Equity bulls keep wishing for a pivot that keeps eluding. As things stand, bears are probably eyeing the June lows at a minimum. But at some point, the selling needs to be faded as the season turns favorable.

No sooner did Federal Reserve Chair Jerome Powell take to the podium post-FOMC meeting on Wednesday than the pivot party got pooped.

Equity investors have been desperate for a pivot. Powell has made it very clear since the Jackson Hole symposium late August that one is not forthcoming – not any time soon anyway.

Ahead of this week’s meeting, the S&P 500 rallied for two weeks in a row, with last week up 3.9 percent and by 4.7 percent in the week before that.

On Wednesday, the fed funds rate was hiked by 75 basis points to a range of 375 basis points to 400 basis points. This was expected. But the use of the new phrase “cumulative tightening” was used as a dovish signal. Through 1:30pm, the S&P 500 was up as much as a percent for the session – which vanished as soon as Powell began to address the press.

Once again, he was adamant that the central bank has no plans to pause its tightening campaign, adding that the benchmark rates, currently at their highest level since the 2008 financial crisis, will also peak at a much higher level than initially thought, as inflation was uncomfortably – and stubbornly – high.

When it was all said and done, the large cap index tumbled 2.5 percent, slicing through the 50-day, to 3760. The daily has plenty of room to continue lower. The bears are probably eyeing the June lows of 3630s – and the October 13 low of 3492 in a worse-case scenario (Chart 1). But at some point, the selling needs to be faded. We are approaching a seasonally strong period, and several indicators are into deep oversold territory.

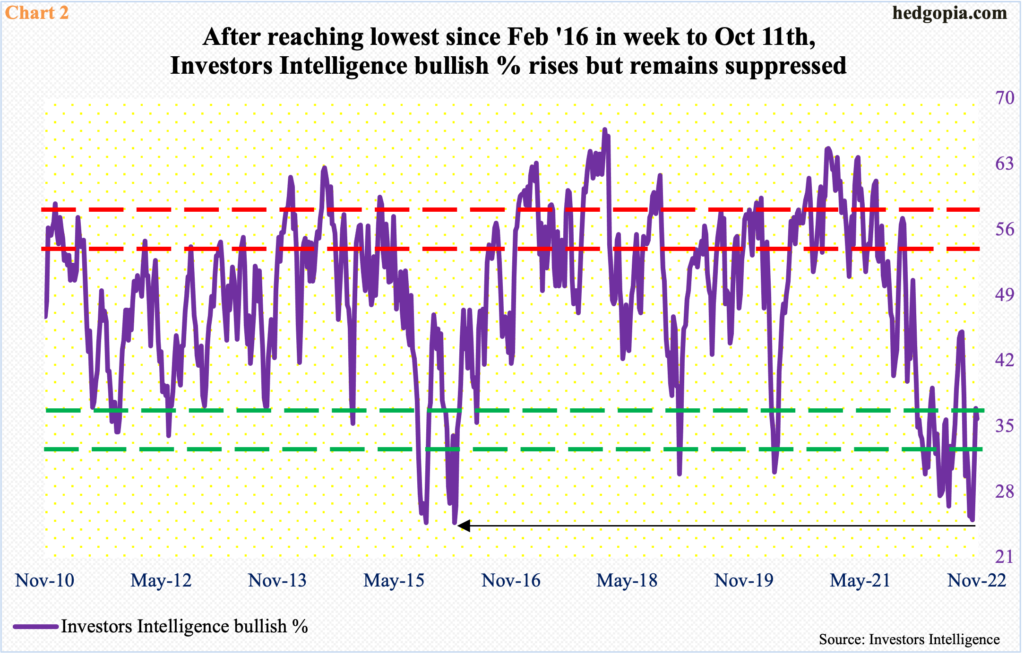

Newsletter writers for one remain cautious. Their bullish count hit 25 percent in the week to October 11, which was the lowest since February 2016 (Chart 2). Before that, Investors Intelligence bulls languished at 25.4 percent for two weeks in a row.

Sentiment has improved after hitting those lows, but it remains in the 30s, with this week at 35.8 percent, down 1.1 percentage points week-over-week.

If past is prelude, this gets unwound sooner or later.

Thanks for reading!