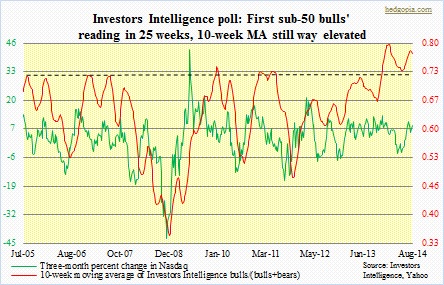

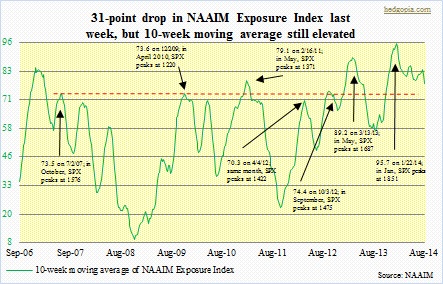

In a global survey of 200 institutional money managers, the Bank of America/Merrill Lynch found that the pros are worried about the stock market and are buying protection against a crash. They are worried about geo-political events and about interest rates, and hence have raised the percentage of cash to 5.1 percent, up from 4.5 percent a month ago. Relatively speaking, this is a steep increase for a single month. This nervousness among the pros also got reflected in the National Association of Active Investment Managers survey last week. The NAAIM Exposure Index fell nearly 31 points to 50.87 – the steepest week-over-week drop since a 35-point drop in August last year. This week, the index pretty much went sideways, sliding ever so slightly to 50.61. So these pros are yet to treat the recent drop (in equities) as a buying opportunity – a fact which is more than reflected in the anemic volume the past several sessions. As has been evident in the mild sell-off, there has not been a mass exodus either. Rather, they are only seeking protection. On August 1st, the CBOE equity put-to-call ratio recorded 1.04. The last time the ratio had a reading over one was on August 19, 2011 (1.03). Also on August 1st, the ISE Sentiment Index (all equity) read a paltry 45 – lowest ever since the series began in 2006 (incidentally, this is a call-to-put ratio). Also among newsletter writers, as per Investors Intelligence, this week was the first time in 25 weeks bulls came in below 50. The beginning of a trend or just a pause in an otherwise exuberant investor mood? Time will tell. But we definitely need several such soft readings in these metrics before the overbought conditions they are in are unwound.

In a global survey of 200 institutional money managers, the Bank of America/Merrill Lynch found that the pros are worried about the stock market and are buying protection against a crash. They are worried about geo-political events and about interest rates, and hence have raised the percentage of cash to 5.1 percent, up from 4.5 percent a month ago. Relatively speaking, this is a steep increase for a single month. This nervousness among the pros also got reflected in the National Association of Active Investment Managers survey last week. The NAAIM Exposure Index fell nearly 31 points to 50.87 – the steepest week-over-week drop since a 35-point drop in August last year. This week, the index pretty much went sideways, sliding ever so slightly to 50.61. So these pros are yet to treat the recent drop (in equities) as a buying opportunity – a fact which is more than reflected in the anemic volume the past several sessions. As has been evident in the mild sell-off, there has not been a mass exodus either. Rather, they are only seeking protection. On August 1st, the CBOE equity put-to-call ratio recorded 1.04. The last time the ratio had a reading over one was on August 19, 2011 (1.03). Also on August 1st, the ISE Sentiment Index (all equity) read a paltry 45 – lowest ever since the series began in 2006 (incidentally, this is a call-to-put ratio). Also among newsletter writers, as per Investors Intelligence, this week was the first time in 25 weeks bulls came in below 50. The beginning of a trend or just a pause in an otherwise exuberant investor mood? Time will tell. But we definitely need several such soft readings in these metrics before the overbought conditions they are in are unwound.