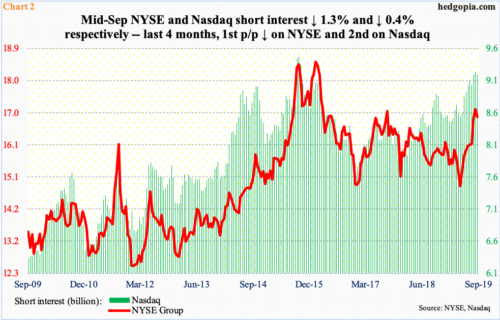

Of late, shorts have been active. In the latest period, which is mid-September, NYSE and Nasdaq short interest respectively dropped 1.3 percent and 0.4 percent period-over-period. This was the first p/p drop in four months on NYSE and second on Nasdaq. The end-August total of 17.1 billion and 9.2 billion was the highest since March 2016 and October 2015 on NYSE and Nasdaq, in that order (Chart 2).

Needless to say, short interest remains elevated, and along the way, shorts more often than not have gotten hurt. So the urge to cover once the index approaches important support likely remains high.

Thanks for reading!