Small-cap earnings are coming in better than expected. The economy continues to churn out strong numbers. But small-caps, which by nature have larger domestic exposure, continue to trade within a five-month range. Near term, potential lower volatility can help bulls but it remains bears’ ball to lose.

Small-cap earnings are living up to expectations. With the earnings season rapidly winding down, 2Q21 blended operating earnings estimates for S&P 600 companies as of last Wednesday were $16.21, better than the $15.98 expected when the quarter ended and the $13.84 when the quarter began.

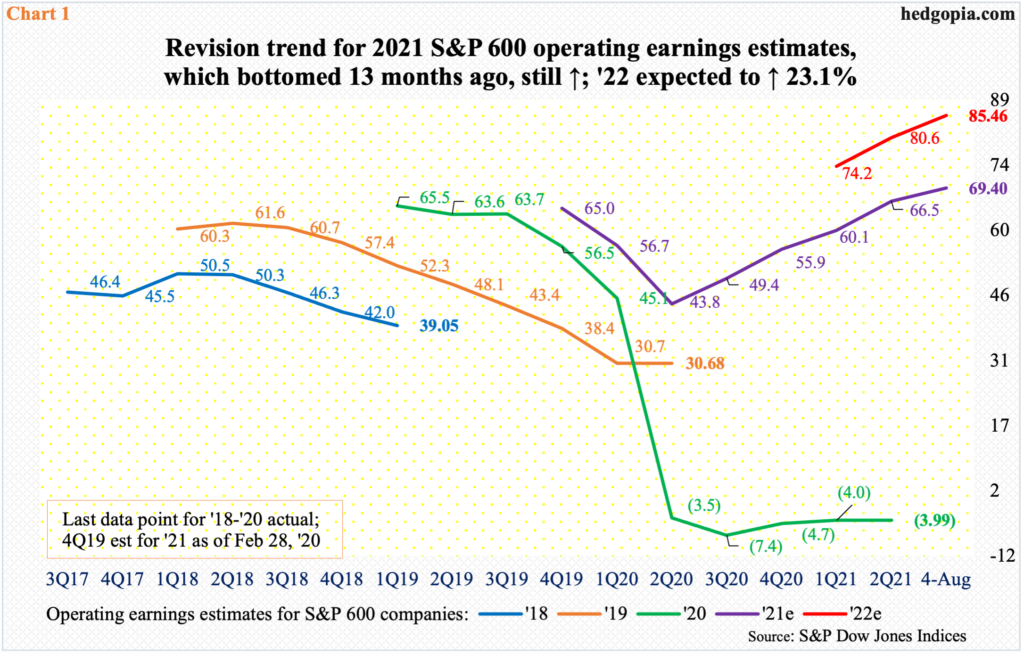

After a post-pandemic tumble in expectations, the 2Q21 revision trend bottomed mid-July last year at $9.46. That was when 2021 estimates for the year as a whole bottomed as well at $42.99, which have now gone up to $69.40 (Chart 1). The momentum is expected to carry over to next year, with the sell-side having penciled in $85.46 for 2022, for growth of 23.1 percent.

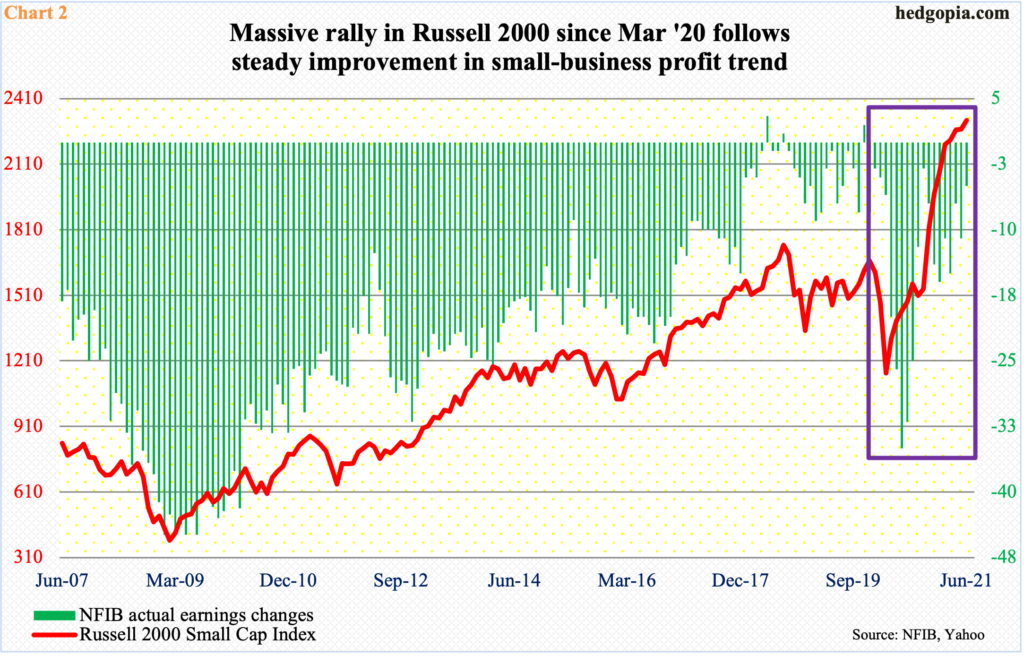

Improvement in small-business profit trend is also evident in the NFIB ‘actual earnings changes’ sub-index, which in June last year hit a low of minus 35. By October, it improved to minus three before deteriorating and then rising again. In June, the metric improved by six points month-over-month to minus five (box in Chart 2). The Russell 2000 is pretty much in lockstep. From the low of March last year through the all-time high from March this year, the small cap index jumped 144 percent. In late June, that high was just about tested – unsuccessfully.

In effect, the Russell 2000 has been rangebound the past five months – between 2080s and 2350s. The low end was just about tested on July 19 when the index ticked 2107 (arrow in Chart 3). The rally off of that low has been lukewarm – to say the least.

Last Friday, the Russel 2000 tagged 2258 but closed 10 points lower. Resistance at 2280s has not been tested since early July. It is only after small-cap bulls recapture this level that they can think about going after the upper bound of the rectangle the index is in.

Small-caps’ lackluster performance the past several months comes at a time when the economy continues to churn out strong numbers.

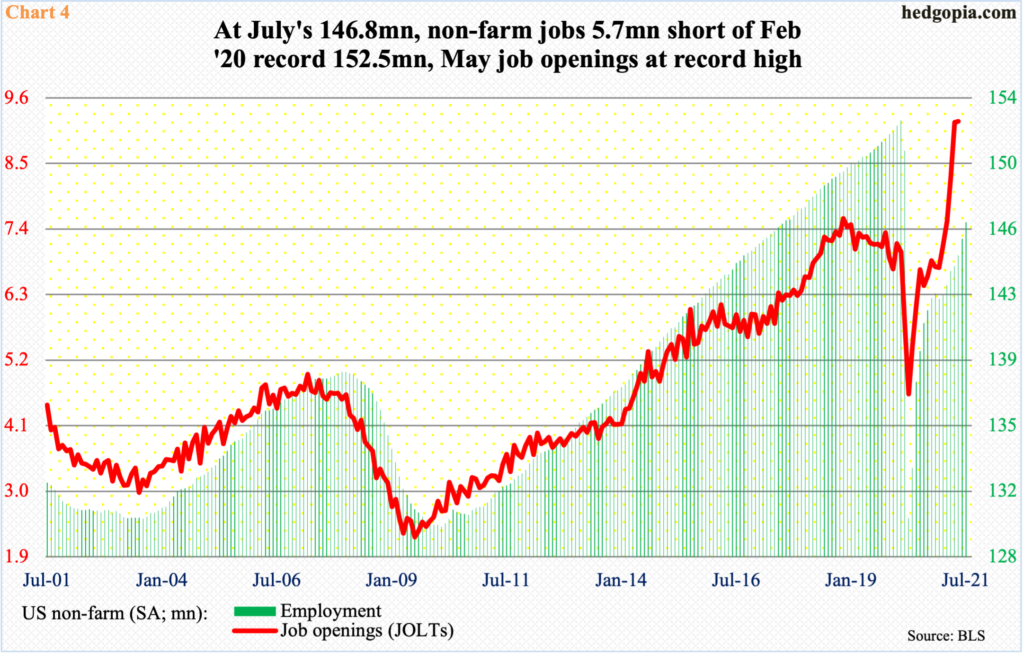

Last Friday, July’s employment report showed 943,000 non-farm jobs were added, coming on the heels of 938,000 in June. The Russell 2000 rallied 0.5 percent in that session but got rejected at the 50-day, which has gone flat the past three weeks.

The economy is still 5.7 million jobs short of the pre-pandemic high of 152.5 million from February last year, but at the same time 16.7 million have been added from the low of April last year. The unemployment rate similarly improved by one half of a percentage point m/m in July to 5.4 percent. This is higher than the 3.5 percent in February last year but marks substantial improvement from the high of 14.8 percent from April last year (Chart 4). Concurrently, non-farm job openings were at a new high in May.

The point is, the economy has made substantial progress from the depths of post-pandemic crash.

In fact, real GDP in 2Q21 posted a fresh high of $19.4 trillion. The first estimate showed it grew at an annual rate of 6.5 percent in 2Q21. This follows 6.3 percent growth in 1Q, 4.5 percent in 4Q20 and 33.8 percent before that. This, of course, follows contractions of 31.2 percent in 2Q20 and 5.1 percent before that. This was the shortest recession ever, lasting only a couple of months between February and April.

Small businesses inherently have larger exposure to the domestic economy than their large-cap cousins which are also exposed internationally. One would think the current heady pace of economic growth would benefit small-cap stocks. But that has not been the case.

It is possible investors are beginning to price in a time when growth decelerates to a more sustainable level, which is only natural and a matter of time. The problem in this scenario is that earnings expectations for next year expect continuation of the current good times.

At some point, an adjustment is needed. Either 2022 earnings expectations get a reality check and are revised lower or the economy defies expectations and continues to grow at an elevated level, in which case the current consensus earnings expectations come through, probably pulling the Russell 2000 along higher.

Right here and now, the majority is not betting on this scenario. The Russell 2000 continues to play ping pong within a range. There is this, though. The ongoing box consolidation could very well be a continuation pattern and will be massively bullish should a decisive breakout occur. At least small-cap bulls are hoping this is the case.

Near term, they could be looking at an opportunity to add to gains.

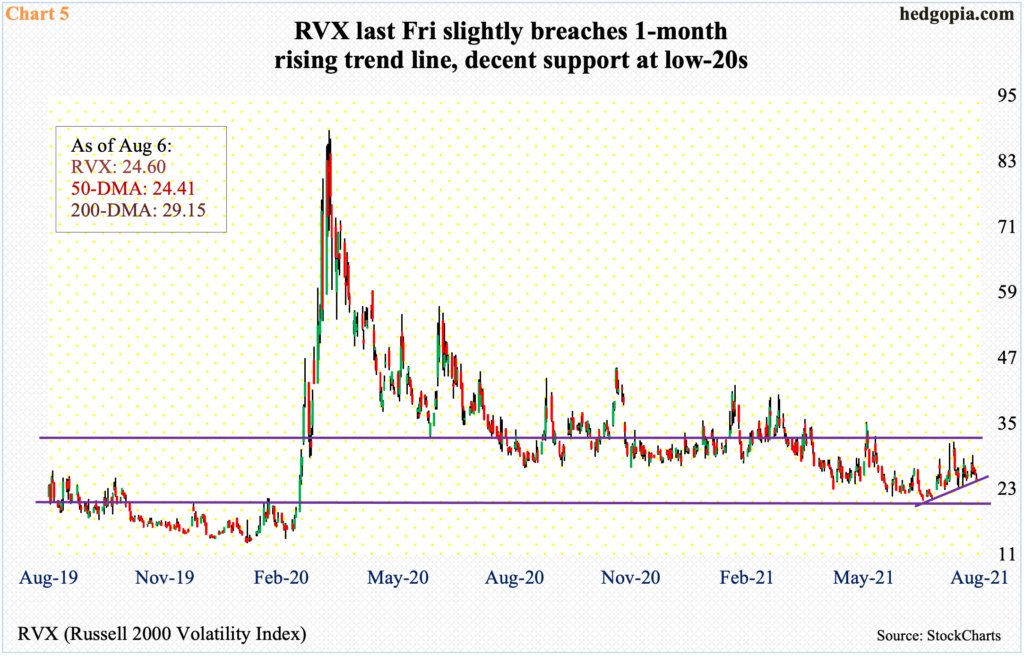

RVX (Russell 2000 Volatility Index) last Friday broke a rising one-month uptrend, albeit only slightly. As is the case with VIX, it too has consistently made lower highs since March last year (Chart 5). Three weeks ago, rally attempts were denied at low-30s. In ideal circumstances for bulls near term, RVX can drop to low-20s.

Even if this scenario pans out near term, until the Russell 2000 convincingly breaks out of its range, it remains bears’ ball to lose.

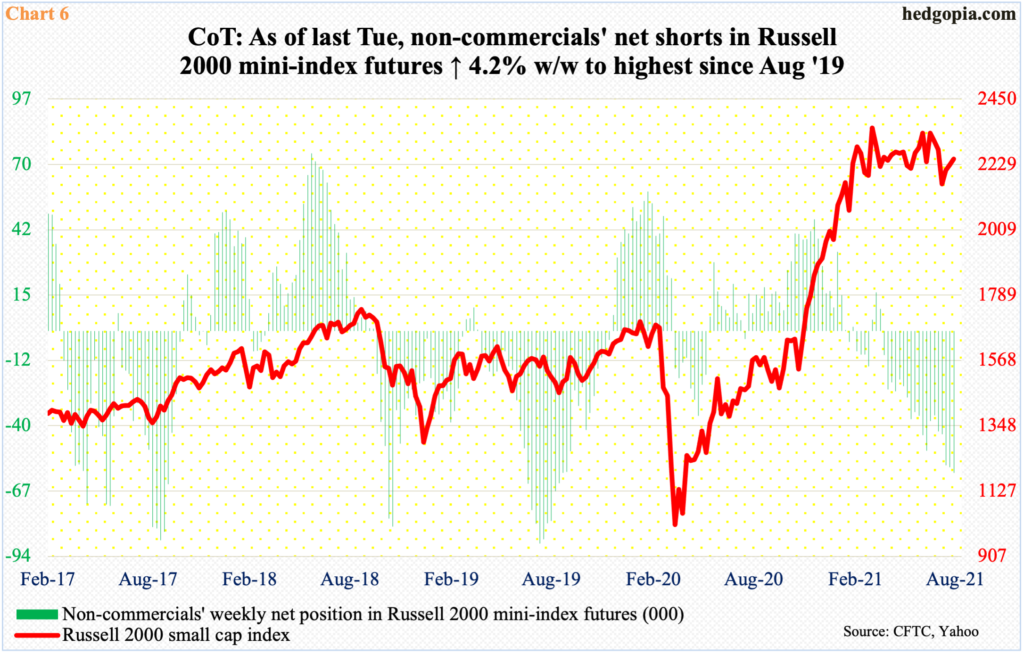

As of last Tuesday, non-commercials were sitting on 59,211 net shorts in Russell 2000 mini-index futures. Holdings are at two-year highs (Chart 6).

In fact, this could be a massive squeeze opportunity for bulls. But for that, a breakout in the cash is needed, which should prompt these traders into beginning to cover, thereby adding a substantial tailwind to the cash. But until that happens, bears have the slight edge. They would have improved their odds once the lower bound on the Russell 2000 cracks.

Thanks for reading!