The 12-month total of US budget deficit just crossed $1 trillion. Treasury issuance is well over $900 billion. Foreigners at the same time have been reducing exposure to US notes and bonds. If the trend persists, this is bound to reverberate through Treasury yields.

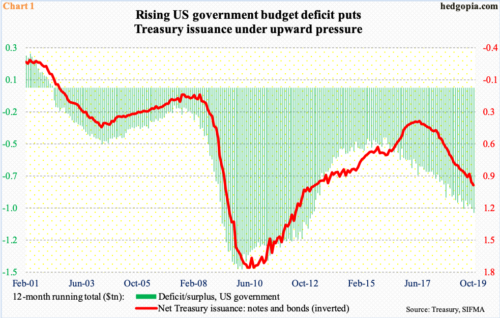

In the 12 months to October, US budget deficit crossed $1 trillion. This is the first time since February 2013 deficit crossed that threshold. There is nothing magical about that number per se. The important thing is the trend, and the news is not good on this front.

In February 2010, post-Great Recession, federal deficit peaked at $1.5 trillion. By January 2016, it dropped to $403.6 billion. Then it swung higher. Sadly, for nearly four years now, deficit has trended higher amidst decent economic expansion. The US economy is in the 11th year of recovery/expansion.

To meet with this massive red ink, federal borrowing has soared (Chart 1). In the 12 months to October, net Treasury issuance of notes and bonds totaled $934 billion. In July 2017, this had dropped to $335 billion. Issuance has tracked deficit higher, which is the case historically.

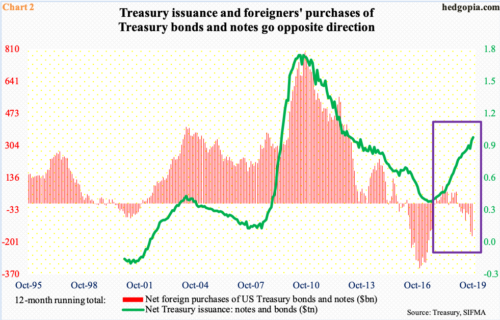

Then we have Chart 2, which pits Treasury issuance against foreigners’ net buying/selling. Historically, the two tend to move together. Foreigners buy more as the Treasury issues more, and vice versa. Of late, this relationship has broken down (box).

In the 12 months to September, foreigners net-sold $171 billion in Treasury notes and bonds. On a 12-month basis, they have been selling since January, even as Treasury issuance persisted higher. It is hard to imagine this divergence continuing, unless it is different this time.

If foreigners continue to reduce exposure to US bonds, it potentially reverberates through Treasury yields sooner or later. In the supply-demand dynamics for long bonds, foreigners obviously are not the make-or-break variable, but their buying – or a lack thereof – makes up an important one.

Incidentally, the 10-year Treasury yield peaked in October last year at 3.25 percent (blue arrow in Chart 3); bonds then rallied. (Price and yield have an inverse relationship.) On a 12-month basis, foreigners were still buying back then. As mentioned earlier, they switched to net selling in January this year. Unless it is a temporary kink, this could mean they took the rally in the long end as an opportunity to lighten up.

Rates then bottomed in September at 1.43 percent. In July 2016, they had fallen to 1.34 percent and to 1.39 percent in July 2012. The September low thus can be interpreted as a retest of those prior lows. After the low of two and a half months ago, the 10-year (1.74 percent) rallied to just under two percent two weeks ago, before coming under pressure. Wednesday, it lost the 50-day (1.76 percent). There is important trend-line support at 1.63 percent. This is worth watching. If the collective wisdom of markets perceive foreigners will continue to reduce exposure – at least for now – then it is likely the support holds. In November 2016, foreigners’ net selling bottomed at $339.2 billion (Chart 2).

Thanks for reading!