- Fed gets rid of “patient”, but hints it will be patient in hiking rates

- Surging dollar impacts exports; Fed takes 2015 GDP forecast down a notch

- With economic data increasingly coming in weak, rate-hike odds this year next to nil

Now that “patience” is out and we will all be patiently waiting as to what the new word or phrase the Street will be agonizing over, here are some observations post-FOMC meeting.

1. The Fed is finally beginning to get concerned over persistent dollar strength. Currency obviously does not fall into its mandate. The three key objectives for monetary policy in the Federal Reserve Act are maximum employment, stable prices, and moderate long-term interest rates. A strong dollar can indirectly impact/influence all three.

The FOMC statement yesterday stated that “export growth has weakened.” Chart 1 shows this has been in progress for three years now. Globally, economies are weak to getting weaker. The U.S. dollar index, which has surged 25 percent since July last year, has not helped. The Beige Book has been mentioning that.

The dollar has been rallying in expectation of a rate hike, which, if materializes, could cause it to rally further. The U.S. economy can least afford it. The bigger question is: Is the Fed putting its foot down as relates to the buck, which increasingly has become a crowded trade? The two other major currencies — euro and yen — are in the midst of a competitive devaluation.

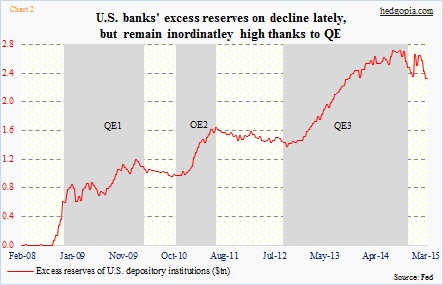

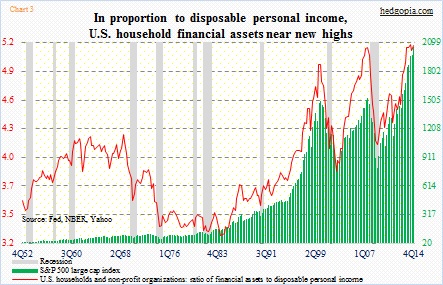

2. With so much excess reserves in the system, is Fed funds even relevant these days? U.S. banks hold $2.3tn at the Fed in excess reserves, which is down from a peak of $2.7tn six months ago, but remains substantially elevated (Chart 2). With rates already zero-bound, the Fed’s monetary quiver is out of arrows. Except reverse repos, and maybe another QE. The latter has already raised U.S. households’ financial assets to unsustainable levels (Chart 3).

3. The ECB charges its banks 20 basis points for depositing at the central bank. In theory at least, this is meant to spur banks into lending. The Fed pays 25 basis points on excess reserves. If it genuinely wants to tighten policy, it can (a) pay more on these reserves, and/or (b) require more reserves. I know how ridiculous this sounds, as U.S. banks are already sitting on boatloads of reserves. By the way, in 1937, the year which has suddenly been thrown into discussion the past couple of days, the Fed doubled reserve requirements.

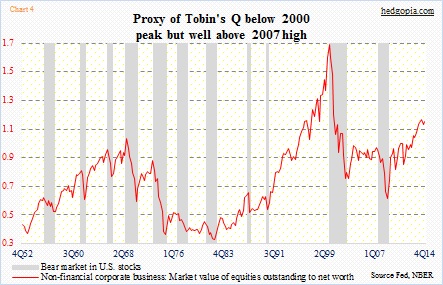

4. The Fed is worried sick not to disappoint the markets. When the global economy was just coming out of the financial crisis, it probably made sense to focus on the wealth effect. But with several valuation metrics at nose-bleed levels, including a proxy of Tobin’s Q (Chart 4), it is perhaps time to begin to worry about the adverse side effects of ultra-easy monetary policy. That argues for normalization, but the Fed keeps moving the goal post. It has painted itself into a corner.

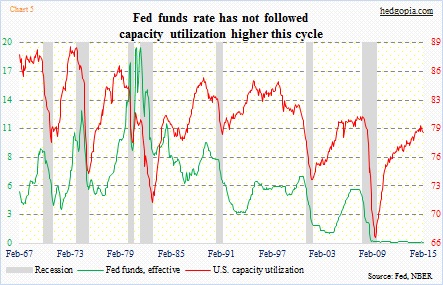

5. Looking at Chart 5, and the divergence between capacity utilization and Fed funds in the current cycle, it is clear if it wanted to, the Fed could have at least done a token hike a long time ago. The longer it waits, the narrower the window of opportunity. This is particularly so now since data are increasingly coming in weaker than expected (except for payroll, of course). The economy is not following the script. The Fed is admitting it. Post-FOMC yesterday, the mid-point of its central tendency of real GDP growth dropped 0.3 percentage point to 2.5 percent in 2015.

This is not a recipe for even one rate hike (as in 1997) this year, forget successive rate hikes (as in 2004).