There was an article on MarketWatch.com on Friday entitled “Why lagging small caps might not bring down the S&P 500.” The title says it all. The story seeks to justify why prevailing weakness in U.S. small-caps is not a cause of concern, pointing out that large-caps instead have managed to rally even in the face of such weakness and that small-caps in the past have seen lengthy periods of underperformance. On the first point, true, large-caps have been resilient even as small-caps have floundered. But come to think of it. That is the whole point – the divergence between the two. Yes, it is possible large-caps will continue to rally. It is equally possible that smart money is getting nervous and beginning to seek shelter in the big names. As old as this bull market is, this is never a good sign – money moving away from previously risk-on favorites to the “safe” names. On the second point, for large-caps to continue to excel their small brethren – not only relative, but absolute – valuations on the former should continue to stretch. They are no longer cheap. Let us look at the leading few.

There was an article on MarketWatch.com on Friday entitled “Why lagging small caps might not bring down the S&P 500.” The title says it all. The story seeks to justify why prevailing weakness in U.S. small-caps is not a cause of concern, pointing out that large-caps instead have managed to rally even in the face of such weakness and that small-caps in the past have seen lengthy periods of underperformance. On the first point, true, large-caps have been resilient even as small-caps have floundered. But come to think of it. That is the whole point – the divergence between the two. Yes, it is possible large-caps will continue to rally. It is equally possible that smart money is getting nervous and beginning to seek shelter in the big names. As old as this bull market is, this is never a good sign – money moving away from previously risk-on favorites to the “safe” names. On the second point, for large-caps to continue to excel their small brethren – not only relative, but absolute – valuations on the former should continue to stretch. They are no longer cheap. Let us look at the leading few.

AAPL ($585bn market cap) has rallied 20.2 percent the past three months, currently trades at 15.5x FY15 consensus earnings estimates of $6.32; three months ago, estimates were $6.28. XOM ($443bn) has gone up 3.5 percent the past three months, trades at 13.1x FY14 estimates of $7.88; consensus was $7.54 three months ago. MSFT ($367bn) has rallied 12.3 percent the past three months, trades at 16.3x FY15 consensus estimates of $2.73; three months ago, consensus was $2.91. JNJ ($289bn) has gone up three percent the past three months, trades at 17.2x FY14 estimates of $5.92; three months ago, consensus was 5.88. GE ($259bn) shares are down 2.2 percent the past three months, trades at 15.4x FY14 estimates of $1.67; three months ago, estimates were $1.69. CVX ($254bn) has rallied 8.6 percent the past three months, trades at 12.4x FY14 consensus of $10.78; three months ago, consensus was $10.89. WMT ($245bn) is down 2.8 percent the past three months, trades at 14.6x FY14 estimates of $5.20; three months ago, estimates were $5.31. JPM ($223bn) is up 6.7 percent the past three months, trades at 10.7x FY14 estimates of $5.50; three months ago, consensus was $5.56. IBM ($194bn) has gone up 3.1 percent the past three months, trades at 10.9x FY14 estimates of $17.90; three months ago, estimates were $17.89. INTC ($171bn) has surged 31.5 percent the past three months, trades at 15.7x FY14 estimates of $2.18; three months ago, consensus was $1.89. You get the drift. Of the ten behemoths, the only two that have seen decent increases in estimates are INTC and XOM, the rest are either down or more or less flat. Nevertheless, only two have gone down in price – only slightly – the past three months. Rising stock prices in the midst of flat to down earnings means multiples have already expanded.

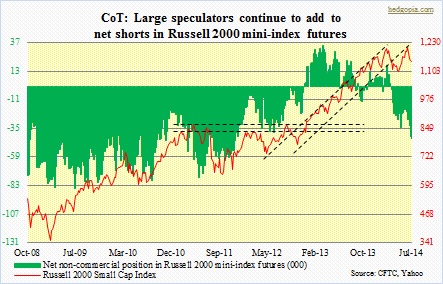

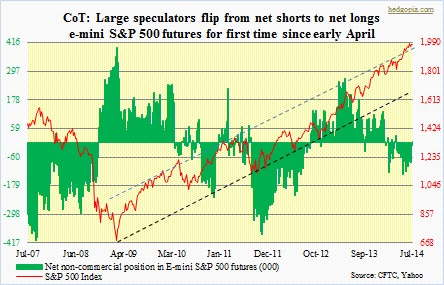

Second-half estimates for year-over-year earnings growth (reported) for S&P 500 companies are high – 15.3 percent in 3Q14 and 8.4 percent in 4Q14; for the year, they are expected to grow 9.5 percent. Even though these estimates have progressively come down this year, it is probable they continue to lean a bit too optimistic. Hence, one can argue, the sell-off in small-caps, and money shifting into “safe” large-caps. In normal circumstances, small-caps and other momentum favorites would have rallied should there be more optimism for growth. Having said all that, an interesting signal is coming out of the futures market – a message that seems to support what the MarketWatch article is saying. As the adjacent chart shows, large speculators started cutting back on their net shorts in S&P 500 e-mini futures in the first week of June and have proven themselves right. The index since has moved higher. Last week saw these traders shift into net longs – for the first time since early April. So they are essentially betting that the shift into large-caps continues and that small-caps will continue to wilt. On the latter, non-commercials are digging in (chart on top). They have gradually increased net shorts since the middle of June and stayed put last week with their position.

Second-half estimates for year-over-year earnings growth (reported) for S&P 500 companies are high – 15.3 percent in 3Q14 and 8.4 percent in 4Q14; for the year, they are expected to grow 9.5 percent. Even though these estimates have progressively come down this year, it is probable they continue to lean a bit too optimistic. Hence, one can argue, the sell-off in small-caps, and money shifting into “safe” large-caps. In normal circumstances, small-caps and other momentum favorites would have rallied should there be more optimism for growth. Having said all that, an interesting signal is coming out of the futures market – a message that seems to support what the MarketWatch article is saying. As the adjacent chart shows, large speculators started cutting back on their net shorts in S&P 500 e-mini futures in the first week of June and have proven themselves right. The index since has moved higher. Last week saw these traders shift into net longs – for the first time since early April. So they are essentially betting that the shift into large-caps continues and that small-caps will continue to wilt. On the latter, non-commercials are digging in (chart on top). They have gradually increased net shorts since the middle of June and stayed put last week with their position.