It is probable the 10-year T-yield has peaked at five percent. In this scenario, a sustained move lower will put shorts, who were heavily betting on higher rates, under pressure to cover.

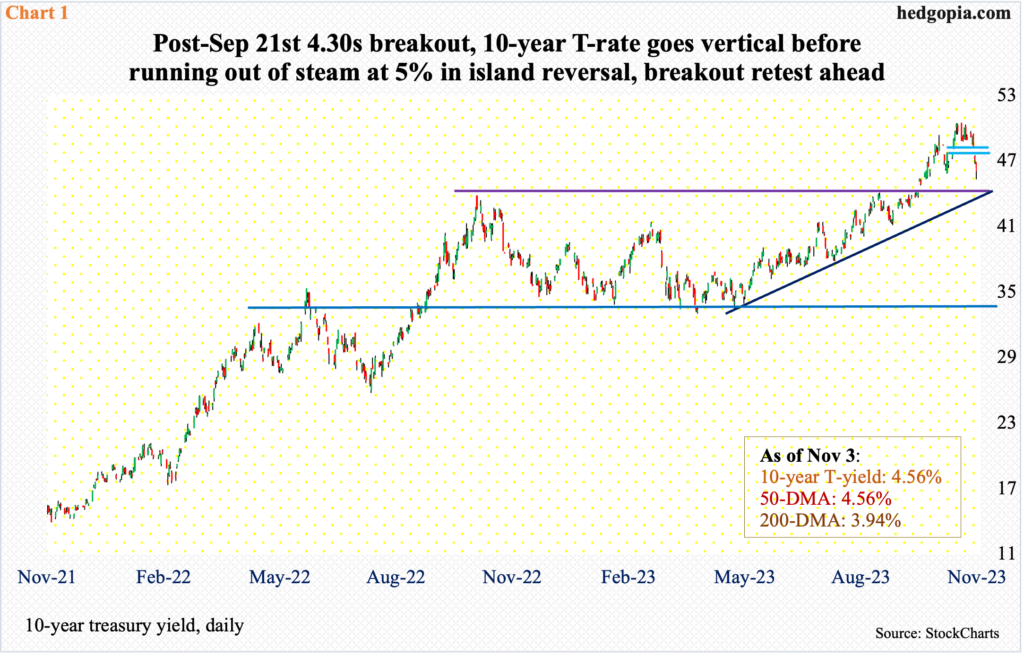

Two weeks ago, the 10-year treasury yield met with strong resistance at five percent – or just under. For three consecutive sessions in October, the level denied bond bears (on price) continued momentum, with a high of 4.997 percent on the 23rd, preceded by 4.993 percent on the 20th and 4.996 percent on the 19th.

Before this, the 10-year has had quite a rally. Early August last year, these notes were yielding 2.53 percent, and 1.13 percent in August 2021. Most recently, yields rallied sharply after breaking out of 4.3s on September 21st.

The October 23rd high was the highest since July 2007. Back then, the 10-year peaked at 5.32 percent in June, before coming under sustained pressure. In March 2020, yields bottomed at 0.40 percent. The June peak in 2007 was posted just before the global financial system was consumed in a severe crisis.

Last week, yields dropped 29 basis points week-over-week to 4.56 percent, having touched 4.48 percent intraday Friday. Rather ominously for bond bears, the 10-year went the other way after forming an island reversal (Chart 1).

For now, the path of least resistance is for the rates to go lower for a breakout retest at 4.3s, which likely does not give way at the very first try. This level currently also lines up with a rising trend line from May. That said, a breakdown is only a matter of time. There is a lot of unwinding of overbought conditions that needs to happen on particularly the weekly and monthly.

Last week’s drop in the 10-year yield followed hints from the Federal Reserve that it is probably done in the current tightening cycle, leaving the fed funds rate unchanged at a range of 525 basis points to 550 basis points. In March last year, the benchmark rates were languishing at zero to 25 basis points, which meant they went up 525 basis points over 16 months, with the last hike in July.

The 10-year followed the short rates higher (Chart 2). Early March last year, it touched 1.68 percent before heading up.

The Fed has said for a while that, given where inflation is – on the decline from last year’s four-decade highs but still high relative to the central bank’s two percent objective – it would like to leave the fed funds rate elevated longer than currently priced in. Markets are not prepared to listen.

In the futures market, traders now expect the first cut as early as next May, ending 2024 between 425 basis points and 450 basis points, which is a whole percentage point lower than where the fed funds rate currently stands. In essence, these traders are betting that the economy is headed for a substantial slowdown at best and a recession at worst. The 10-year, in this scenario, follows the fed funds rate lower.

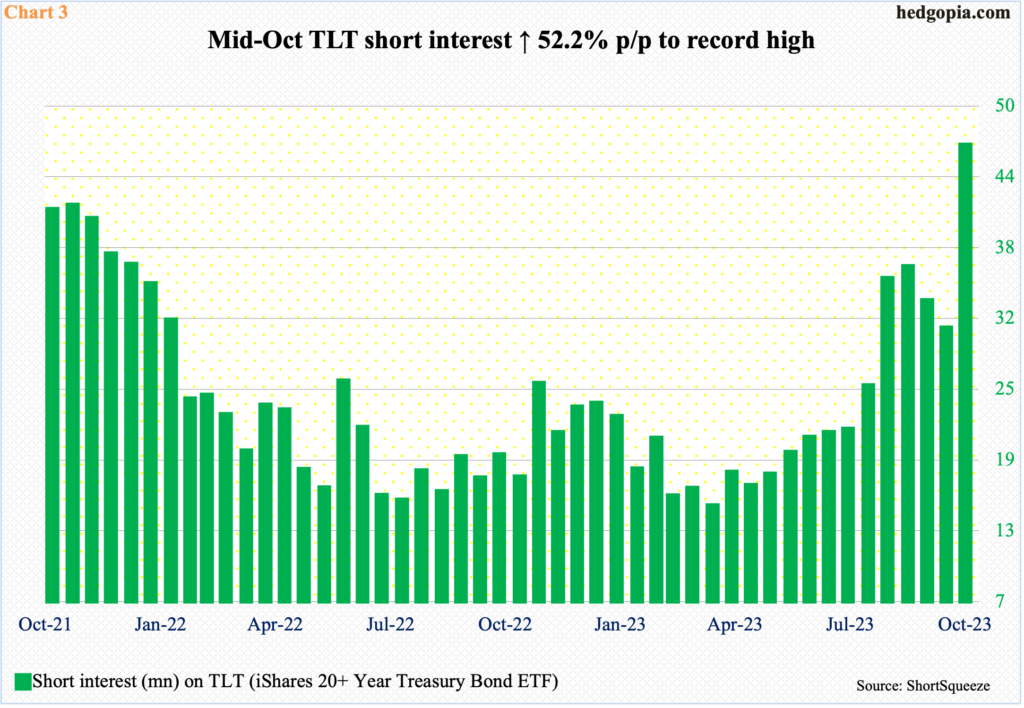

This runs counter to bond shorts’ thesis that the 10-year yield is still headed higher. There is no shortage of them.

Mid-October, short interest on TLT (iShares 20+ Year Treasury Bond ETF) shot up 52.2 percent period-over-period to 46.3 million – a record high. In seven months, short interest has tripled (Chart 3). Giving credit where credit is due, these shorts have killed it directionally, as yields headed higher and prices lower. (Prices and yields have an inverse relationship.) But any signal that the trade has run its course will tempt them to lock in the gains. This in and of itself can send rates on the long end of the yield curve lower – timing and magnitude notwithstanding.

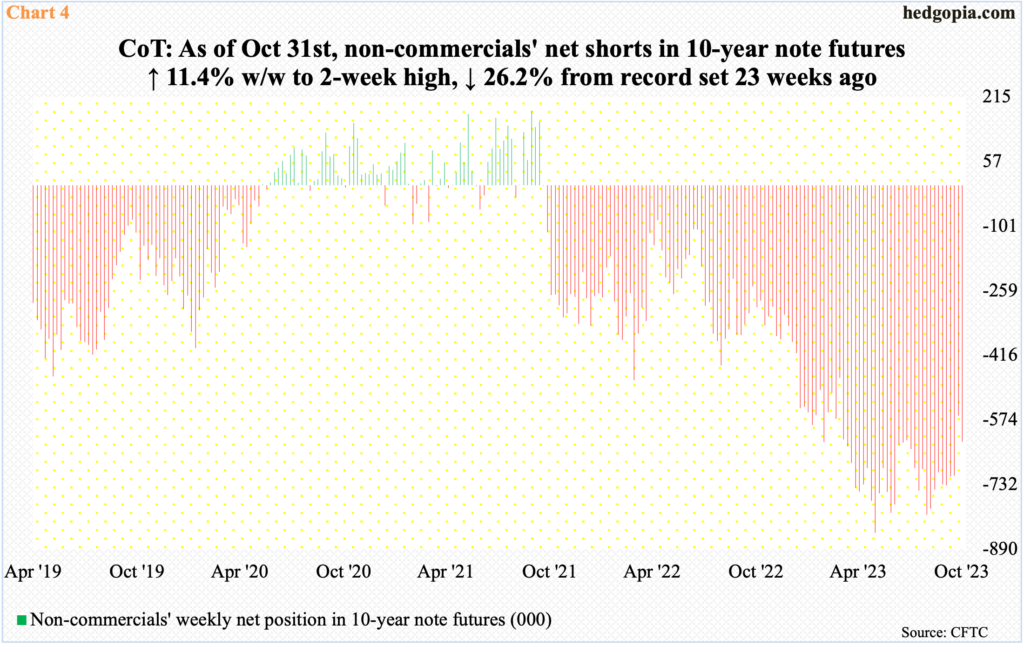

Similar dynamics are in play in the futures market, where non-commercials have accumulated net shorts in 10-year note futures up to the gills.

As of May 30th this year, these traders were net short 850,421 contracts – a record. Since then, holdings have fluctuated quite a bit but in essence non-commercials are hanging on to their overall bearish theme. As of last Tuesday, they were net short 627,698 contracts, down 26.2 percent from the May high but still massive.

Once these traders decide to go the other way and begin to cut back their holdings, yields are likely to face a headwind – which in and of itself has the potential to act as a self-fulfilling prophecy.

Thanks for reading!