Major equity indices are within striking distance of new highs. The bull market has come a long way, sending the ratio of S&P 500 market cap to nominal GDP to near record territory. Unwinding is a matter of when, not if, and, once it begins, will not be pleasant.

Major US equity indices are near record highs. The S&P 500 large cap index is only 0.7 percent from the record high set on July 26. In fact, intraday Thursday, it was within 0.2 percent of the July high.

Amidst this, some subtle signs of fatigue are showing up. Thursday last week, when the S&P 500 tagged 3020.74, a long-legged doji formed. On Wednesday, the index sold off after the FOMC decision was announced, but bulls bought that weakness right at a trend line from last December, forming a potentially bearish hanging man (Chart 1). Thursday, bulls were not able to hang on to the early gains, resulting in a candle with a long upper shadow.

The daily in particular remains extended.

Near-term uncertainty aside, the bull market has produced extraordinary results.

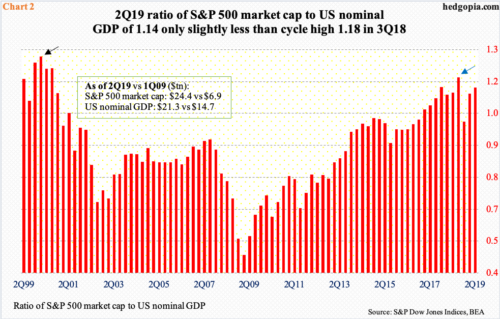

The S&P 500 (3006.79) bottomed in March 2009 (676.53 on a closing basis on the 9th and 666.79 intraday on the 6th). In 1Q that year, when it bottomed, the index had a market cap of $6.9 trillion. At the end of the second quarter this year, it boasted a market cap of $24.4 trillion. During the same period, US nominal GDP went from $14.7 trillion to $21.3 trillion. The market cap surged by $17.5 trillion, even as the economy expanded by $6.6tn. As a result, the ratio of market cap to nominal GDP persistently went from the lower left to the upper right (Chart 2).

In 2Q, the ratio was 1.14, not that far away from the cycle high 1.18 in 3Q18 (blue arrow). This was the highest since the highs of 2000. Back then, the ratio rose as high as 1.27 (black arrow), which laid the foundation for the unwinding that followed. In 2Q09, the ratio bottomed at 0.55. Once again, the ratio – if not in uncharted territory – is way elevated. It is safe to say that the path of least resistance from these lofty levels is down – timing notwithstanding.

Thanks for reading!