Investor sentiment has done a yo-yo in recent weeks – from multi-month highs six weeks ago to the lows of three weeks ago to the week-over-week rise this week. Investment managers are very bullish, retail not quite there but high enough.

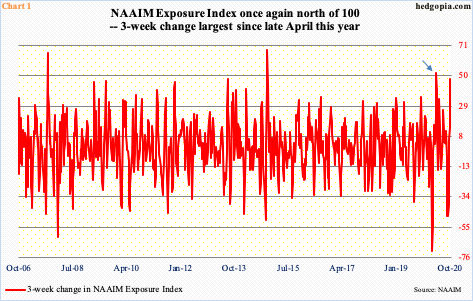

Once again, professionals who manage money for a living are exceedingly bullish. The NAAIM Exposure Index, which represents the average exposure of National Association of Active Investment Managers members to US equity markets, jumped 29.9 points from last week to 102.9. This was the highest reading since hitting 106.6 in the week to August 26, which was right before the S&P 500 peaked on September 2nd; in the next three weeks, the large cap index corrected just a tad over 10 percent.

The difference between then and now is that the August 26th NAAIM reading preceded two other 100-plus readings and four more in the 90s before that, suggesting persistently bullish sentiment. In recent weeks, however, as the S&P 500 corrected, the NAAIM Exposure Index quickly collapsed to 53.1 in the week to September 9. Most recently, it was down to 55.3 in the week to September 23. From that low, it jumped 47.6 points. This was the largest three-week positive change since the week to April 29 (arrow in Chart 1). Back then, the S&P 500 quickly shed five-plus percent in just a few sessions.

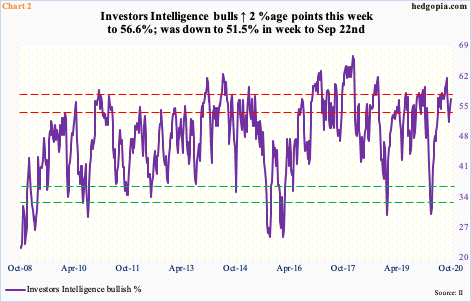

In the meantime, newsletter writers, too, are more bullish than they were three weeks ago, but are yet to reach the highs just ahead of the early-September peak in the S&P 500.

This week, Investors Intelligence bulls rose two percentage points week-over-week to 56.6 percent. Three weeks ago, their count was 51.5 percent. Earlier, in the week to September 1, bulls were 61.5 percent – a 100-week high. Some of that elevated sentiment got unwound in the three-week correction in the S&P 500.

The takeaway here is that investor sentiment once again is elevated. However, should things evolve similar to the weeks leading to the peak in stocks early last month, there is room for it go sideways in the case of investment managers and even rise in the case of retail. Failure to do so suggests bulls at this juncture are playing a weak hand.

Thanks for reading!