More evidence came out this week that the labor market is in deceleration and more weakness lies ahead.

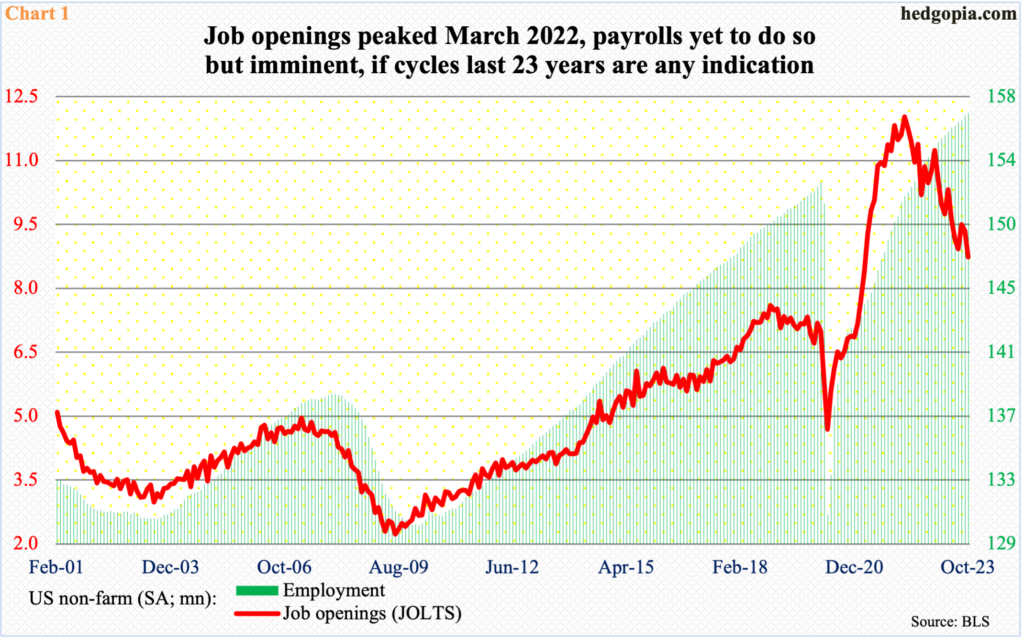

Non-farm job openings tumbled 617,000 month-over-month in October to 8.73 million. This was the lowest since March 2021. The series reached a record high in March last year when there were as many as 12.03 million openings. Evidently, openings are now down 3.29 million from that peak.

The openings data only goes back to December 2000, but it also covers three recessions – from April to November 2001, from January 2008 to June 2009, and from March to April 2020 – but if past is guide, they tend to lead payrolls – both leading to and coming out of recession. Non-farm payrolls are yet to peak and retreat (Chart 1). In all likelihood, it is coming.

In October, the economy created 150,000 jobs. This was the third sub-200,000 month in five. In the first 10 months this year, an average of 239,000 jobs was created, versus a monthly average of 399,000 last year. (November’s print is due out later this morning.)

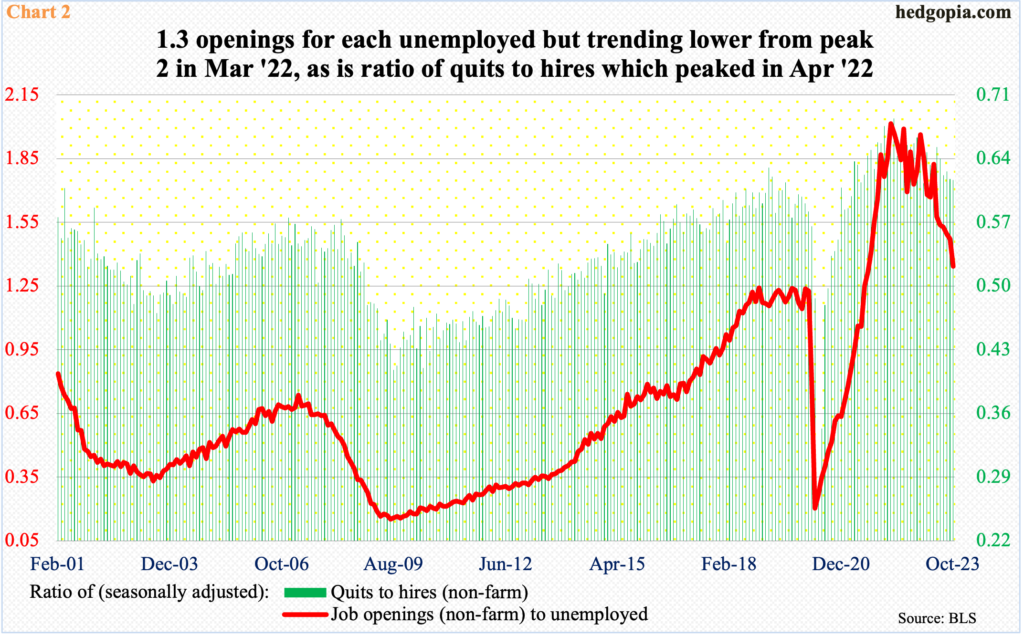

Other signs of deceleration include a ratio of job openings to unemployed, which in March 2022 peaked at 2.01 – a record. In October, this stood at 1.34, which was the lowest since August 2021. A rising ratio reflects underlying strength, and vice versa. That said, October’s reading is still very healthy. The metric had shot up parabolically post-Covid and has room to go down a lot more before it shakes off the excesses.

This also applies to a ratio of quits to hires. One of the signs of a healthy job market is employees’ willingness or ability to quit, which reflects conviction on their part that they would have no problem finding another. In October, there were 3.6 million quits, down 388,000 m/m and down 873,000 from the November 2021 all-time high of 4.5 million. The ratio of quits to hires in October was 0.62, down from the record 0.68 in April last year.

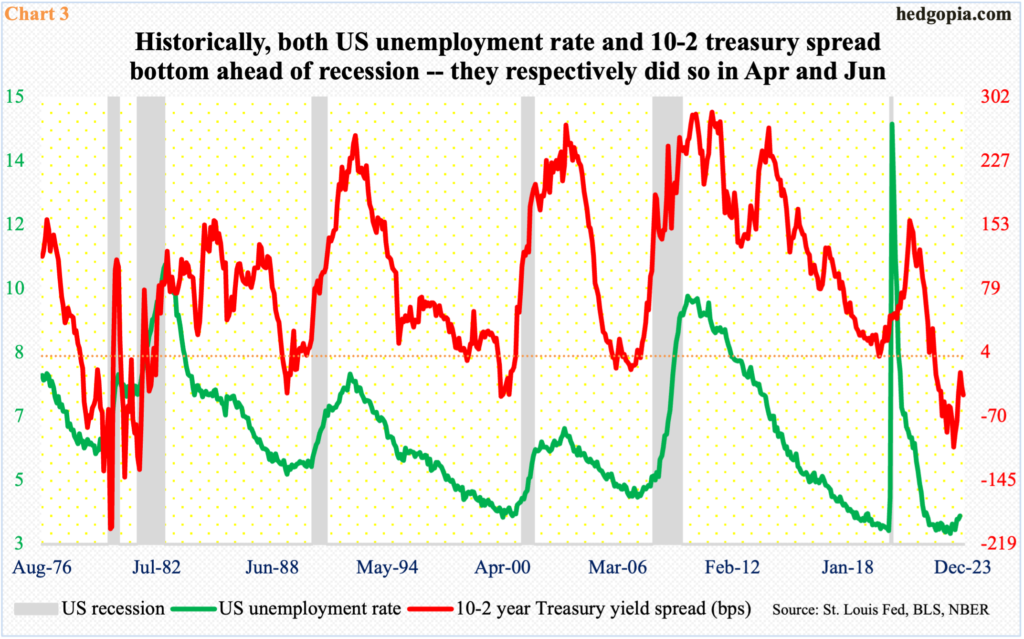

Historically, the US unemployment rate has tended to bottom just ahead of the onset of a recession. As does the spread between two- and 10-year treasury yields, which have been in inversion since July last year (Chart 3).

At the end of June this year, the two-year yielded 106 basis points more than the 10-year – 4.87 percent versus 3.81 percent. From that high, the spread has narrowed to 45 basis points but remains inverted. This gap should continue to narrow and enter positive territory in the months and quarters to come.

In this scenario, the unemployment rate moves hand in hand directionally. In April, it hit 3.39 percent and has gradually risen since, with October at 3.88 percent. Irrespective of what November’s report brings this morning, the path of least resistance is up.

Thanks for reading!